Claim Form - Dependent Care Assistance Plan (Dcap)

ADVERTISEMENT

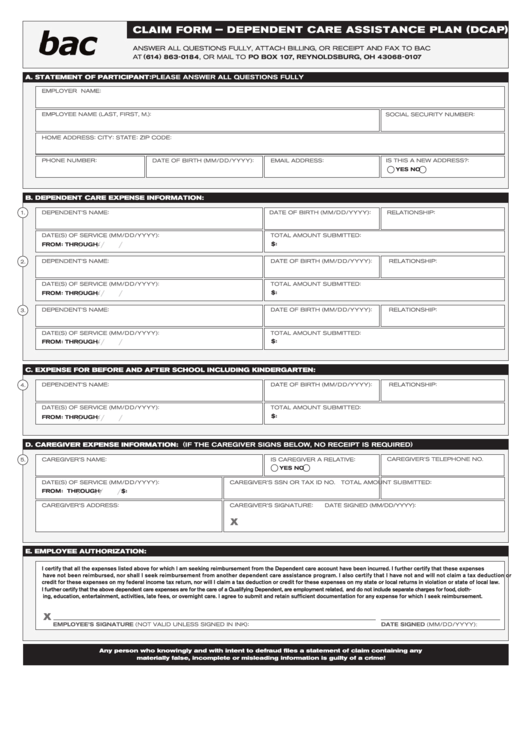

CLAIM FORM – DEPENDENT CARE ASSISTANCE PLAN ( DCAP )

ANSWER ALL QUESTIONS FULLY, ATTACH BILLING , OR RECEIPT AND FAX TO BAC

AT ( 614 ) 863 - 0184 , OR MAIL TO PO BOX 107 , REYNOLDSBURG, OH 43068 - 0107

A. STATEMENT OF PARTICIPANT : PLEASE ANSWER ALL QUESTIONS FULLY

EMPLOYER NAME :

EMPLOYEE NAME (LAST, FIRST, M.) :

SOCIAL SECURITY NUMBER :

HOME ADDRESS :

CITY :

STATE :

ZIP CODE :

PHONE NUMBER :

DATE OF BIRTH (MM/DD/YYYY):

EMAIL ADDRESS :

IS THIS A NEW ADDRESS? :

YES

NO

B. DEPENDENT CARE EXPENSE INFORMATION:

DEPENDENT’S NAME :

DATE OF BIRTH (MM/DD/YYYY):

RELATIONSHIP :

1.

DATE(S) OF SERVICE (MM/DD/YYYY):

TOTAL AMOUNT SUBMITTED :

/

/

/

/

FROM :

THROUGH :

$ :

DEPENDENT’S NAME :

DATE OF BIRTH (MM/DD/YYYY):

RELATIONSHIP :

2.

DATE(S) OF SERVICE (MM/DD/YYYY):

TOTAL AMOUNT SUBMITTED :

/

/

/

/

FROM :

THROUGH :

$ :

DEPENDENT’S NAME :

DATE OF BIRTH (MM/DD/YYYY):

RELATIONSHIP :

3.

DATE(S) OF SERVICE (MM/DD/YYYY):

TOTAL AMOUNT SUBMITTED :

/

/

/

/

FROM :

THROUGH :

$ :

C. EXPENSE FOR BEFORE AND AFTER SCHOOL INCLUDING KINDERGARTEN:

DEPENDENT’S NAME :

DATE OF BIRTH (MM/DD/YYYY):

RELATIONSHIP :

4.

DATE(S) OF SERVICE (MM/DD/YYYY):

TOTAL AMOUNT SUBMITTED :

/

/

/

/

$ :

FROM :

THROUGH :

D. CAREGIVER EXPENSE INFORMATION: ( IF THE CAREGIVER SIGNS BELOW, NO RECEIPT IS REQUIRED )

CAREGIVER’S NAME :

IS CAREGIVER A RELATIVE :

CAREGIVER’S TELEPHONE NO.

5.

YES

NO

DATE(S) OF SERVICE (MM/DD/YYYY):

CAREGIVER’S SSN OR TAX ID NO.

TOTAL AMOUNT SUBMITTED :

/

/

/

/

FROM :

THROUGH :

$ :

CAREGIVER’S ADDRESS :

CAREGIVER’S SIGNATURE :

DATE SIGNED (MM/DD/YYYY) :

X

E. EMPLOYEE AUTHORIZATION:

I certify that all the expenses listed above for which I am seeking reimbursement from the Dependent care account have been incurred. I further certify that these expenses

have not been reimbursed, nor shall I seek reimbursement from another dependent care assistance program. I also certify that I have not and will not claim a tax deduction or

credit for these expenses on my federal income tax return, nor will I claim a tax deduction or credit for these expenses on my state or local returns in violation or state of local law.

I further certify that the above dependent care expenses are for the care of a Qualifying Dependent, are employment related, and do not include separate charges for food, cloth-

ing, education, entertainment, activities, late fees, or overnight care. I agree to submit and retain sufficient documentation for any expense for which I seek reimbursement.

X

EMPLOYEE’S SIGNATURE (NOT VALID UNLESS SIGNED IN INK) :

DATE SIGNED (MM/DD/YYYY):

Any person who knowingly and with intent to defraud files a statement of claim containing any

materially false, incomplete or misleading information is guilty of a crime!

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2