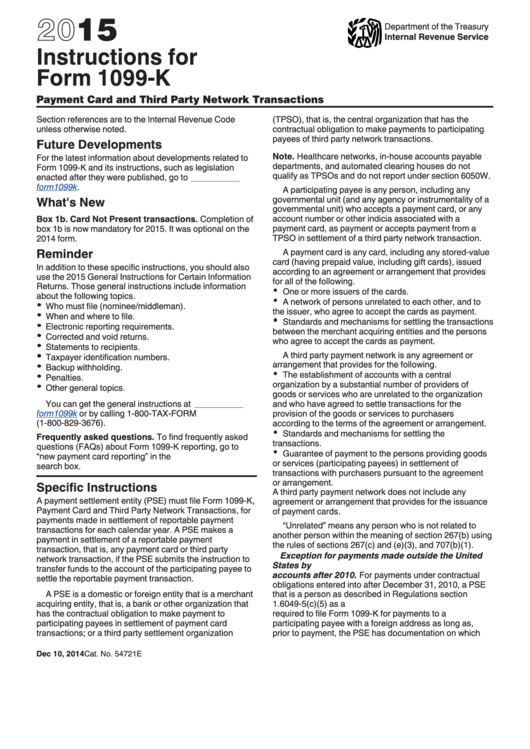

Instructions For Form 1099-K - 2015

ADVERTISEMENT

2015

Department of the Treasury

Internal Revenue Service

Instructions for

Form 1099-K

Payment Card and Third Party Network Transactions

Section references are to the Internal Revenue Code

(TPSO), that is, the central organization that has the

unless otherwise noted.

contractual obligation to make payments to participating

payees of third party network transactions.

Future Developments

Note. Healthcare networks, in-house accounts payable

For the latest information about developments related to

departments, and automated clearing houses do not

Form 1099-K and its instructions, such as legislation

qualify as TPSOs and do not report under section 6050W.

enacted after they were published, go to

form1099k.

A participating payee is any person, including any

What's New

governmental unit (and any agency or instrumentality of a

governmental unit) who accepts a payment card, or any

Box 1b. Card Not Present transactions. Completion of

account number or other indicia associated with a

box 1b is now mandatory for 2015. It was optional on the

payment card, as payment or accepts payment from a

2014 form.

TPSO in settlement of a third party network transaction.

Reminder

A payment card is any card, including any stored-value

card (having prepaid value, including gift cards), issued

In addition to these specific instructions, you should also

according to an agreement or arrangement that provides

use the 2015 General Instructions for Certain Information

for all of the following.

Returns. Those general instructions include information

One or more issuers of the cards.

about the following topics.

A network of persons unrelated to each other, and to

Who must file (nominee/middleman).

the issuer, who agree to accept the cards as payment.

When and where to file.

Standards and mechanisms for settling the transactions

Electronic reporting requirements.

between the merchant acquiring entities and the persons

Corrected and void returns.

who agree to accept the cards as payment.

Statements to recipients.

A third party payment network is any agreement or

Taxpayer identification numbers.

arrangement that provides for the following.

Backup withholding.

The establishment of accounts with a central

Penalties.

organization by a substantial number of providers of

Other general topics.

goods or services who are unrelated to the organization

You can get the general instructions at

and who have agreed to settle transactions for the

form1099k

or by calling 1-800-TAX-FORM

provision of the goods or services to purchasers

(1-800-829-3676).

according to the terms of the agreement or arrangement.

Standards and mechanisms for settling the

Frequently asked questions. To find frequently asked

transactions.

questions (FAQs) about Form 1099-K reporting, go to

Guarantee of payment to the persons providing goods

IRS.gov and enter “new payment card reporting” in the

or services (participating payees) in settlement of

search box.

transactions with purchasers pursuant to the agreement

or arrangement.

Specific Instructions

A third party payment network does not include any

A payment settlement entity (PSE) must file Form 1099-K,

agreement or arrangement that provides for the issuance

Payment Card and Third Party Network Transactions, for

of payment cards.

payments made in settlement of reportable payment

“Unrelated” means any person who is not related to

transactions for each calendar year. A PSE makes a

another person within the meaning of section 267(b) using

payment in settlement of a reportable payment

the rules of sections 267(c) and (e)(3), and 707(b)(1).

transaction, that is, any payment card or third party

Exception for payments made outside the United

network transaction, if the PSE submits the instruction to

States by U.S. payers or middlemen to offshore

transfer funds to the account of the participating payee to

accounts after 2010. For payments under contractual

settle the reportable payment transaction.

obligations entered into after December 31, 2010, a PSE

A PSE is a domestic or foreign entity that is a merchant

that is a person as described in Regulations section

acquiring entity, that is, a bank or other organization that

1.6049-5(c)(5) as a U.S. payer or U.S. middleman is not

has the contractual obligation to make payment to

required to file Form 1099-K for payments to a

participating payees in settlement of payment card

participating payee with a foreign address as long as,

transactions; or a third party settlement organization

prior to payment, the PSE has documentation on which

Dec 10, 2014

Cat. No. 54721E

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5