Application Form For Property Tax Exemption - Tennessee State Board Of Equalization

ADVERTISEMENT

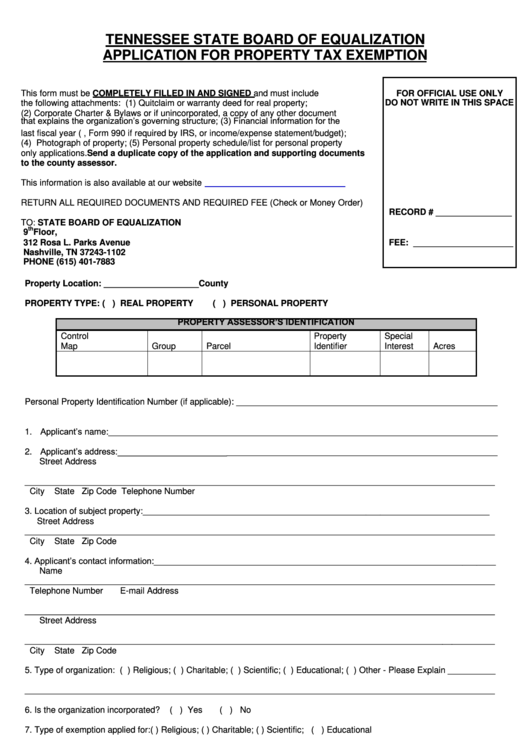

TENNESSEE STATE BOARD OF EQUALIZATION

APPLICATION FOR PROPERTY TAX EXEMPTION

This form must be COMPLETELY FILLED IN AND SIGNED and must include

FOR OFFICIAL USE ONLY

the following attachments: (1) Quitclaim or warranty deed for real property;

DO NOT WRITE IN THIS SPACE

(2) Corporate Charter & Bylaws or if unincorporated, a copy of any other document

that explains the organization’s governing structure; (3) Financial information for the

last fiscal year (i.e., Form 990 if required by IRS, or income/expense statement/budget);

(4) Photograph of property; (5) Personal property schedule/list for personal property

only applications. Send a duplicate copy of the application and supporting documents

to the county assessor.

This information is also available at our website

RETURN ALL REQUIRED DOCUMENTS AND REQUIRED FEE (Check or Money Order)

RECORD # ________________

TO:

STATE BOARD OF EQUALIZATION

th

9

Floor, W.R. Snodgrass TN Tower

312 Rosa L. Parks Avenue

FEE: _____________________

Nashville, TN 37243-1102

PHONE (615) 401-7883

Property Location: ____________________County

PROPERTY TYPE: ( ) REAL PROPERTY

( ) PERSONAL PROPERTY

PROPERTY ASSESSOR’S IDENTIFICATION

Control

Property

Special

Map

Group

Parcel

Identifier

Interest

Acres

Personal Property Identification Number (if applicable): _______________________________________________________

1. Applicant’s name:__________________________________________________________________________________

2. Applicant’s address:________________________________________________________________________________

Street Address

___________________________________________________________________________________________________

City

State

Zip Code

Telephone Number

3. Location of subject property:_________________________________________________________________________

Street Address

___________________________________________________________________________________________________

City

State

Zip Code

4. Applicant’s contact information:________________________________________________________________________

Name

___________________________________________________________________________________________________

Telephone Number

E-mail Address

___________________________________________________________________________________________________

Street Address

___________________________________________________________________________________________________

City

State

Zip Code

5. Type of organization: ( ) Religious; ( ) Charitable; ( ) Scientific; ( ) Educational; ( ) Other - Please Explain __________

___________________________________________________________________________________________________

6. Is the organization incorporated?

( ) Yes

( ) No

7. Type of exemption applied for: ( ) Religious; ( ) Charitable; ( ) Scientific; ( ) Educational

8. Has the organization previously made application for exemption for this or any other property? ( ) Yes

( ) No

9. If religious, was this property exempt under previous owner?

( ) Yes

( ) No

10. If religious, does this property replace previously approved exemption property owned by your organization?

( ) Yes ( ) No

(Over)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2