Vehicle Mileage Statement Template

ADVERTISEMENT

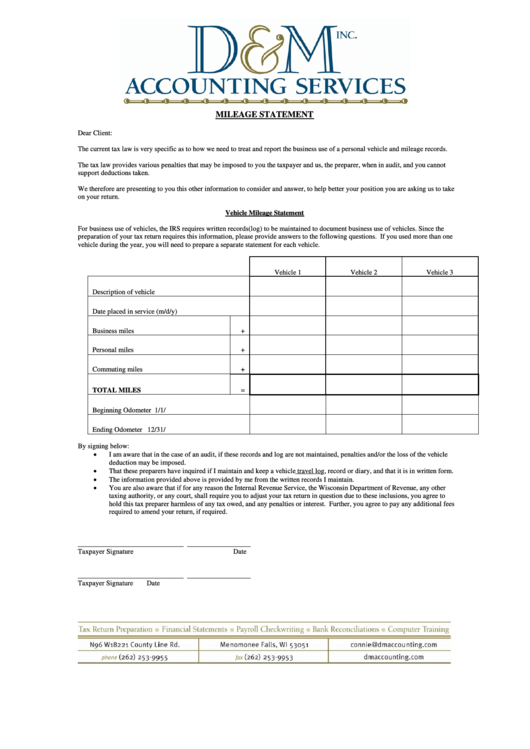

MILEAGE STATEMENT

Dear Client:

The current tax law is very specific as to how we need to treat and report the business use of a personal vehicle and mileage records.

The tax law provides various penalties that may be imposed to you the taxpayer and us, the preparer, when in audit, and you cannot

support deductions taken.

We therefore are presenting to you this other information to consider and answer, to help better your position you are asking us to take

on your return.

Vehicle Mileage Statement

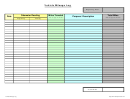

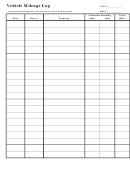

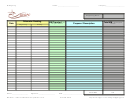

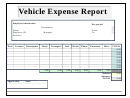

For business use of vehicles, the IRS requires written records(log) to be maintained to document business use of vehicles. Since the

preparation of your tax return requires this information, please provide answers to the following questions. If you used more than one

vehicle during the year, you will need to prepare a separate statement for each vehicle.

Vehicle 1

Vehicle 2

Vehicle 3

Description of vehicle

Date placed in service (m/d/y)

Business miles

+

Personal miles

+

Commuting miles

+

TOTAL MILES

=

Beginning Odometer 1/1/

Ending Odometer 12/31/

By signing below:

I am aware that in the case of an audit, if these records and log are not maintained, penalties and/or the loss of the vehicle

deduction may be imposed.

That these preparers have inquired if I maintain and keep a vehicle travel log, record or diary, and that it is in written form.

The information provided above is provided by me from the written records I maintain.

You are also aware that if for any reason the Internal Revenue Service, the Wisconsin Department of Revenue, any other

taxing authority, or any court, shall require you to adjust your tax return in question due to these inclusions, you agree to

hold this tax preparer harmless of any tax owed, and any penalties or interest. Further, you agree to pay any additional fees

required to amend your return, if required.

______________________________

__________________

Taxpayer Signature

Date

______________________________

__________________

Taxpayer Signature

Date

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Miscellaneous

1

1