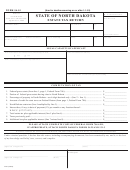

Form 21 - Annual Taxable Wage Base Per Employee - South Dakota Page 4

ADVERTISEMENT

INSTRUCTIONS FOR COMPLETING QUARTERLY CONTRIBUTION, INVESTMENT FEE AND WAGE REPORT

Report and remittance are considered received on date shown on postmark of envelope in which they are received.

WAGE REPORT. Each page must show a total with a grand total on the

LINE 14. CHANGES IN BUSINESS OR OWNERSHIP. GO TO ITEM 9 &

last page.

14 PAGE.

INTERNET REPORTING. Employers have the option to submit quarterly

DISCONTINUANCE OF BUSINESS. Enter the date that wages were last

wage information online, by entering wage information or by uploading a

paid.

file. Log-In at Click on File a Quarterly

Report on left.

BUSINESS SOLD, LEASED OR OTHERWISE TRANSFERRED.

Complete Item 14 (Form 55) portion in full, showing the name of the

COMPACT DISC OR DIGITAL VIDEO DISC. Rather than sending in

successor or successors and the effective date of the disposition. The

quarterly wage information on paper, employers may submit this

Unemployment Insurance Law permits transfer of the employer’s payroll

information on compact disc or digital video disc. Visit the SD Department

experience and experience rating account. Therefore, be specific as to

of Labor and Regulation website ( ) for more information.

whether you authorize the transfer of your experience rating account to

ACCOUNT NUMBER, BUSINESS NAME, ADDRESS. Enter your UI

the successor in the business.

account number, and your business name and address.

SIGNATURE. This report must be signed by (1) the individual, if the

QUARTER/YEAR. Enter the quarter and the two-digit year the report is

employer is an individual; (2) the President, Treasurer or other principal

for.

officer, if the employer is a corporation; or (3) a responsible duly-

authorized member or agent having knowledge of company affairs.

DUE DATE. Report due by last day of month, following end of quarter.

Q1 due by 4/30, Q2 due by 7/31, Q3 due by 10/31, and Q4 due by 1/31.

LINE 15. EMPLOYEE'S SOCIAL SECURITY NUMBER. The employee’s

Social Security number is required. Those without Social Security

UI CONTRIBUTION RATE, SURCHARGE, AND INVESTMENT FEE.

numbers must apply for one. Enter without hyphens.

Enter your current Unemployment Insurance tax rate on Line 6, the

applicable Surcharge rate on Line 6a, and Investment Fee rate on Line 7.

LINE 16. EMPLOYEE'S NAME. Enter the full name of the employee in

this order: Last Name, First Name.

LINE 1. NUMBER OF WORKERS. The monthly employment data

reported on the Quarterly Contribution Report should be a count of all full-

LINE 17. TOTAL GROSS WAGES PAID THIS QUARTER. Enter the

time and part-time workers who worked during or received pay (subject to

gross wages paid this quarter subject to the Unemployment Insurance

Unemployment Insurance wages) for the payroll period that includes the

Act. Wages paid include: money wages paid for employment,

12th of the month.

commissions paid, and special cash payment (such as cash gifts, cash

prizes or cash bonuses), reasonable cash value of remuneration for

LINE 2. LOCATIONS. Mark "Yes" if your business has more than one

services paid in a medium other than cash (such as lodging, meals, free

location.

or paid rent, etc.), and special payments made in any medium (such as

gifts and prizes). Tips are also reportable in most instances. Employee

LINE 3. TOTAL GROSS WAGES PAID THIS QUARTER. Enter the total

contributions to tax-deferred retirement plan or cafeteria (Sec. 125) plan

from Line 21. See Line 17 instructions for more information.

are taxable. Employer contributions to retirement or pension plans,

established under USC 26: 401(k), 403(b), 408(k), 457 and 408(p) are not

LINE 4. WAGES PAID THIS QUARTER IN EXCESS OF ANNUAL

reportable wages.

WAGES BASE. Enter the total from Line 22. See Line 18 instructions for

more information.

LINE 18. EXCESS WAGES PAID THIS QUARTER. Enter the portion of

Line 17 paid to each individual during this quarter that exceeds the annual

LINE 5. TAXABLE WAGES. Subtract Line 4 from Line 3 and enter.

taxable wage base for the calendar year. This will include only the wages

LINE 6. UI CONTRIBUTION. Multiply wages from Line 5 by rate listed.

paid this quarter in excess of the annual taxable wage base for the

Enter tax here. This tax is reported on IRS Form 940.

individual. The amount of this item can not exceed the amount reported

on Line 17 for any individual.

LINE 6A. SURCHARGE. Multiply wages from Line 5 by rate listed. Enter

Taxable wage bases:

tax here. This tax is not included on IRS Form 940. Surcharge rate will be

2011=$11,000

2014=$14,000

announced prior to end of each quarter, if applicable.

2012=$12,000

2015 & after=$15,000

LINE 7. INVESTMENT FEE. Multiply wages from Line 5 by rate listed.

2013=$13,000

Enter tax here. This tax is not included on IRS Form 940.

LINE 19. GROSS WAGES THIS PAGE. Enter the sum of all wages in

LINE 8. TOTAL TAX DUE. Enter the total amount of tax due by adding

Item 17 for this page.

Lines 6, 6a and 7.

LINE 20. TOTAL EXCESS WAGES THIS PAGE. Enter the sum of all

LINE 9. ADJUSTMENTS. Enter the amount of any debit or credit notices

excess wages in Item 18 for this page. This total cannot exceed the

received from the Department or adjustments from prior quarters you may

amount on Line 19.

have found. Include an explanation on Item 9 & 14 page or an attached

sheet. Remember to include this amount when completing Line 13.

LINE 21. TOTAL GROSS WAGES ALL PAGES. Enter the sum of Line

19 from all pages of this report. Enter this figure on Line 3 also.

LINE 10. INTEREST. Enter the interest due if the report is late. Interest is

1.5% per month (or fraction of a month) from the due date of a report.

LINE 22. TOTAL EXCESS WAGES ALL PAGES. Enter the sum of Line

Multiply the payment due from Line 8 by interest rate listed.

20 from all pages of this report. This total cannot exceed the amount on

Line 21. Enter this figure on Line 4 also.

LINE 11. PENALTY FOR LATE FILING. If the report is late, enter the

penalty amount. The penalty for filing a report late is $25 per month (or

SIGNATURE. This report must be signed by the employer or on the

fraction of a month) from the due date. The maximum penalty is $150 per

employer's behalf by someone having personal knowledge of the facts

quarterly report.

herein stated and who has been authorized to sign such report.

LINE 12. PENALTY FOR LATE PAYMENT. If the payment is late, enter

PREPARED BY. Enter the report preparer’s name and telephone

the penalty amount. The penalty for being late making full payment is $25

number.

per month (or fraction of a month) from the due date. The maximum

penalty is $150 per quarterly report.

LINE 13. TOTAL REMITTANCE. Enter the sum of Lines 8 through 12.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4