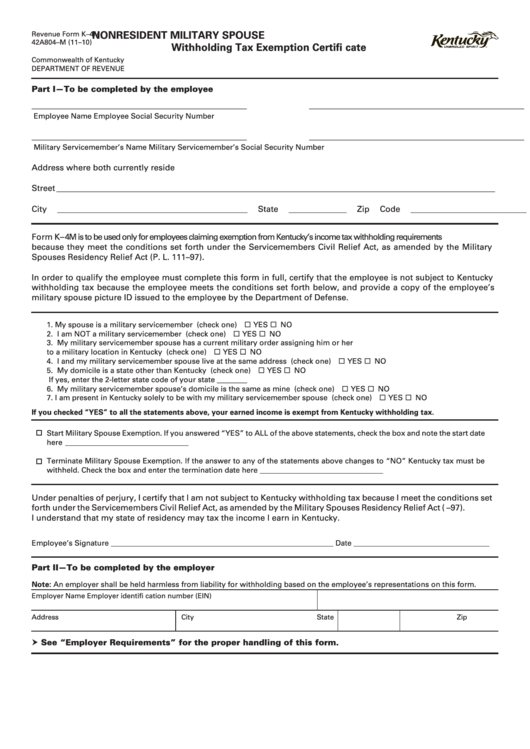

Revenue Form K-4m - Nonresident Military Spouse Withholding Tax Exemption Certificate

ADVERTISEMENT

Revenue Form K–4M

NONRESIDENT MILITARY SPOUSE

42A804–M (11–10)

Withholding Tax Exemption Certifi cate

Commonwealth of Kentucky

DEPARTMENT OF REVENUE

Part I—To be completed by the employee

____________________________________________________

____________________________________________________

Employee Name

Employee Social Security Number

____________________________________________________

____________________________________________________

Military Servicemember’s Name

Military Servicemember’s Social Security Number

Address where both currently reside

Street __________________________________________________________________________________________________________

City ______________________________________________

State ______________

Zip Code ____________________________

Form K – 4M is to be used only for employees claiming exemption from Kentucky’s income tax withholding requirements

because they meet the conditions set forth under the Servicemembers Civil Relief Act, as amended by the Military

Spouses Residency Relief Act (P. L. 111–97).

In order to qualify the employee must complete this form in full, certify that the employee is not subject to Kentucky

withholding tax because the employee meets the conditions set forth below, and provide a copy of the employee’s

military spouse picture ID issued to the employee by the Department of Defense.

1. My spouse is a military servicemember .......................................................................................... (check one)

YES

NO

2. I am NOT a military servicemember ................................................................................................ (check one)

YES

NO

3. My military servicemember spouse has a current military order assigning him or her

to a military location in Kentucky ..................................................................................................... (check one)

YES

NO

4. I and my military servicemember spouse live at the same address ............................................. (check one)

YES

NO

5. My domicile is a state other than Kentucky .................................................................................... (check one)

YES

NO

If yes, enter the 2-letter state code of your state ________

6. My military servicemember spouse’s domicile is the same as mine ............................................ (check one)

YES

NO

7. I am present in Kentucky solely to be with my military servicemember spouse ......................... (check one)

YES

NO

If you checked “YES” to all the statements above, your earned income is exempt from Kentucky withholding tax.

Start Military Spouse Exemption. If you answered “YES” to ALL of the above statements, check the box and note the start date

here _________________________________

Terminate Military Spouse Exemption. If the answer to any of the statements above changes to “NO” Kentucky tax must be

withheld. Check the box and enter the termination date here _________________________________

Under penalties of perjury, I certify that I am not subject to Kentucky withholding tax because I meet the conditions set

forth under the Servicemembers Civil Relief Act, as amended by the Military Spouses Residency Relief Act (P.L. 111–97).

I understand that my state of residency may tax the income I earn in Kentucky.

Employee’s Signature ___________________________________________________________

Date ____________________________________

Part II—To be completed by the employer

Note: An employer shall be held harmless from liability for withholding based on the employee’s representations on this form.

Employer Name

Employer identifi cation number (EIN)

Address

City

State

Zip Code

See “Employer Requirements” for the proper handling of this form.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Business

1

1 2

2