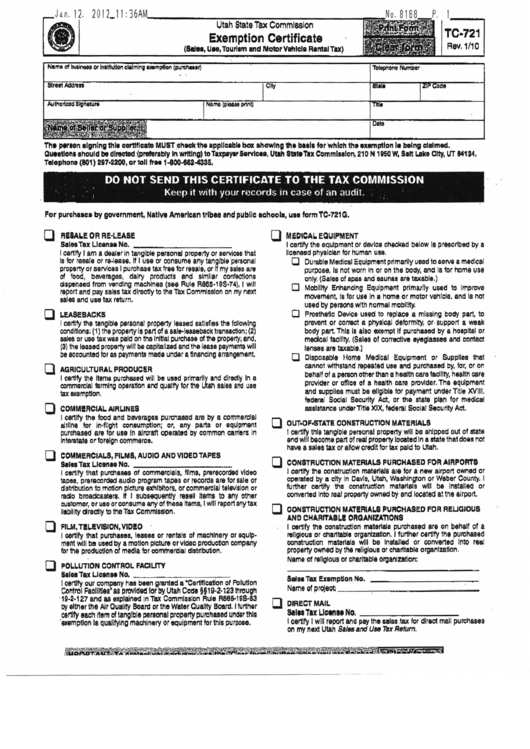

Utah State Sales Tax Exemption Form

ADVERTISEMENT

Jan.

12. 201Lll:36AM,

_

(i)

Utah State Tax

Commission

" ,

(S-'

UEXliem,ptiodn"Ctoerv!!.fliCI

IRta

••H.

H,

our

1m 1ft

or

•• , c

I

ental Tu)

P.

1_---.

TC·721

Rev, 1/10

Clly

Nama

of

bu4ineGa

01'

Institutionclllmlrlll_mpt!on

(pu~.r)

Slreet

Add~ss

Name (Pleaae print)

Dels

Th. ptl'lOn algnlng thla

certificate

MUST

.check the

applicable

box ahowlnglht

b •• la for

'whlch the axemptlon

I.

being claimed.

Que,tlc,,'

Ihould be directed

'(preferablv

In

writing)

to

TaxpayerServlcu,

Utah

Stat. Tax Commission, 210 N 1850

W.

Silt Lake

CIty,

VT

14134.

Telephone (S01) 287.2200, or toll

"H

1-800-GS2-4335.

DO NOT

SEND

THIS

CERTIFICATE

.TO THE TAX COMMISSION

.

.

;

Keep it with your

records

in case of an

audit.

,

.

For purchase,

by

government,

Natlv. American tribes and public IIchoola,

Us,

form

TC·721

G.

o

RESALE OR RE-L.EASE

SalelTax

Wean.e

No.

_

I CQl1lfy

I

am

a

dealer in tangible personal property or services that

Is fer resale or re-Iea$e. If I use or consume any tangible personal

property or servlcaa I purchase tax free for resale, or If my sales are

of

food,

beveragas,

dairy

products

and

similar

confections

dispensed from vending machines (see Rule

R86~-19S·74),

I Will

report and

pay

sales tax directly to the

'Tlax

Commission

en

my

next

sal8$ and use

tax

return.

o

LEASE BACKS

I

certify the tenglble personal property leased sati&fies the following

conditions; (1) the property Is part of a sale-leaseback transac!lon; (2)

sale& or use tax was paid on the Initial purchase of the property; end,

(3) the leased property will be capitalized and the lease paymen1s will

be accounted lor as payments made under

Ii

financing arrangement,

o

AGRICULTURAL

PRODUCER

I certify the Items purchased

will

be used primarily and dlrec1~ In a

commercial farming operation and

qualify

for the

Utah

sales

and

use

tax exemption.

o

COMM!ACIAL.

A1RUNES

I cenlfy the food and beverages purchased

are by

a

commercial

airline for in-flight

consumption;

or. any parts

or equipment

purchased are for use In aircraft operated by common carriers In

Interatate or foreign commerce,

COMMERCIALS,

FILMS, AUDIO AND VIDEO TAPES

SeiliTax Llcenle

No.

_

I certify that purchases

of commercials,

films, prerecorded video

tapes, prerecorded

audlo program tapes

or

records are for sale or

distribution to motion ple!ure exhibitors. or commercial television or

radio broadcasters.

If I subsequently

resell

items

to

any other

customer, or use or consume any of these Items, I will report any

tax

liability directly to the Tax Commission.

o

o

FILM, T!~VISION,

VID!O

.

I cenlfy that purchasea. leasea or rentals of machinery

or 9Qulp.

ment

will be used by a motion picture or video production company

for

the

production

01

media fer oommercial

dlstrlbution.

POLLUTION

CONTROL. FACIUTY

SeluTax

Ucan" No.

,.---

I certify our company has been granted a ·Certlflcation

or Pollution

Control Faolll~es' as provided for

by

Utah Cod.

§§19-2-123

through

'19-2-127

and

as

explained in

laX

Commll55lon Rul.

RSSS-1eS·83

by

either the Air Quality

Soard

or the Water Quality Board. I further

certify each

item

of

tangible personal property purchued

undor this

.exemption

Is

qualifying machinery or eCluipment for this purpose,

o

o

MEDICAL

EQUIPMENT

I certify the equipment or device checked below IS prescribed by a

licensed physician for human ulla.

o

Durable Medica! Equipment primarily used to serve a medical

purpose,

Is not worn in or on the body, and

Is

for home use

only.

(Sales of spae and saunas are taxable.)

o

Mobility

Enhancing

equipment

primarily

used to Improve

movement,

Is

for use in

a

home or motor

vehIcle,

and Is not

used by persons with normal

mobility,

o

Prosthetlc

Device used to replace

a

missing body part. to

prevent or correct

a

physical

deformity,

or support

Ii

weak

body

part, This Is also ~empt

If

purchased

by a hospital cr

medical

facility,

(Sales

01

corrective eyeglasses

and contae!

lenses are taxable,)

o

Disposable

Home

Medical

Equipment

or

Supplies

that

cannot withstand repeated use and purchased by. for, or on

behalf of a person other than a health care facility, health care

provider or office of

a

health care provider. The equipment

and supplies must be eligible for payment under Title XVIII,

federal

Social Security Act, or the state plan for medical

ssal91ance under Title

XIX.

faoeral Social Security Act.

o

OUT·DF·STATE

CONSTRUCTION

MATERIALS

I certify this tangible personal property will be shipped out of state

and will become part

01

real property located In a state that does not

have a sales tax or allow credit

lor

tax paid to utah.

o

CONSTRUCTION

MATERIALS

PURCHASED

FOR AIAPORTS

I certify the construction

materials

are

for a new airport owned or

operat.d

by a c1ty

In

Cavls, Utah, WashIngton

or Weber

County.

I

further

certify

the constructron

materials

will be Installed

or

converted Into real property ownad

by

end located at the airport.

D

CONSTRUCTION

MATEAIALS

PURCHASED

FOR REUGIOUS

AND CHARITABL!

OAGANlZATlONS

I certify the construction

materials purchased

are

on

behall

01

a

religious or cI'Ilrltabie

organization.

Ifurther certify the purchased

construction

materials

will be Installed

or converted

Into real

property owned

by

the religiOUS or charitable organization.

Name of religious or charitable organization:

Salel

Tax Exemption No.

Name

01

project;

-e-t-

_

D

DIRECT MAIl.

SI'" Tax Uo." •• No. __

--:--:---:---::---::---:-:--

I oertify

I

will repon and pay the 511es .tax for direct mall purchases

on my next Utah S8185 and Use 7I!Ix

Return.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1