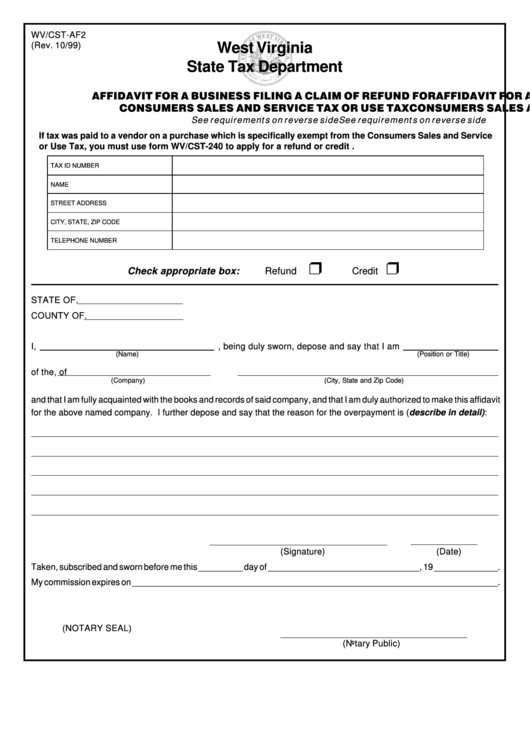

Affidavit For A Business Filing A Claim Of Refund For Consumers Sales And Service Tax Or Use Tax

ADVERTISEMENT

WV/CST-AF2

(Rev. 10/99)

West Virginia

State Tax Department

AFFIDAVIT FOR A BUSINESS FILING A CLAIM OF REFUND FOR

AFFIDAVIT FOR A BUSINESS FILING A CLAIM OF REFUND FOR

CONSUMERS SALES AND SERVICE TAX OR USE TAX

CONSUMERS SALES AND SERVICE TAX OR USE TAX

See requirements on reverse side

See requirements on reverse side

If tax was paid to a vendor on a purchase which is specifically exempt from the Consumers Sales and Service

or Use Tax, you must use form WV/CST-240 to apply for a refund or credit .

TAX ID NUMBER

NAME

STREET ADDRESS

CITY, STATE, ZIP CODE

TELEPHONE NUMBER

Check appropriate box:

Refund

Credit

STATE OF

.

COUNTY OF

.

I,

, being duly sworn, depose and say that I am

(Name)

(Position or Title)

of the

, of

(Company)

(City, State and Zip Code)

and that I am fully acquainted with the books and records of said company, and that I am duly authorized to make this affidavit

for the above named company. I further depose and say that the reason for the overpayment is (describe in detail):

(Signature)

(Date)

Taken, subscribed and sworn before me this _________ day of _______________________________, 19 _____________.

My commission expires on ___________________________________________________________________________.

(NOTARY SEAL)

(Notary Public)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2