Annual Return To East Greenwich Form - R.i. Town Assessor

ADVERTISEMENT

Annual Return to

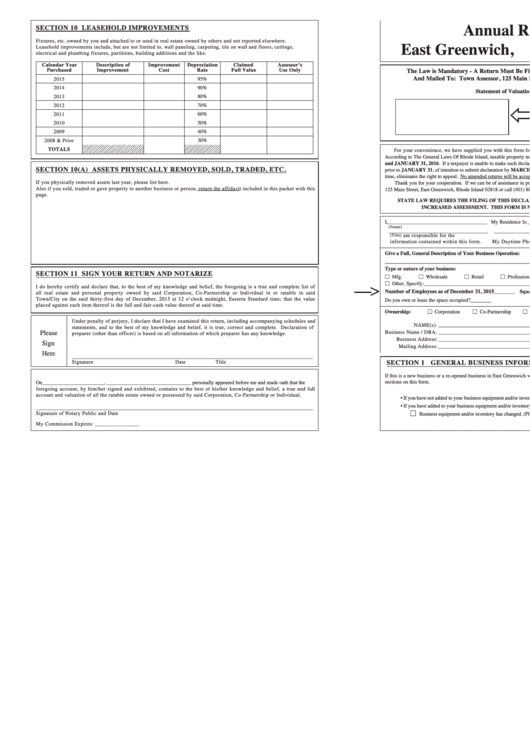

SECTION 10 LEASEHOLD IMPROVEMENTS

East Greenwich, R.I. Town Assessor

Fixtures, etc. owned by you and attached to or used in real estate owned by others and not reported elsewhere.

Leasehold improvements include, but are not limited to, wall paneling, carpeting, tile on wall and floors, ceilings,

electrical and plumbing fixtures, partitions, building additions and the like.

Calendar Year

Description of

Improvement

Depreciation

Claimed

Assessor’s

Purchased

Improvement

Cost

Rate

Full Value

Use Only

The Law is Mandatory - A Return Must Be Filed (RI Law Section 44-5-15, as amended)

And Mailed To: Town Assessor, 125 Main Street, P O Box 111, Rhode Island 02818

95%

2015

2014

90%

Statement of Valuation as of 12/31/2015

80%

2013

2012

70%

This Name and Mailing Address will be used

2011

60%

for tax bill. Please change if incorrect.

2010

50%

2009

40%

2008 & Prior

30%

TOTALS

For your convenience, we have supplied you with this form for the declaration of taxable property located in Rhode Island.

According to The General Laws Of Rhode Island, taxable property must be declared to the Assessor between DECEMBER 31, 2015

and JANUARY 31, 2016. If a taxpayer is unable to make such declaration within the prescribed time, they may submit written notice,

SECTION 10 (A) ASSETS PHYSICALLY REMOVED, SOLD, TRADED, ETC.

prior to JANUARY 31, of intention to submit declaration by MARCH 15

th

. Failure to file a true and full account, within the prescribed

time, eliminates the right to appeal. No amended returns will be accepted after MARCH 15

, 2016.

th

If you physically removed assets last year, please list here.

Thank you for your cooperation. If we can be of assistance in preparing your report, feel free to come to our office at Town Hall,

Also if you sold, traded or gave property to another business or person, return the affidavit included in this packet with this

125 Main Street, East Greenwich, Rhode Island 02818 or call (401) 886-8614.

page.

STATE LAW REQUIRES THE FILING OF THIS DECLARATION. FAILURE TO DO SO MAY RESULT IN AN

INCREASED ASSESSMENT. THIS FORM IS NOT SUBJECT TO PUBLIC INSPECTION.

I,_______________________________________ My Residence Is:___________________________________________________

(Name)

_______________________________________

___________________________________________________

am responsible for the

(Title)

information contained within this form.

My Daytime Phone Number Is:______________________________________

Give a Full, General Description of Your Business Operation:

NAICS#______________________________

____________________________________________________________________________________________________________

Type or nature of your business:

SECTION 11 SIGN YOUR RETURN AND NOTARIZE

M Mfg.

M Wholesale

M Retail

M Professional

M Service

M Leasing/Rental

>

M Other, Specify:_____________________________________________________________________________________________

I do hereby certify and declare that, to the best of my knowledge and belief, the foregoing is a true and complete list of

Number of Employees as of December 31, 2015

________ Square Feet Occupied________ At Location_________________

all real estate and personal property owned by said Corporation, Co-Partnership or Individual in or ratable in said

Monthly Rent:____________________

Town/City on the said thirty-first day of December, 2015 at 12 o’clock midnight, Eastern Standard time; that the value

Do you own or lease the space occupied?________

placed against each item thereof is the full and fair-cash value thereof at said time.

Ownership:

M Corporation

M Co-Partnership

M Individual

Under penalty of perjury, I declare that I have examined this return, including accompanying schedules and

NAME(s):

_______________________________________________________________________________________

statements, and to the best of my knowledge and belief, it is true, correct and complete. Declaration of

Please

Business Name / DBA:

_______________________________________________________________________________________

preparer (other than officer) is based on all information of which preparer has any knowledge.

Business Address:

_______________________________________________________________________________________

Sign

Mailing Address:

_______________________________________________________________________________________

Here

______________________________________________________________________________________________

SECTION 1 GENERAL BUSINESS INFORMATION

Signature

Date

Title

If this is a new business or a re-opened business in East Greenwich within the past year, pleas skip this section and continue with the

sections on this form.

On________________________, _________________________________ personally appeared before me and made oath that the

foregoing account, by him/her signed and exhibited, contains to the best of his/her knowledge and belief, a true and full

account and valuation of all the ratable estate owned or possessed by said Corporation, Co-Partnership or Individual.

b If you have not added to your business equipment and/or inventory, then please check the #1 box below and complete the return.

b If you have added to your business equipment and/or inventory, then please check the box below.

____________________________________________________________________________________________________________

Signature of Notary Public and Date

M

Business equipment and/or inventory has changed. (Please edit data sheet)

My Commission Expires: ________________

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2