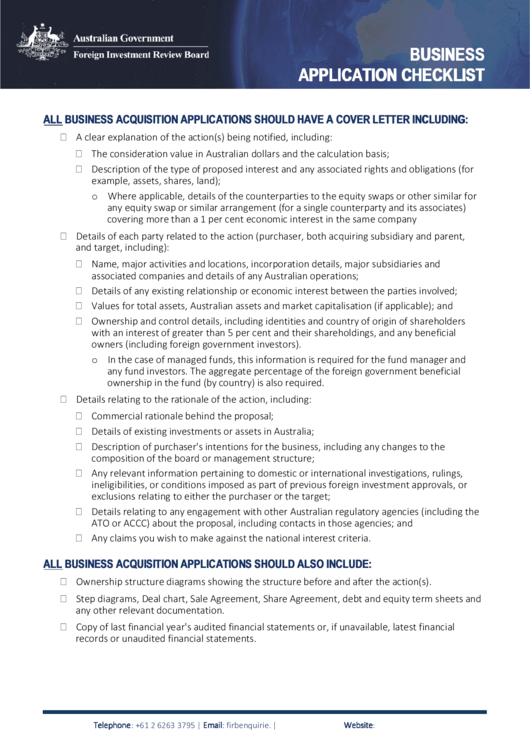

Firb Business Application Checklist

ADVERTISEMENT

BUSINESS

APPLICATION CHECKLIST

ALL BUSINESS ACQUISITION APPLICATIONS SHOULD HAVE A COVER LETTER INCLUDING:

A clear explanation of the action(s) being notified, including:

The consideration value in Australian dollars and the calculation basis;

Description of the type of proposed interest and any associated rights and obligations (for

example, assets, shares, land);

o Where applicable, details of the counterparties to the equity swaps or other similar for

any equity swap or similar arrangement (for a single counterparty and its associates)

covering more than a 1 per cent economic interest in the same company

Details of each party related to the action (purchaser, both acquiring subsidiary and parent,

and target, including):

Name, major activities and locations, incorporation details, major subsidiaries and

associated companies and details of any Australian operations;

Details of any existing relationship or economic interest between the parties involved;

Values for total assets, Australian assets and market capitalisation (if applicable); and

Ownership and control details, including identities and country of origin of shareholders

with an interest of greater than 5 per cent and their shareholdings, and any beneficial

owners (including foreign government investors).

o In the case of managed funds, this information is required for the fund manager and

any fund investors. The aggregate percentage of the foreign government beneficial

ownership in the fund (by country) is also required.

Details relating to the rationale of the action, including:

Commercial rationale behind the proposal;

Details of existing investments or assets in Australia;

Description of purchaser's intentions for the business, including any changes to the

composition of the board or management structure;

Any relevant information pertaining to domestic or international investigations, rulings,

ineligibilities, or conditions imposed as part of previous foreign investment approvals, or

exclusions relating to either the purchaser or the target;

Details relating to any engagement with other Australian regulatory agencies (including the

ATO or ACCC) about the proposal, including contacts in those agencies; and

Any claims you wish to make against the national interest criteria.

ALL BUSINESS ACQUISITION APPLICATIONS SHOULD ALSO INCLUDE:

Ownership structure diagrams showing the structure before and after the action(s).

Step diagrams, Deal chart, Sale Agreement, Share Agreement, debt and equity term sheets and

any other relevant documentation.

Copy of last financial year's audited financial statements or, if unavailable, latest financial

records or unaudited financial statements.

Telephone: +61 2 6263 3795 | Email: firbenquiries@treasury.gov.au | Website:

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Business

1

1 2

2