Vehicle & Mileage Deduction Worksheet Template

ADVERTISEMENT

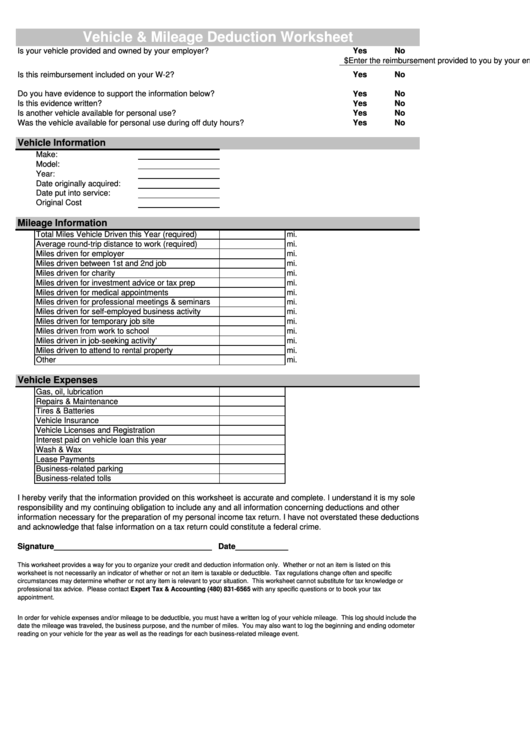

Vehicle & Mileage Deduction Worksheet

Is your vehicle provided and owned by your employer?

Yes

No

Enter the reimbursement provided to you by your employer for vehicle-related expenses:

$

Is this reimbursement included on your W-2?

Yes

No

Do you have evidence to support the information below?

Yes

No

Is this evidence written?

Yes

No

Is another vehicle available for personal use?

Yes

No

Was the vehicle available for personal use during off duty hours?

Yes

No

Vehicle Information

Make:

Model:

Year:

Date originally acquired:

Date put into service:

Original Cost

Mileage Information

Total Miles Vehicle Driven this Year (required)

mi.

Average round-trip distance to work (required)

mi.

Miles driven for employer

mi.

Miles driven between 1st and 2nd job

mi.

Miles driven for charity

mi.

Miles driven for investment advice or tax prep

mi.

Miles driven for medical appointments

mi.

Miles driven for professional meetings & seminars

mi.

Miles driven for self-employed business activity

mi.

Miles driven for temporary job site

mi.

Miles driven from work to school

mi.

Miles driven in job-seeking activity'

mi.

Miles driven to attend to rental property

mi.

Other

mi.

Vehicle Expenses

Gas, oil, lubrication

Repairs & Maintenance

Tires & Batteries

Vehicle Insurance

Vehicle Licenses and Registration

Interest paid on vehicle loan this year

Wash & Wax

Lease Payments

Business-related parking

Business-related tolls

I hereby verify that the information provided on this worksheet is accurate and complete. I understand it is my sole

responsibility and my continuing obligation to include any and all information concerning deductions and other

information necessary for the preparation of my personal income tax return. I have not overstated these deductions

and acknowledge that false information on a tax return could constitute a federal crime.

Signature____________________________________ Date____________

This worksheet provides a way for you to organize your credit and deduction information only. Whether or not an item is listed on this

worksheet is not necessarily an indicator of whether or not an item is taxable or deductible. Tax regulations change often and specific

circumstances may determine whether or not any item is relevant to your situation. This worksheet cannot substitute for tax knowledge or

professional tax advice. Please contact Expert Tax & Accounting (480) 831-6565 with any specific questions or to book your tax

appointment.

In order for vehicle expenses and/or mileage to be deductible, you must have a written log of your vehicle mileage. This log should include the

date the mileage was traveled, the business purpose, and the number of miles. You may also want to log the beginning and ending odometer

reading on your vehicle for the year as well as the readings for each business-related mileage event.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Miscellaneous

1

1