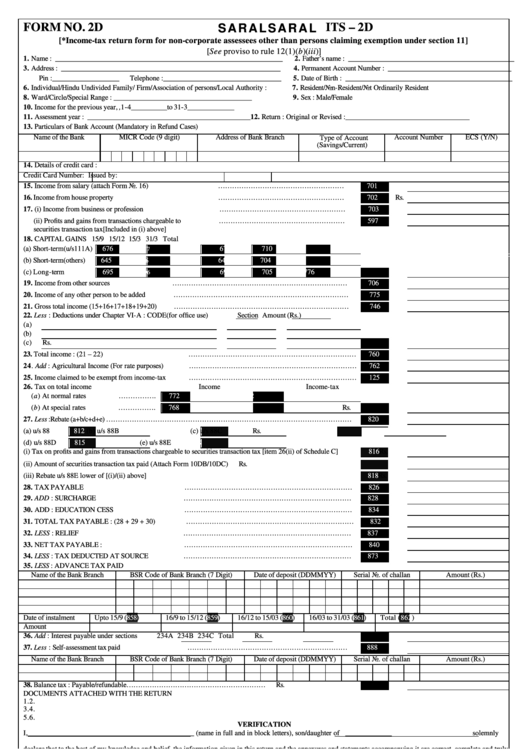

Form No. 2d - Income Tax Return Form For Noncorporate Assessees Other Than Persons Claiming Exemption Under Section 11

ADVERTISEMENT

SARAL

SARAL

FORM NO. 2D

ITS – 2D

[*Income -tax return form for non-corporate assessees other than persons claiming exemption under section 11]

[See proviso to rule 12(1)(b)(iii)]

1. Name : ________________________________________________________________

2. Father’s name : _______________________________________________

3. Address : ______________________________________________________________

4. Permanent Account Number : ___________________________________

Pin :___________________

Telephone :_________________________________

5. Date of Birth : _______________________________________________

6. Individual/Hindu Undivided Family/ Firm/Association of persons/Local Authority :

7. Resident/Non-Resident/Not Ordinarily Resident

8. Ward/Circle/Special Range : _______________________________________

9. Sex : Male/Female

10. Income for the previous year, i.e.,

1-4__________to 31-3_____________

11. Assessment year : ______________________________________________

12. Return : Original or Revised :___________________________________

13. Particulars of Bank Account (Mandatory in Refund Cases)

Name of the Bank

MICR Code (9 digit)

Address of Bank Branch

Account Number

ECS (Y/N)

Type of Account

(Savings/Current)

14. Details of credit card :

Credit Card Number:

Issued by:

15. Income from salary (attach Form No. 16)

………………………………………………

701

Rs.

16. Income from house property

………………………………………………

702

Rs.

17. (i) Income from business or profession

………………………………………………

703

Rs.

(ii) Profits and gains from transactions chargeable to

………………………………………………

597

Rs.

securities transaction tax[Included in (i) above]

18. CAPITAL GAINS

15/9

15/12

15/3

31/3

Total

(a) Short-term(u/s111A)

676

678

679

710

677

(b) Short -term(others)

645

647

648

704

646

(c) Long-term

695

697

698

705

776

Rs.

696

19. Income from other sources

…………………………………………………………………

706

Rs.

20. Income of any other person to be added

…………………………………………………………………

775

Rs.

21. Gross total income (15+16+17+18+19+20)

…………………………………………………………………

746

Rs.

22. Less : Deductions under Chapter VI-A : CODE(for office use)

Section

Amount (Rs.)

(a)

(b)

(c)

747

Rs.

23. Total income : (21 – 22)

………………………………………………………………

760

Rs.

24. Add : Agricultural Income (For rate purposes)

………………………………………………………………

762

Rs.

25. Income claimed to be exempt from income-tax

………………………………………………………………

125

Rs.

26. Tax on total income

Income

Income-tax

(a) At normal rates

…………….

772

802

(b) At special rates

…………….

768

801

810

Rs.

27. Less :Rebate (a+b/c+d+e) ……………………………………………………………………………………………

820

Rs.

(a) u/s 88

812

(b) u/s 88B

813

(c) u/s 88C

814

Rs.

(d) u/s 88D

815

(e) u/s 88E

818

(i) Tax on profits and gains from transactions chargeable to securities transaction tax [item 26(ii) of Schedule C]

816

Rs.

(ii) Amount of securities transaction tax paid (Attach Form 10DB/10DC)

817

Rs.

(iii) Rebate u/s 88E lower of [(i)/(ii) above]

818

Rs.

28. TAX PAYABLE

………………………………………………………………

826

Rs.

29. ADD : SURCHARGE

………………………………………………………………

828

Rs.

30. ADD : EDUCATION CESS

………………………………………………………………

834

Rs.

31. TOTAL TAX PAYABLE : (28 + 29 + 30)

………………………………………………………………

832

Rs.

32. LESS : RELIEF

………………………………………………………………

837

Rs.

33. NET TAX PAYABLE :

………………………………………………………………

840

Rs.

34. LESS : TAX DEDUCTED AT SOURCE

………………………………………………………………

873

Rs.

35. LESS : ADVANCE TAX PAID

Name of the Bank Branch

BSR Code of Bank Branch (7 Digit)

Date of deposit (DDMMYY)

Serial No. of challan

Amount (Rs.)

Date of instalment

Upto 15/9 (858)

16/9 to 15/12 (859)

16/12 to 15/03 (860)

16/03 to 31/03 (861)

Total (862)

Amount

36. Add : Interest payable under sections

234A

234B

234C

Total

851

Rs.

37. Less : Self-assessment tax paid

……………………………………………………………

888

Rs.

Name of the Bank Branch

BSR Code of Bank Branch (7 Digit)

Date of deposit (DDMMYY)

Serial No. of challan

Amount (Rs.)

38. Balance tax : Payable/refundable

……………………………………………………

891

Rs.

DOCUMENTS ATTACHED WITH THE RETURN

1.

2.

3.

4.

5.

6.

VERIFICATION

I,_______________________________________________ (name in full and in block letters), son/daughter of _____________

solemnly

declare that to th e best of my knowledge and belief, the information given in this return and the annexures and statements accompanying it are correct, complete and truly

stated and in accordance with the provisions of the Income-tax Act, 1961, in respect of income chargeable to income-tax for the previous year relevant to the assessment

year_______________

Receipt No______________

Date____________

Date :

Seal

Signature of the receiving official

Place :

Signature

* Please go through the instructions

Printed from

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2