Hotel Motel Occupancy Tax Report Form

ADVERTISEMENT

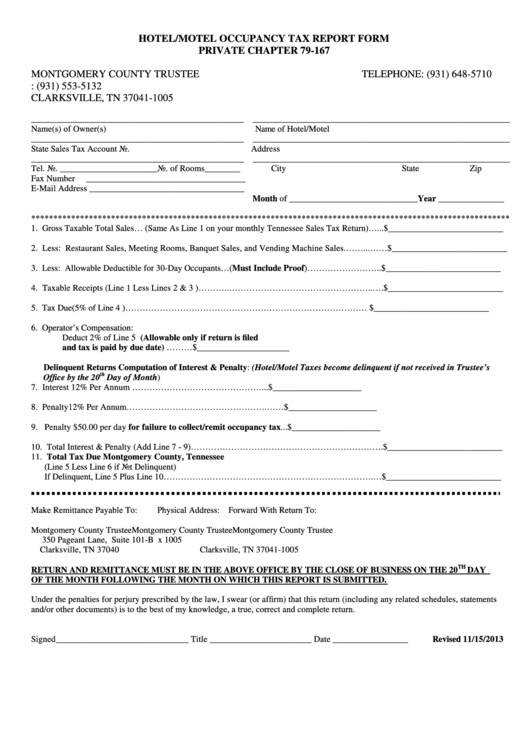

HOTEL/MOTEL OCCUPANCY TAX REPORT FORM

PRIVATE CHAPTER 79-167

MONTGOMERY COUNTY TRUSTEE

TELEPHONE: (931) 648-5710

P.O. BOX 1005

FAX: (931) 553-5132

CLARKSVILLE, TN 37041-1005

________________________________________________ __________________________________________________________

Name(s) of Owner(s)

Name of Hotel/Motel

________________________________________________ __________________________________________________________

State Sales Tax Account No.

Address

________________________________________________ __________________________________________________________

Tel. No. ______________________No. of Rooms________

City

State

Zip

Fax Number

____________________________________

E-Mail Address ___________________________________

Month of _____________________________Year _______________

************************************************************************************************************

1. Gross Taxable Total Sales… (Same As Line 1 on your monthly Tennessee Sales Tax Return)…...$__________________________

2. Less: Restaurant Sales, Meeting Rooms, Banquet Sales, and Vending Machine Sales.……...……$__________________________

3. Less: Allowable Deductible for 30-Day Occupants…(Must Include Proof)……………………..$__________________________

4. Taxable Receipts (Line 1 Less Lines 2 & 3 )………..…………………………………………..….$__________________________

5. Tax Due (5% of Line 4 )………………………………………………………………………….....$__________________________

6. Operator’s Compensation:

Deduct 2% of Line 5 (Allowable only if return is filed

and tax is paid by due date) .........................………..............................$_____________________

Delinquent Returns Computation of Interest & Penalty: (Hotel/Motel Taxes become delinquent if not received in Trustee’s

th

Office by the 20

Day of Month)

7. Interest 12% Per Annum ………………………………………............$____________________

8. Penalty12% Per Annum………………………………………….……$____________________

9. Penalty $50.00 per day for failure to collect/remit occupancy tax...$____________________

10. Total Interest & Penalty (Add Line 7 - 9)………………………………………………………….$__________________________

11. Total Tax Due Montgomery County, Tennessee

(Line 5 Less Line 6 if Not Delinquent)

If Delinquent, Line 5 Plus Line 10……………………………………………………………….…$__________________________

Make Remittance Payable To:

Physical Address:

Forward With Return To:

Montgomery County Trustee

Montgomery County Trustee

Montgomery County Trustee

350 Pageant Lane, Suite 101-B

P.O. Box 1005

Clarksville, TN 37040

Clarksville, TN 37041-1005

TH

RETURN AND REMITTANCE MUST BE IN THE ABOVE OFFICE BY THE CLOSE OF BUSINESS ON THE 20

DAY

OF THE MONTH FOLLOWING THE MONTH ON WHICH THIS REPORT IS SUBMITTED.

Under the penalties for perjury prescribed by the law, I swear (or affirm) that this return (including any related schedules, statements

and/or other documents) is to the best of my knowledge, a true, correct and complete return.

Signed______________________________ Title _______________________ Date _________________

Revised 11/15/2013

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1