Liquor By The Drink Excise Tax Return Form - City Of Port Wentworth

ADVERTISEMENT

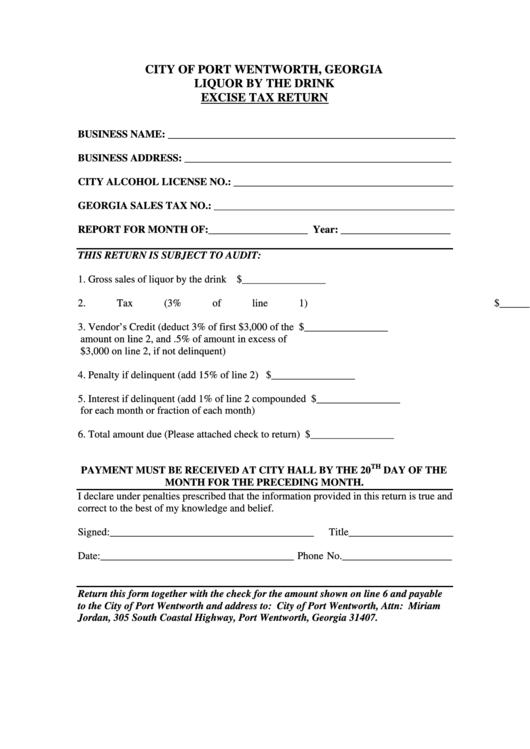

CITY OF PORT WENTWORTH, GEORGIA

LIQUOR BY THE DRINK

EXCISE TAX RETURN

BUSINESS NAME: _______________________________________________________

BUSINESS ADDRESS: ___________________________________________________

CITY ALCOHOL LICENSE NO.: __________________________________________

GEORGIA SALES TAX NO.: ______________________________________________

REPORT FOR MONTH OF:___________________ Year: _____________________

THIS RETURN IS SUBJECT TO AUDIT:

1.

Gross sales of liquor by the drink

$________________

2.

Tax (3% of line 1)

$________________

3.

Vendor’s Credit (deduct 3% of first $3,000 of the

$________________

amount on line 2, and .5% of amount in excess of

$3,000 on line 2, if not delinquent)

4.

Penalty if delinquent (add 15% of line 2)

$________________

5.

Interest if delinquent (add 1% of line 2 compounded

$________________

for each month or fraction of each month)

6.

Total amount due (Please attached check to return)

$________________

TH

PAYMENT MUST BE RECEIVED AT CITY HALL BY THE 20

DAY OF THE

MONTH FOR THE PRECEDING MONTH.

I declare under penalties prescribed that the information provided in this return is true and

correct to the best of my knowledge and belief.

Signed:_______________________________________

Title____________________

Date:_____________________________________ Phone No._____________________

Return this form together with the check for the amount shown on line 6 and payable

to the City of Port Wentworth and address to: City of Port Wentworth, Attn: Miriam

Jordan, 305 South Coastal Highway, Port Wentworth, Georgia 31407.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1