Form T-7 - Bill Of Sale (Vehicle)

Download a blank fillable Form T-7 - Bill Of Sale (Vehicle) in PDF format just by clicking the "DOWNLOAD PDF" button.

Open the file in any PDF-viewing software. Adobe Reader or any alternative for Windows or MacOS are required to access and complete fillable content.

Complete Form T-7 - Bill Of Sale (Vehicle) with your personal data - all interactive fields are highlighted in places where you should type, access drop-down lists or select multiple-choice options.

Some fillable PDF-files have the option of saving the completed form that contains your own data for later use or sending it out straight away.

ADVERTISEMENT

Print

Clear

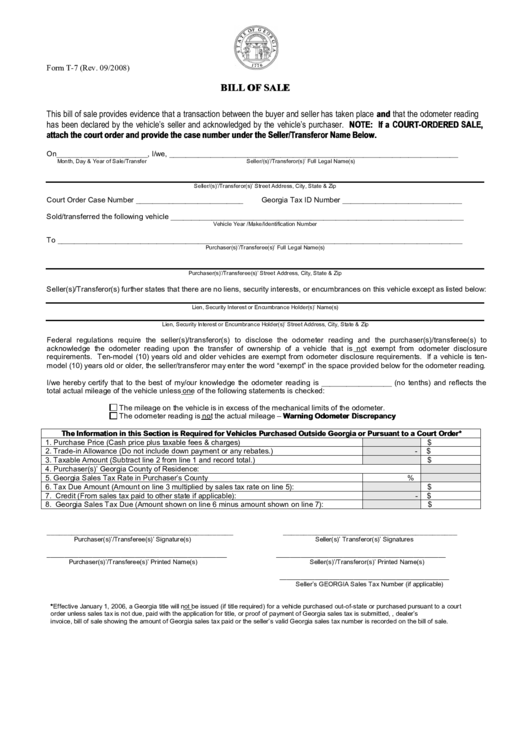

Form T-7 (Rev. 09/2008)

BILL OF SALE

This bill of sale provides evidence that a transaction between the buyer and seller has taken place and that the odometer reading

has been declared by the vehicle’s seller and acknowledged by the vehicle’s purchaser. NOTE: If a COURT-ORDERED SALE,

attach the court order and provide the case number under the Seller/Transferor Name Below.

On______________________, I/we, ______________________________________________________________________

Month, Day & Year of Sale/Transfer

Seller/(s)’/Transferor(s)’ Full Legal Name(s)

Seller/(s)’/Transferor(s)’ Street Address, City, State & Zip

Court Order Case Number __________________________

Georgia Tax ID Number _____________________________

Sold/transferred the following vehicle _______________________________________________________________________

Vehicle Year /Make/Identification Number

To __________________________________________________________________________________________________

Purchaser(s)’/Transferee(s)’ Full Legal Name(s)

Purchaser(s)’/Transferee(s)’ Street Address, City, State & Zip

Seller(s)/Transferor(s) further states that there are no liens, security interests, or encumbrances on this vehicle except as listed below:

Lien, Security Interest or Encumbrance Holder(s)’ Name(s)

Lien, Security Interest or Encumbrance Holder(s)’ Street Address, City, State & Zip

Federal regulations require the seller(s)/transferor(s) to disclose the odometer reading and the purchaser(s)/transferee(s) to

acknowledge the odometer reading upon the transfer of ownership of a vehicle that is not exempt from odometer disclosure

requirements. Ten-model (10) years old and older vehicles are exempt from odometer disclosure requirements. If a vehicle is ten-

model (10) years old or older, the seller/transferor may enter the word “exempt” in the space provided below for the odometer reading.

I/we hereby certify that to the best of my/our knowledge the odometer reading is _________________ (no tenths) and reflects the

total actual mileage of the vehicle unless one of the following statements is checked:

The mileage on the vehicle is in excess of the mechanical limits of the odometer.

The odometer reading is not the actual mileage – Warning Odometer Discrepancy

The Information in this Section is Required for Vehicles Purchased Outside Georgia or Pursuant to a Court Order*

1. Purchase Price (Cash price plus taxable fees & charges)

$

2. Trade-in Allowance (Do not include down payment or any rebates.)

-

$

3. Taxable Amount (Subtract line 2 from line 1 and record total.)

$

4. Purchaser(s)’ Georgia County of Residence:

5. Georgia Sales Tax Rate in Purchaser’s County

%

6. Tax Due Amount (Amount on line 3 multiplied by sales tax rate on line 5):

$

7. Credit (From sales tax paid to other state if applicable):

-

$

8. Georgia Sales Tax Due (Amount shown on line 6 minus amount shown on line 7):

$

_____________________________________________

__________________________________________

Purchaser(s)’/Transferee(s)’ Signature(s)

Seller(s)’ Transferor(s)’ Signatures

___________________________________________________

________________________________________________

Purchaser(s)’/Transferee(s)’ Printed Name(s)

Seller(s)’/Transferor(s)’ Printed Name(s)

________________________________________________

Seller’s GEORGIA Sales Tax Number (if applicable)

*Effective January 1, 2006, a Georgia title will not be issued (if title required) for a vehicle purchased out-of-state or purchased pursuant to a court

order unless sales tax is not due, paid with the application for title, or proof of payment of Georgia sales tax is submitted, e.g. contract, dealer’s

invoice, bill of sale showing the amount of Georgia sales tax paid or the seller’s valid Georgia sales tax number is recorded on the bill of sale.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Business

1

1