Quit Claim Deed Brochure Scott Sturvist Properties

ADVERTISEMENT

Quitclaim deed flyer

6/14/05

2:06 PM

Page 1

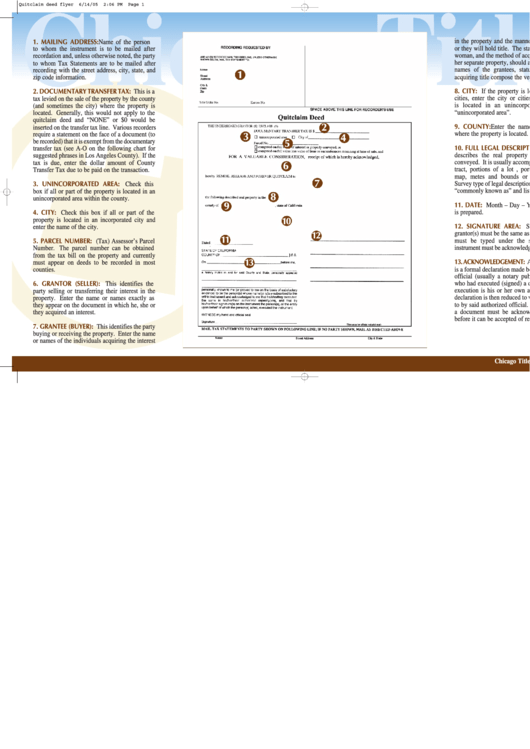

1. MAILING ADDRESS:

in the property and the manner in which he, she

Name of the person

or they will hold title. The status, e.g., a married

to whom the instrument is to be mailed after

woman, and the method of acquiring title, e.g., as

recordation and, unless otherwise noted, the party

her separate property, should also be set out. The

to whom Tax Statements are to be mailed after

names of the grantees, status and method of

recording with the street address, city, state, and

1

acquiring title compose the vesting.

zip code information.

8. CITY:

2. DOCUMENTARY TRANSFER TAX:

This is a

If the property is located in a city or

cities, enter the city or cities. If the property

tax levied on the sale of the property by the county

is located in an unincorporated area, enter

(and sometimes the city) where the property is

“unincorporated area”.

located. Generally, this would not apply to the

quitclaim deed and “NONE” or $0 would be

2

9. COUNTY:

Enter the name of the county

inserted on the transfer tax line. Various recorders

where the property is located.

require a statement on the face of a document (to

3

4

be recorded) that it is exempt from the documentary

5

10. FULL LEGAL DESCRIPTION:

transfer tax (see A-O on the following chart for

This legally

suggested phrases in Los Angeles County). If the

describes the real property or interest being

conveyed. It is usually accomplished by a lot and

tax is due, enter the dollar amount of County

6

tract, portions of a lot , portions or a Rancho

Transfer Tax due to be paid on the transaction.

map, metes and bounds or U.S. Government

7

3. UNINCORPORATED AREA:

Survey type of legal description. You may include

Check this

“commonly known as” and list the street address.

box if all or part of the property is located in an

8

unincorporated area within the county.

9

11. DATE:

Month – Day – Year this instrument

4. CITY:

Check this box if all or part of the

is prepared.

property is located in an incorporated city and

10

12. SIGNATURE AREA:

Signature(s) of the

enter the name of the city.

grantor(s) must be the same as # 6 above. Names

12

11

5. PARCEL NUMBER:

must be typed under the signature and the

(Tax) Assessor’s Parcel

instrument must be acknowledged before a Notary.

Number. The parcel number can be obtained

from the tax bill on the property and currently

13

13. ACKNOWLEDGEMENT:

must appear on deeds to be recorded in most

An acknowledgement

counties.

is a formal declaration made before an authorized

official (usually a notary public) by the person

6. GRANTOR (SELLER):

who had executed (signed) a document that such

This identifies the

execution is his or her own act and deed. This

party selling or transferring their interest in the

declaration is then reduced to writing and attested

property. Enter the name or names exactly as

to by said authorized official. In most instances,

they appear on the document in which he, she or

a document must be acknowledged (notarized)

they acquired an interest.

before it can be accepted of recordation.

7. GRANTEE (BUYER):

This identifies the party

buying or receiving the property. Enter the name

or names of the individuals acquiring the interest

Chicago Title – It’s your choice.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Business

1

1 2

2