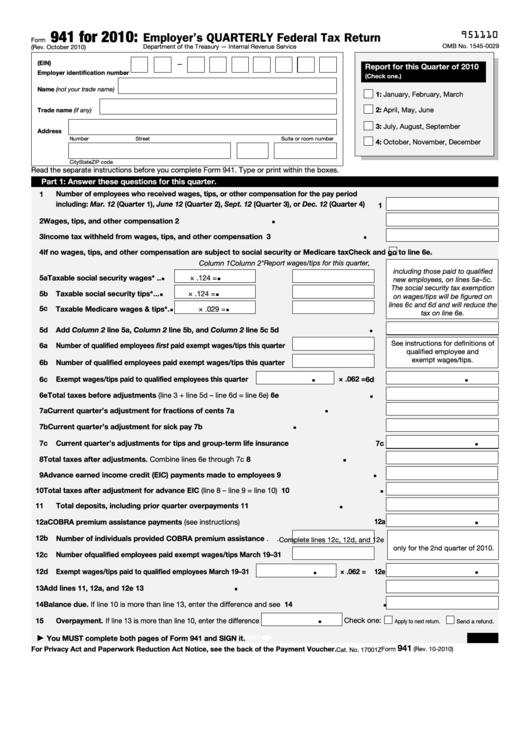

941 for 2010:

951110

Employer’s QUARTERLY Federal Tax Return

Form

OMB No. 1545-0029

Department of the Treasury — Internal Revenue Service

(Rev. October 2010)

(EIN)

—

Report for this Quarter of 2010

Employer identification number

(Check one.)

Name (not your trade name)

1: January, February, March

2: April, May, June

Trade name (if any)

3: July, August, September

Address

Number

Street

Suite or room number

4: October, November, December

City

State

ZIP code

Read the separate instructions before you complete Form 941. Type or print within the boxes.

Part 1: Answer these questions for this quarter.

Number of employees who received wages, tips, or other compensation for the pay period

1

including: Mar. 12 (Quarter 1), June 12 (Quarter 2), Sept. 12 (Quarter 3), or Dec. 12 (Quarter 4)

1

.

2

Wages, tips, and other compensation

2

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

3

Income tax withheld from wages, tips, and other compensation

3

.

.

.

.

.

.

.

.

4

If no wages, tips, and other compensation are subject to social security or Medicare tax

Check and go to line 6e.

*Report wages/tips for this quarter,

Column 1

Column 2

.

.

including those paid to qualified

5a

Taxable social security wages* .

.

× .124 =

new employees, on lines 5a–5c.

.

.

The social security tax exemption

5b

Taxable social security tips* .

.

.

× .124 =

on wages/tips will be figured on

.

.

lines 6c and 6d and will reduce the

5 c

Taxable Medicare wages & tips*

.

× .029 =

tax on line 6e.

.

5d

Add Column 2 line 5a, Column 2 line 5b, and Column 2 line 5c

.

.

.

.

.

.

.

.

.

5d

See instructions for definitions of

6a

Number of qualified employees first paid exempt wages/tips this quarter

qualified employee and

exempt wages/tips.

6b

Number of qualified employees paid exempt wages/tips this quarter

.

.

Exempt wages/tips paid to qualified employees this quarter

× .062 =

6c

6d

.

6e

Total taxes before adjustments (line 3 + line 5d – line 6d = line 6e) .

.

.

.

.

.

.

.

.

6e

.

7a

Current quarter’s adjustment for fractions of cents .

7a

.

.

.

.

.

.

.

.

.

.

.

.

.

7b

Current quarter’s adjustment for sick pay .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

7b

.

7c

Current quarter’s adjustments for tips and group-term life insurance

.

.

.

.

.

.

.

7c

.

8

Total taxes after adjustments. Combine lines 6e through 7c .

.

.

.

.

.

.

.

.

.

.

8

.

9

Advance earned income credit (EIC) payments made to employees

.

.

.

.

.

.

.

9

.

10

Total taxes after adjustment for advance EIC (line 8 – line 9 = line 10)

.

.

.

.

.

.

.

10

.

Total deposits, including prior quarter overpayments

11

11

.

.

.

.

.

.

.

.

.

.

.

.

.

12a

12a

COBRA premium assistance payments (see instructions)

.

.

.

.

.

.

.

.

.

.

.

12b

Number of individuals provided COBRA premium assistance .

.

Complete lines 12c, 12d, and 12e

only for the 2nd quarter of 2010.

12c

Number of qualified employees paid exempt wages/tips March 19–31

.

.

12d

Exempt wages/tips paid to qualified employees March 19–31

× .062 =

12e

.

13

Add lines 11, 12a, and 12e

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

13

.

14

Balance due. If line 10 is more than line 13, enter the difference and see instructions

14

.

.

.

.

15

Overpayment. If line 13 is more than line 10, enter the difference

Check one:

Apply to next return.

Send a refund.

Next

You MUST complete both pages of Form 941 and SIGN it.

▶

▶

■

941

For Privacy Act and Paperwork Reduction Act Notice, see the back of the Payment Voucher.

Form

(Rev. 10-2010)

Cat. No. 17001Z

1

1 2

2 3

3 4

4