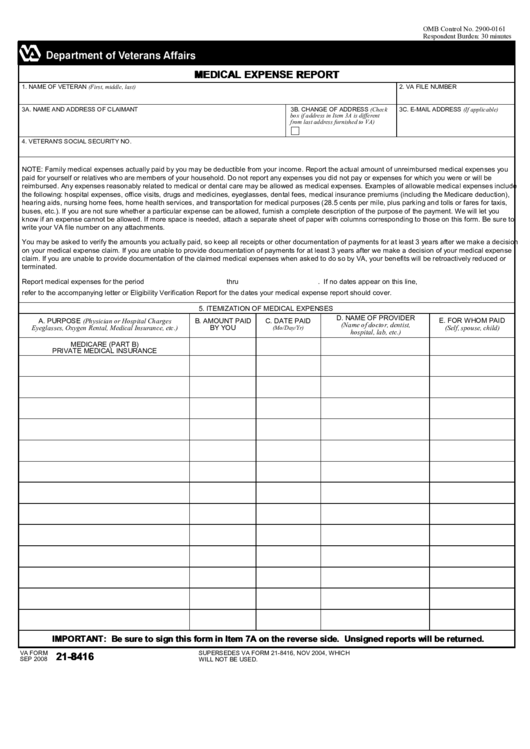

OMB Control No. 2900-0161

Respondent Burden: 30 minutes

MEDICAL EXPENSE REPORT

1. NAME OF VETERAN (First, middle, last)

2. VA FILE NUMBER

3A. NAME AND ADDRESS OF CLAIMANT

3B. CHANGE OF ADDRESS (Check

3C. E-MAIL ADDRESS (If applicable)

box if address in Item 3A is different

from last address furnished to VA)

4. VETERAN'S SOCIAL SECURITY NO.

NOTE: Family medical expenses actually paid by you may be deductible from your income. Report the actual amount of unreimbursed medical expenses you

paid for yourself or relatives who are members of your household. Do not report any expenses you did not pay or expenses for which you were or will be

reimbursed. Any expenses reasonably related to medical or dental care may be allowed as medical expenses. Examples of allowable medical expenses include

the following: hospital expenses, office visits, drugs and medicines, eyeglasses, dental fees, medical insurance premiums (including the Medicare deduction),

hearing aids, nursing home fees, home health services, and transportation for medical purposes (28.5 cents per mile, plus parking and tolls or fares for taxis,

buses, etc.). If you are not sure whether a particular expense can be allowed, furnish a complete description of the purpose of the payment. We will let you

know if an expense cannot be allowed. If more space is needed, attach a separate sheet of paper with columns corresponding to those on this form. Be sure to

write your VA file number on any attachments.

You may be asked to verify the amounts you actually paid, so keep all receipts or other documentation of payments for at least 3 years after we make a decision

on your medical expense claim. If you are unable to provide documentation of payments for at least 3 years after we make a decision of your medical expense

claim. If you are unable to provide documentation of the claimed medical expenses when asked to do so by VA, your benefits will be retroactively reduced or

terminated.

Report medical expenses for the period

thru

. If no dates appear on this line,

refer to the accompanying letter or Eligibility Verification Report for the dates your medical expense report should cover.

5. ITEMIZATION OF MEDICAL EXPENSES

D. NAME OF PROVIDER

A. PURPOSE (Physician or Hospital Charges

B. AMOUNT PAID

C. DATE PAID

E. FOR WHOM PAID

(Name of doctor, dentist,

Eyeglasses, Oxygen Rental, Medical Insurance, etc.)

BY YOU

(Mo/Day/Yr)

(Self, spouse, child)

hospital, lab, etc.)

MEDICARE (PART B)

PRIVATE MEDICAL INSURANCE

IMPORTANT: Be sure to sign this form in Item 7A on the reverse side. Unsigned reports will be returned.

VA FORM

SUPERSEDES VA FORM 21-8416, NOV 2004, WHICH

21-8416

SEP 2008

WILL NOT BE USED.

1

1 2

2