Day Care Provider Income And Expense Worksheet Template

ADVERTISEMENT

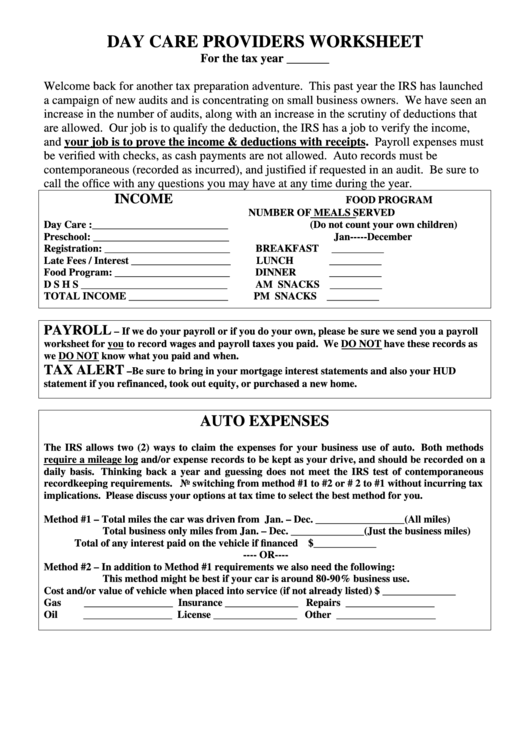

DAY CARE PROVIDERS WORKSHEET

For the tax year _______

Welcome back for another tax preparation adventure. This past year the IRS has launched

a campaign of new audits and is concentrating on small business owners. We have seen an

increase in the number of audits, along with an increase in the scrutiny of deductions that

are allowed. Our job is to qualify the deduction, the IRS has a job to verify the income,

and your job is to prove the income & deductions with receipts. Payroll expenses must

be verified with checks, as cash payments are not allowed. Auto records must be

contemporaneous (recorded as incurred), and justified if requested in an audit. Be sure to

call the office with any questions you may have at any time during the year.

INCOME

FOOD PROGRAM

NUMBER OF MEALS SERVED

Day Care :__________________________

(Do not count your own children)

Preschool: __________________________

Jan-----December

Registration: ________________________

BREAKFAST

__________

Late Fees / Interest ___________________

LUNCH

__________

Food Program: ______________________

DINNER

__________

D S H S ____________________________

AM SNACKS __________

TOTAL INCOME ___________________

PM SNACKS __________

PAYROLL

– If we do your payroll or if you do your own, please be sure we send you a payroll

worksheet for you to record wages and payroll taxes you paid. We DO NOT have these records as

we DO NOT know what you paid and when.

TAX ALERT

–Be sure to bring in your mortgage interest statements and also your HUD

statement if you refinanced, took out equity, or purchased a new home.

AUTO EXPENSES

The IRS allows two (2) ways to claim the expenses for your business use of auto. Both methods

require a mileage log and/or expense records to be kept as your drive, and should be recorded on a

daily basis. Thinking back a year and guessing does not meet the IRS test of contemporaneous

recordkeeping requirements. No switching from method #1 to #2 or # 2 to #1 without incurring tax

implications. Please discuss your options at tax time to select the best method for you.

Method #1 – Total miles the car was driven from Jan. – Dec. _________________(All miles)

Total business only miles from Jan. – Dec. ______________(Just the business miles)

Total of any interest paid on the vehicle if financed $____________

---- OR----

Method #2 – In addition to Method #1 requirements we also need the following:

This method might be best if your car is around 80-90% business use.

Cost and/or value of vehicle when placed into service (if not already listed) $ ______________

Gas

_________________ Insurance ______________ Repairs _________________

Oil

_________________ License ________________ Other ___________________

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3