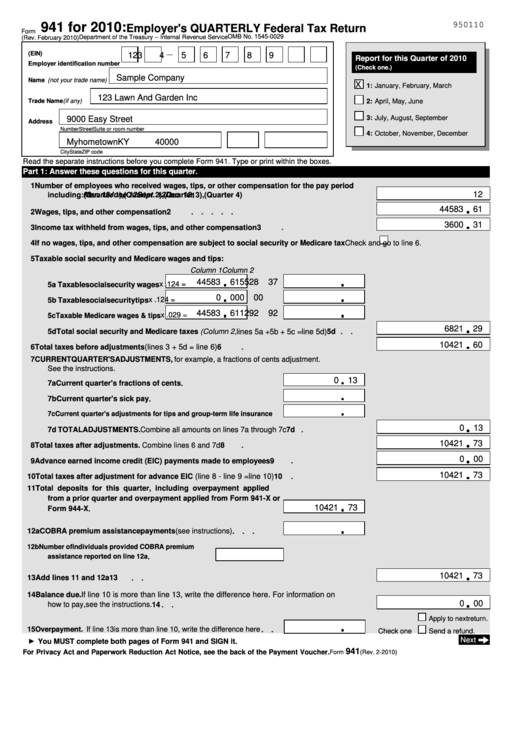

Form 941 - Employers Quarterly Federal Tax Return, Schedule B (Form 941): Report Of Tax Liability For Semiweekly Schedule Depositors - 2010

ADVERTISEMENT

9 5 0 1 1 0

941 for 2010:

Employer's QUARTERLY Federal Tax Return

Form

OMB No. 1545-0029

Department of the Treasury -- Internal Revenue Service

(Rev. February 2010)

(EIN)

1

2

3

4

5

6

7

8

9

Report for this Quarter of 2010

Employer identification number

(Check one.)

Sample Company

Name (not your trade name)

X

January, February, March

1:

123 Lawn And Garden Inc

Trade Name (if any)

2:

April, May, June

9000 Easy Street

3:

July, August, September

Address

Number

Street

Suite or room number

4:

October, November, December

Myhometown

KY

40000

City

State

ZIP code

Read the separate instructions before you complete Form 941. Type or print within the boxes.

Part 1: Answer these questions for this quarter.

1

Number of employees who received wages, tips, or other compensation for the pay period

12

including:

Mar. 12

(Quarter 1),

June 12

(Quarter 2),

Sept. 12

(Quarter 3),

Dec. 12

(Quarter 4)

1

44583

61

2

Wages, tips, and other compensation

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

2

.

.

3600

31

3

Income tax withheld from wages, tips, and other compensation

3

.

.

.

.

.

.

.

.

4

If no wages, tips, and other compensation are subject to social security or Medicare tax

Check and go to line 6.

5

Taxable social security and Medicare wages and tips:

Column 1

Column 2

44583

61

5528

37

x .124 =

5a Taxable social security wages

0

00

0

00

x .124 =

5b Taxable social security tips

44583

61

1292

92

x .029 =

5c Taxable Medicare wages & tips

6821

29

5d Total social security and Medicare taxes (Column 2, lines 5a + 5b + 5c = line 5d)

5d

.

.

10421

60

6

Total taxes before adjustments (lines 3 + 5d = line 6)

6

.

.

.

.

.

.

.

.

.

.

.

.

7

CURRENT QUARTER'S ADJUSTMENTS, for example, a fractions of cents adjustment.

See the instructions.

0

13

7a Current quarter's fractions of cents

.

.

.

.

.

.

.

.

.

7b Current quarter's sick pay

.

.

.

.

.

.

.

.

.

.

.

.

.

7c Current quarter's adjustments for tips and group-term life insurance

0

13

7d TOTAL ADJUSTMENTS. Combine all amounts on lines 7a through 7c

7d

.

.

.

.

.

.

10421

73

8

Total taxes after adjustments. Combine lines 6 and 7d

8

.

.

.

.

.

.

.

.

.

.

.

.

0

00

9

Advance earned income credit (EIC) payments made to employees

9

.

.

.

.

.

.

.

10421

73

10

Total taxes after adjustment for advance EIC (line 8 - line 9 = line 10)

10

.

.

.

.

.

.

.

11

Total deposits for this quarter, including overpayment applied

from a prior quarter and overpayment applied from Form 941-X or

10421

73

Form 944-X

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

COBRA premium assistance payments (see instructions)

12a

.

.

.

12b

Number of individuals provided COBRA premium

assistance reported on line 12a .

.

.

.

.

.

10421

73

13

Add lines 11 and 12a

13

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

Balance due. If line 10 is more than line 13, write the difference here. For information on

14

0

00

how to pay, see the instructions.

14

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

Apply to next return.

Overpayment. If line 13 is more than line 10, write the difference here

15

.

.

Check one

Send a refund.

Next

You MUST complete both pages of Form 941 and SIGN it.

941

For Privacy Act and Paperwork Reduction Act Notice, see the back of the Payment Voucher.

Form

(Rev. 2-2010)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3