Dependent Care Claim Form

Download a blank fillable Dependent Care Claim Form in PDF format just by clicking the "DOWNLOAD PDF" button.

Open the file in any PDF-viewing software. Adobe Reader or any alternative for Windows or MacOS are required to access and complete fillable content.

Complete Dependent Care Claim Form with your personal data - all interactive fields are highlighted in places where you should type, access drop-down lists or select multiple-choice options.

Some fillable PDF-files have the option of saving the completed form that contains your own data for later use or sending it out straight away.

ADVERTISEMENT

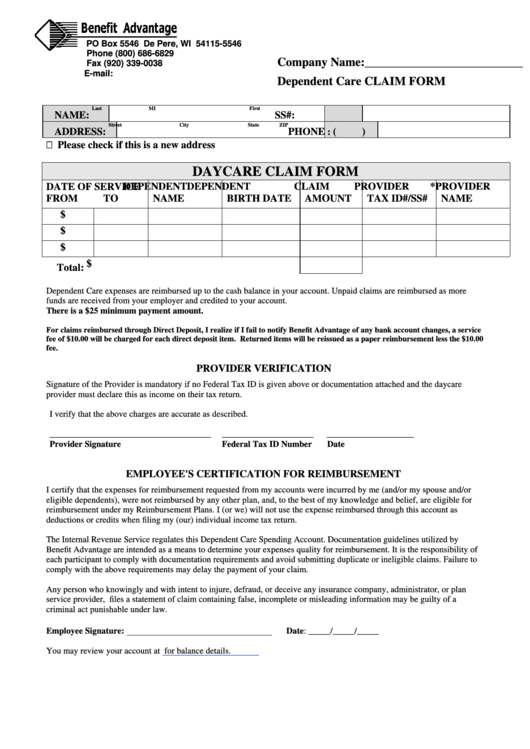

PO Box 5546 De Pere, WI 54115-5546

Phone (800) 686-6829

Company Name:__________________________

Fax (920) 339-0038

E-mail:

Dependent Care CLAIM FORM

Last

MI

First

NAME:

SS#:

Street

City

State

ZIP

ADDRESS:

PHONE

(

)

:

Please check if this is a new address

DAYCARE CLAIM FORM

DATE OF SERVICE

DEPENDENT

DEPENDENT

CLAIM

PROVIDER

*PROVIDER

FROM

TO

NAME

BIRTH DATE

AMOUNT

TAX ID#/SS#

NAME

$

$

$

$

Total:

Dependent Care expenses are reimbursed up to the cash balance in your account. Unpaid claims are reimbursed as more

funds are received from your employer and credited to your account.

There is a $25 minimum payment amount.

For claims reimbursed through Direct Deposit, I realize if I fail to notify Benefit Advantage of any bank account changes, a service

fee of $10.00 will be charged for each direct deposit item. Returned items will be reissued as a paper reimbursement less the $10.00

fee.

PROVIDER VERIFICATION

Signature of the Provider is mandatory if no Federal Tax ID is given above or documentation attached and the daycare

provider must declare this as income on their tax return.

I verify that the above charges are accurate as described.

_____________________________________

_____________________

____________________

Provider Signature

Federal Tax ID Number

Date

EMPLOYEE'S CERTIFICATION FOR REIMBURSEMENT

I certify that the expenses for reimbursement requested from my accounts were incurred by me (and/or my spouse and/or

eligible dependents), were not reimbursed by any other plan, and, to the best of my knowledge and belief, are eligible for

reimbursement under my Reimbursement Plans. I (or we) will not use the expense reimbursed through this account as

deductions or credits when filing my (our) individual income tax return.

The Internal Revenue Service regulates this Dependent Care Spending Account. Documentation guidelines utilized by

Benefit Advantage are intended as a means to determine your expenses quality for reimbursement. It is the responsibility of

each participant to comply with documentation requirements and avoid submitting duplicate or ineligible claims. Failure to

comply with the above requirements may delay the payment of your claim.

Any person who knowingly and with intent to injure, defraud, or deceive any insurance company, administrator, or plan

service provider, files a statement of claim containing false, incomplete or misleading information may be guilty of a

criminal act punishable under law.

Employee Signature:

Date: _____/_____/_____

You may review your account at

for balance details.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2