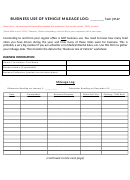

Business Vehicle Mileage Log For Tax Purposes

ADVERTISEMENT

RECORD KEEPING REQUIREMENTS

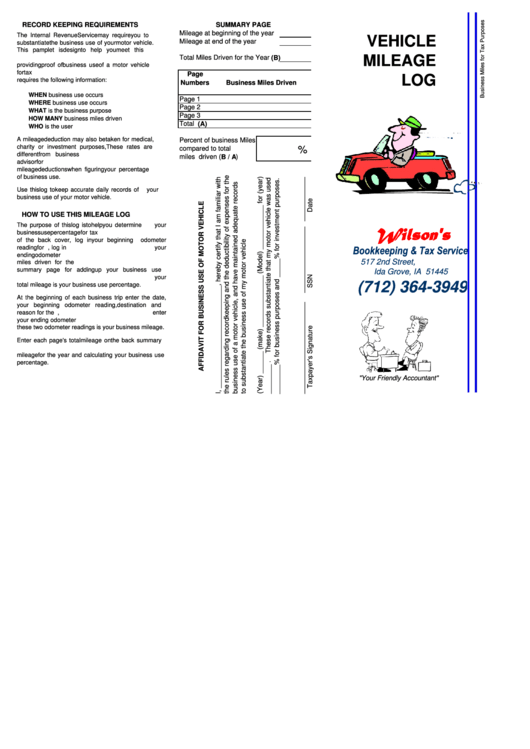

SUMMARY PAGE

Mileage at beginning of the year

The Internal Revenue Service may require you to

VEHICLE

Mileage at end of the year

substantiate the business use of your motor vehicle.

This pamplet is design to help you meet this

MILEAGE

obligation.

Accurate recordkeeping is vital to

Total Miles Driven for the Year (B)

providing proof of business use of a motor vehicle

for tax purposes. The Internal Revenue Service

Page

LOG

requires the following information:

Numbers

Business Miles Driven

WHEN business use occurs

Page 1

WHERE business use occurs

Page 2

WHAT is the business purpose

Page 3

HOW MANY business miles driven

Total (A)

WHO is the user

A mileage deduction may also be taken for medical,

Percent of business Miles

charity or investment purposes, These rates are

%

compared to total

different from business use.

Consult your tax

miles driven (B / A)

advisor for applicable rates. DO NOT use these

mileage deductions when figuring your percentage

of business use.

Use this log to keep accurate daily records of your

business use of your motor vehicle.

HOW TO USE THIS MILEAGE LOG

The purpose of this log is to help you determine your

Wilson's

business use percentage for tax purposes. On the top

of the back cover, log in your beginning odometer

Bookkeeping & Tax Service

reading for the year. At the end of the year, log in your

ending odometer reading. This will give you the total

517 2nd Street, P.O. Box 43

miles driven for the year. On the back there is a

summary page for adding up your business use

Ida Grove, IA 51445

mileage. Your business use mileage divided by your

(712) 364-3949

total mileage is your business use percentage.

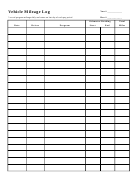

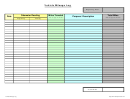

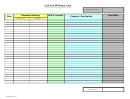

At the beginning of each business trip enter the date,

your beginning odometer reading, destination and

reason for the trip. At the end of the business trip, enter

your ending odometer reading. The difference between

these two odometer readings is your business mileage.

Enter each page's total mileage on the back summary

page. This will allow for easy totaling of your business

mileage for the year and calculating your business use

percentage.

"Your Friendly Accountant"

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Miscellaneous

1

1