Form 21 - Annual Taxable Wage Base Per Employee - South Dakota Page 3

ADVERTISEMENT

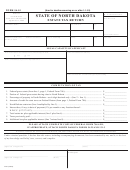

EMPLOYER’S QUARTERLY CONTRIBUTION, INVESTMENT FEE, AND WAGE REPORT

South Dakota Department of Labor and Regulation, Unemployment Insurance Division

ITEM 9

Quarter Ending

______/______/______

Explanation of Adjustment (attach additional sheet if more space is needed):

_________________________________________________________________________________________________________________________

_________________________________________________________________________________________________________________________

_________________________________________________________________________________________________________________________

CHANGE IN BUSINESS OPERATION OR OWNERSHIP

ITEM 14

Application for Exemption or Transfer of Liability (Form 55)

1.

Account Number

____________________________

Owner and Business Name

_________________________________________________________________________________________

Mailing Address

_________________________________________________________________________________________

2.

I hereby make application for exemption from filing all reports required under the unemployment insurance law of South Dakota. I agree to advise

SD Unemployment Insurance Division if I have employment again at any time in the future.

If employment ceased or business discontinued without a successor, give last date wages were paid

________________________________

or

If business was sold, leased or otherwise transferred, please complete the following:

Effective date of disposition _____________________________

Reason for disposition (sale, merger, etc.) _______________________

Date you last paid wages in South Dakota _____________________

Are you retaining any part of the business?

Yes _____

No _____

3.

Name of Successor

________________________________________________________________________________________

Address of Successor

________________________________________________________________________________________

4.

It is agreed between the Former Owner and the New Owner that: All ______

None ______ Portion _____ of the employer’s experience rating

account shall be transferred with assets and liabilities following the account, as provided in SDCL 61-5-42.

5.

THIS REPORT MUST BE SIGNED BY THE OWNER, PARTNER OR AUTHORIZED OFFICIAL.

Signature _____________________________________________________

Title ____________________________________________

Date

_____________________________________________________

Phone __________________________________________

For SD DLR use only:

Approved date ________________________ By _________________

Effective date ________________________

Termination date ______________________

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4