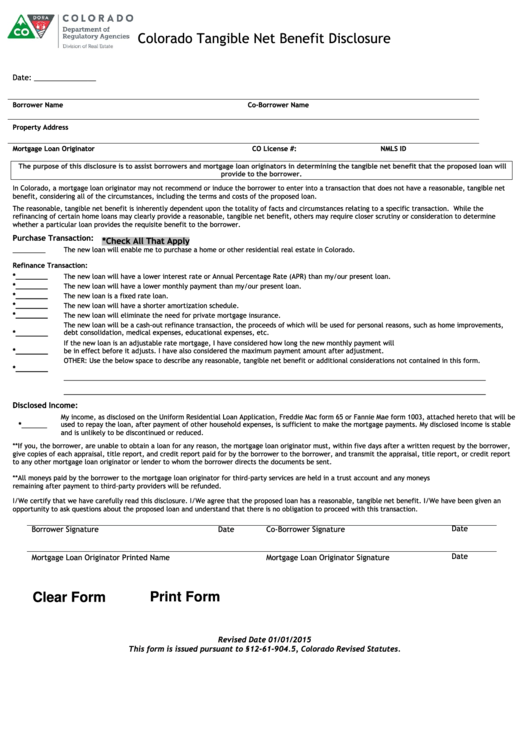

Colorado Tangible Net Benefit Disclosure

Date: _______________

Borrower Name

Co-Borrower Name

Property Address

Mortgage Loan Originator

CO License #:

NMLS ID

The purpose of this disclosure is to assist borrowers and mortgage loan originators in determining the tangible net benefit that the proposed loan will

provide to the borrower.

In Colorado, a mortgage loan originator may not recommend or induce the borrower to enter into a transaction that does not have a reasonable, tangible net

benefit, considering all of the circumstances, including the terms and costs of the proposed loan.

The reasonable, tangible net benefit is inherently dependent upon the totality of facts and circumstances relating to a specific transaction. While the

refinancing of certain home loans may clearly provide a reasonable, tangible net benefit, others may require closer scrutiny or consideration to determine

whether a particular loan provides the requisite benefit to the borrower.

Purchase Transaction:

*Check All That Apply

_________

The new loan will enable me to purchase a home or other residential real estate in Colorado.

Refinance Transaction:

*________

The new loan will have a lower interest rate or Annual Percentage Rate (APR) than my/our present loan.

*________

The new loan will have a lower monthly payment than my/our present loan.

*________

The new loan is a fixed rate loan.

*________

The new loan will have a shorter amortization schedule.

*________

The new loan will eliminate the need for private mortgage insurance.

The new loan will be a cash-out refinance transaction, the proceeds of which will be used for personal reasons, such as home improvements,

*________

debt consolidation, medical expenses, educational expenses, etc.

If the new loan is an adjustable rate mortgage, I have considered how long the new monthly payment will

*________

be in effect before it adjusts. I have also considered the maximum payment amount after adjustment.

OTHER: Use the below space to describe any reasonable, tangible net benefit or additional considerations not contained in this form.

*________

______________________________________________________________________________________________________

______________________________________________________________________________________________________

Disclosed Income:

My income, as disclosed on the Uniform Residential Loan Application, Freddie Mac form 65 or Fannie Mae form 1003, attached hereto that will be

*_______

used to repay the loan, after payment of other household expenses, is sufficient to make the mortgage payments. My disclosed income is stable

and is unlikely to be discontinued or reduced.

**If you, the borrower, are unable to obtain a loan for any reason, the mortgage loan originator must, within five days after a written request by the borrower,

give copies of each appraisal, title report, and credit report paid for by the borrower to the borrower, and transmit the appraisal, title report, or credit report

to any other mortgage loan originator or lender to whom the borrower directs the documents be sent.

**All moneys paid by the borrower to the mortgage loan originator for third-party services are held in a trust account and any moneys

remaining after payment to third-party providers will be refunded.

I/We certify that we have carefully read this disclosure. I/We agree that the proposed loan has a reasonable, tangible net benefit. I/We have been given an

opportunity to ask questions about the proposed loan and understand that there is no obligation to proceed with this transaction.

Borrower Signature

Date

Co-Borrower Signature

Date

Mortgage Loan Originator Printed Name

Mortgage Loan Originator Signature

Date

Print Form

Clear Form

Revised Date 01/01/2015

This form is issued pursuant to §12-61-904.5, Colorado Revised Statutes.

1

1