2015-2016 Verification Of 2014 Income For Parent Tax Filers Form

ADVERTISEMENT

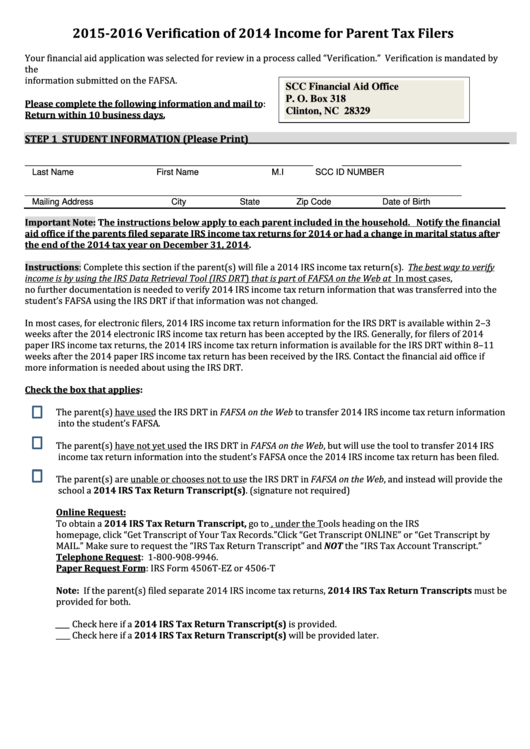

2015-2016 Verification of 2014 Income for Parent Tax Filers

Your financial aid application was selected for review in a process called “Verification.” Verification is mandated by

the U.S. Department of Education and requires schools to gather additional documentation to check the accuracy of

information submitted on the FAFSA.

SCC Financial Aid Office

P. O. Box 318

Please complete the following information and mail to:

Clinton, NC 28329

Return within 10 business days.

STEP 1 STUDENT INFORMATION (Please Print)___________________________________________________________________

__________________________________________________________________________________

__________________________________

Last Name

First Name

M.I

SCC ID NUMBER

____________________________________________________________________________________________

Mailing Address

City

State

Zip Code

Date of Birth

Important Note: The instructions below apply to each parent included in the household. Notify the financial

aid office if the parents filed separate IRS income tax returns for 2014 or had a change in marital status after

the end of the 2014 tax year on December 31, 2014.

Instructions: Complete this section if the parent(s) will file a 2014 IRS income tax return(s). The best way to verify

income is by using the IRS Data Retrieval Tool (IRS DRT) that is part of FAFSA on the Web at FAFSA.gov. In most cases,

no further documentation is needed to verify 2014 IRS income tax return information that was transferred into the

student’s FAFSA using the IRS DRT if that information was not changed.

In most cases, for electronic filers, 2014 IRS income tax return information for the IRS DRT is available within 2–3

weeks after the 2014 electronic IRS income tax return has been accepted by the IRS. Generally, for filers of 2014

paper IRS income tax returns, the 2014 IRS income tax return information is available for the IRS DRT within 8–11

weeks after the 2014 paper IRS income tax return has been received by the IRS. Contact the financial aid office if

more information is needed about using the IRS DRT.

Check the box that applies:

The parent(s) have used the IRS DRT in FAFSA on the Web to transfer 2014 IRS income tax return information

into the student’s FAFSA.

The parent(s) have not yet used the IRS DRT in FAFSA on the Web, but will use the tool to transfer 2014 IRS

income tax return information into the student’s FAFSA once the 2014 IRS income tax return has been filed.

The parent(s) are unable or chooses not to use the IRS DRT in FAFSA on the Web, and instead will provide the

school a 2014 IRS Tax Return Transcript(s). (signature not required)

Online Request:

To obtain a 2014 IRS Tax Return Transcript, go to , under the Tools heading on the IRS

homepage, click “Get Transcript of Your Tax Records.” Click “Get Transcript ONLINE” or “Get Transcript by

MAIL.” Make sure to request the “IRS Tax Return Transcript” and NOT the “IRS Tax Account Transcript.”

Telephone Request: 1-800-908-9946.

Paper Request Form: IRS Form 4506T-EZ or 4506-T

Note: If the parent(s) filed separate 2014 IRS income tax returns, 2014 IRS Tax Return Transcripts must be

provided for both.

____ Check here if a 2014 IRS Tax Return Transcript(s) is provided.

____ Check here if a 2014 IRS Tax Return Transcript(s) will be provided later.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2