Application For Income-Sensitive Repayment

ADVERTISEMENT

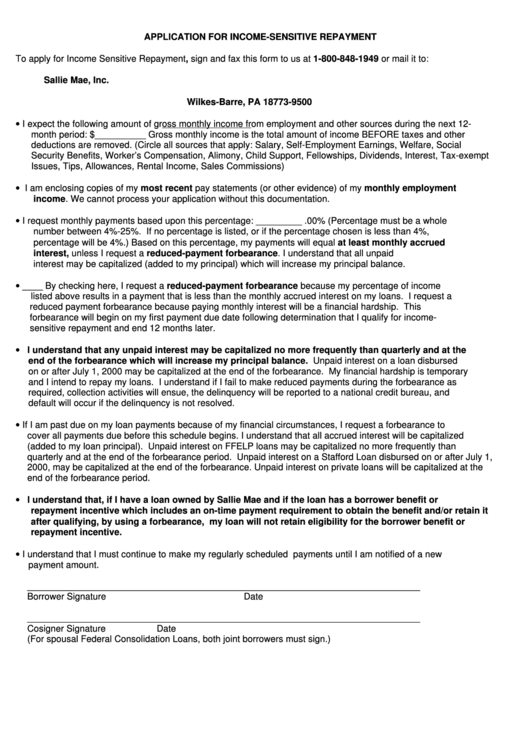

APPLICATION FOR INCOME-SENSITIVE REPAYMENT

To apply for Income Sensitive Repayment, sign and fax this form to us at 1-800-848-1949 or mail it to:

Sallie Mae, Inc.

P.O. Box 9500

Wilkes-Barre, PA 18773-9500

I expect the following amount of gross monthly income from employment and other sources during the next 12-

•

month period: $__________ Gross monthly income is the total amount of income BEFORE taxes and other

deductions are removed. (Circle all sources that apply: Salary, Self-Employment Earnings, Welfare, Social

Security Benefits, Worker’s Compensation, Alimony, Child Support, Fellowships, Dividends, Interest, Tax-exempt

Issues, Tips, Allowances, Rental Income, Sales Commissions)

I am enclosing copies of my most recent pay statements (or other evidence) of my monthly employment

•

income. We cannot process your application without this documentation.

I request monthly payments based upon this percentage: _________ .00% (Percentage must be a whole

•

number between 4%-25%. If no percentage is listed, or if the percentage chosen is less than 4%,

percentage will be 4%.) Based on this percentage, my payments will equal at least monthly accrued

interest, unless I request a reduced-payment forbearance. I understand that all unpaid

interest may be capitalized (added to my principal) which will increase my principal balance.

____ By checking here, I request a reduced-payment forbearance because my percentage of income

•

listed above results in a payment that is less than the monthly accrued interest on my loans. I request a

reduced payment forbearance because paying monthly interest will be a financial hardship. This

forbearance will begin on my first payment due date following determination that I qualify for income-

sensitive repayment and end 12 months later.

• I understand that any unpaid interest may be capitalized no more frequently than quarterly and at the

end of the forbearance which will increase my principal balance. Unpaid interest on a loan disbursed

on or after July 1, 2000 may be capitalized at the end of the forbearance. My financial hardship is temporary

and I intend to repay my loans. I understand if I fail to make reduced payments during the forbearance as

required, collection activities will ensue, the delinquency will be reported to a national credit bureau, and

default will occur if the delinquency is not resolved.

• If I am past due on my loan payments because of my financial circumstances, I request a forbearance to

cover all payments due before this schedule begins. I understand that all accrued interest will be capitalized

(added to my loan principal). Unpaid interest on FFELP loans may be capitalized no more frequently than

quarterly and at the end of the forbearance period. Unpaid interest on a Stafford Loan disbursed on or after July 1,

2000, may be capitalized at the end of the forbearance. Unpaid interest on private loans will be capitalized at the

end of the forbearance period.

• I understand that, if I have a loan owned by Sallie Mae and if the loan has a borrower benefit or

repayment incentive which includes an on-time payment requirement to obtain the benefit and/or retain it

after qualifying, by using a forbearance, my loan will not retain eligibility for the borrower benefit or

repayment incentive.

• I understand that I must continue to make my regularly scheduled payments until I am notified of a new

payment amount.

_____________________________________________________________________________

Borrower Signature

Date

_____________________________________________________________________________

Cosigner Signature

Date

(For spousal Federal Consolidation Loans, both joint borrowers must sign.)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1