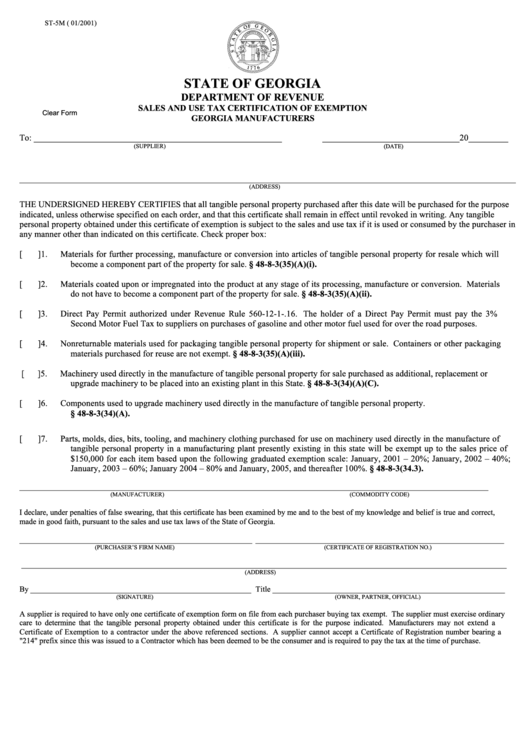

ST-5M ( 01/2001)

STATE OF GEORGIA

DEPARTMENT OF REVENUE

SALES AND USE TAX CERTIFICATION OF EXEMPTION

Clear Form

GEORGIA MANUFACTURERS

To: ________________________________________________________

_______________________________20_________

(SUPPLIER)

(DATE)

________________________________________________________________________________________________________________

(ADDRESS)

THE UNDERSIGNED HEREBY CERTIFIES that all tangible personal property purchased after this date will be purchased for the purpose

indicated, unless otherwise specified on each order, and that this certificate shall remain in effect until revoked in writing. Any tangible

personal property obtained under this certificate of exemption is subject to the sales and use tax if it is used or consumed by the purchaser in

any manner other than indicated on this certificate. Check proper box:

[

]

1.

Materials for further processing, manufacture or conversion into articles of tangible personal property for resale which will

become a component part of the property for sale. O.C.G.A. § 48-8-3(35)(A)(i).

[

]

2.

Materials coated upon or impregnated into the product at any stage of its processing, manufacture or conversion. Materials

do not have to become a component part of the property for sale. O.C.G.A. § 48-8-3(35)(A)(ii).

[

]

3.

Direct Pay Permit authorized under Revenue Rule 560-12-1-.16. The holder of a Direct Pay Permit must pay the 3%

Second Motor Fuel Tax to suppliers on purchases of gasoline and other motor fuel used for over the road purposes.

[

]

4.

Nonreturnable materials used for packaging tangible personal property for shipment or sale. Containers or other packaging

materials purchased for reuse are not exempt. O.C.G.A. § 48-8-3(35)(A)(iii).

[

]

5.

Machinery used directly in the manufacture of tangible personal property for sale purchased as additional, replacement or

upgrade machinery to be placed into an existing plant in this State. O.C.G.A. § 48-8-3(34)(A)(C).

[

]

6.

Components used to upgrade machinery used directly in the manufacture of tangible personal property.

O.C.G.A. § 48-8-3(34)(A).

[

]

7.

Parts, molds, dies, bits, tooling, and machinery clothing purchased for use on machinery used directly in the manufacture of

tangible personal property in a manufacturing plant presently existing in this state will be exempt up to the sales price of

$150,000 for each item based upon the following graduated exemption scale: January, 2001 – 20%; January, 2002 – 40%;

January, 2003 – 60%; January 2004 – 80% and January, 2005, and thereafter 100%. O.C.G.A. § 48-8-3(34.3).

__________________________________________________________________________________________________________________________

(MANUFACTURER)

(COMMODITY CODE)

I declare, under penalties of false swearing, that this certificate has been examined by me and to the best of my knowledge and belief is true and correct,

made in good faith, pursuant to the sales and use tax laws of the State of Georgia.

___________________________________________________________

_______________________________________________________________

(PURCHASER’S FIRM NAME)

(CERTIFICATE OF REGISTRATION NO.)

___________________________________________________________________________________________________________________________

(ADDRESS)

By ________________________________________________________

Title ___________________________________________________________

(SIGNATURE)

(OWNER, PARTNER, OFFICIAL)

A supplier is required to have only one certificate of exemption form on file from each purchaser buying tax exempt. The supplier must exercise ordinary

care to determine that the tangible personal property obtained under this certificate is for the purpose indicated. Manufacturers may not extend a

Certificate of Exemption to a contractor under the above referenced sections. A supplier cannot accept a Certificate of Registration number bearing a

"214" prefix since this was issued to a Contractor which has been deemed to be the consumer and is required to pay the tax at the time of purchase.

1

1