Hm Revenue And Customs Tax Relief For Expenses Of Employment

ADVERTISEMENT

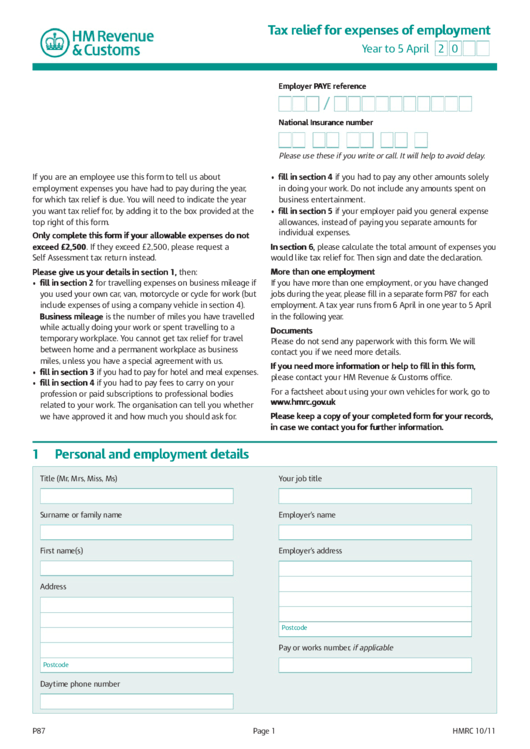

Tax relief for expenses of employment

Year to 5 April

2 0

Employer PAYE reference

/

National Insurance number

Please use these if you write or call. It will help to avoid delay.

If you are an employee use this form to tell us about

• fill in section 4 if you had to pay any other amounts solely

employment expenses you have had to pay during the year,

in doing your work. Do not include any amounts spent on

for which tax relief is due. You will need to indicate the year

business entertainment.

you want tax relief for, by adding it to the box provided at the

• fill in section 5 if your employer paid you general expense

top right of this form.

allowances, instead of paying you separate amounts for

individual expenses.

Only complete this form if your allowable expenses do not

exceed £2,500. If they exceed £2,500, please request a

In section 6, please calculate the total amount of expenses you

Self Assessment tax return instead.

would like tax relief for. Then sign and date the declaration.

Please give us your details in section 1, then:

More than one employment

• fill in section 2 for travelling expenses on business mileage if

If you have more than one employment, or you have changed

you used your own car, van, motorcycle or cycle for work (but

jobs during the year, please fill in a separate form P87 for each

include expenses of using a company vehicle in section 4).

employment. A tax year runs from 6 April in one year to 5 April

Business mileage is the number of miles you have travelled

in the following year.

while actually doing your work or spent travelling to a

Documents

temporary workplace. You cannot get tax relief for travel

Please do not send any paperwork with this form. We will

between home and a permanent workplace as business

contact you if we need more details.

miles, unless you have a special agreement with us.

If you need more information or help to fill in this form,

• fill in section 3 if you had to pay for hotel and meal expenses.

please contact your HM Revenue & Customs office.

• fill in section 4 if you had to pay fees to carry on your

For a factsheet about using your own vehicles for work, go to

profession or paid subscriptions to professional bodies

related to your work. The organisation can tell you whether

we have approved it and how much you should ask for.

Please keep a copy of your completed form for your records,

in case we contact you for further information.

1

Personal and employment details

Title (Mr, Mrs, Miss, Ms)

Your job title

Surname or family name

Employer’s name

First name(s)

Employer’s address

Address

Postcode

Pay or works number, if applicable

Postcode

Daytime phone number

P87

Page 1

HMRC 10/11

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4