Form W-9 (Substitute) - Request For Taxpayer Identification And Certification - Oregon Department Of Administrative Services

ADVERTISEMENT

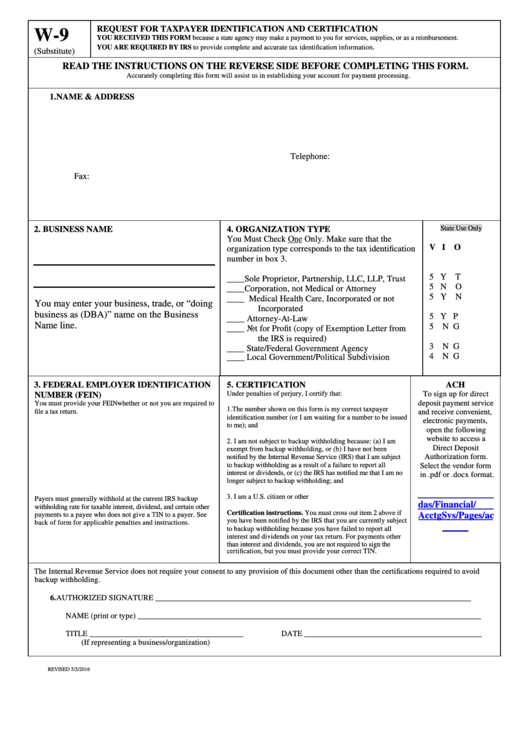

REQUEST FOR TAXPAYER IDENTIFICATION AND CERTIFICATION

W-9

YOU RECEIVED THIS FORM because a state agency may make a payment to you for services, supplies, or as a reimbursement.

.

YOU ARE REQUIRED BY IRS to provide complete and accurate tax identification information

(Substitute)

READ THE INSTRUCTIONS ON THE REVERSE SIDE BEFORE COMPLETING THIS FORM.

Accurately completing this form will assist us in establishing your account for payment processing.

1.

NAME & ADDRESS

Telephone:

Fax:

State Use Only

2. BUSINESS NAME

4. ORGANIZATION TYPE

You Must Check One Only. Make sure that the

V I O

organization type corresponds to the tax identification

number in box 3.

5 Y T

____ Sole Proprietor, Partnership, LLC, LLP, Trust

5 N O

____ Corporation, not Medical or Attorney

5 Y N

____ Medical Health Care, Incorporated or not

You may enter your business, trade, or “doing

Incorporated

business as (DBA)” name on the Business

5 Y P

____ Attorney-At-Law

Name line.

5 N G

____ Not for Profit (copy of Exemption Letter from

the IRS is required)

3 N G

____ State/Federal Government Agency

4 N G

____ Local Government/Political Subdivision

3. FEDERAL EMPLOYER IDENTIFICATION

5. CERTIFICATION

ACH

Under penalties of perjury, I certify that:

To sign up for direct

NUMBER (FEIN)

deposit payment service

You must provide your FEIN whether or not you are required to

1. The number shown on this form is my correct taxpayer

file a tax return.

and receive convenient,

identification number (or I am waiting for a number to be issued

electronic payments,

to me); and

open the following

website to access a

2. I am not subject to backup withholding because: (a) I am

Direct Deposit

exempt from backup withholding, or (b) I have not been

Authorization form.

notified by the Internal Revenue Service (IRS) that I am subject

to backup withholding as a result of a failure to report all

Select the vendor form

interest or dividends, or (c) the IRS has notified me that I am no

in .pdf or .docx format.

longer subject to backup withholding; and

3. I am a U.S. citizen or other U.S. person.

Payers must generally withhold at the current IRS backup

.gov/das/Financial/

withholding rate for taxable interest, dividend, and certain other

Certification instructions. You must cross out item 2 above if

AcctgSys/Pages/ac

payments to a payee who does not give a TIN to a payer. See

you have been notified by the IRS that you are currently subject

back of form for applicable penalties and instructions.

h.aspx

to backup withholding because you have failed to report all

interest and dividends on your tax return. For payments other

than interest and dividends, you are not required to sign the

certification, but you must provide your correct TIN.

The Internal Revenue Service does not require your consent to any provision of this document other than the certifications required to avoid

backup withholding.

6.

AUTHORIZED SIGNATURE ________________________________________________________________________________

NAME (print or type) _______________________________________________________________________________________

TITLE _______________________________________

DATE _____________________________________________

(If representing a business/organization)

REVISED 5/2/2016

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2