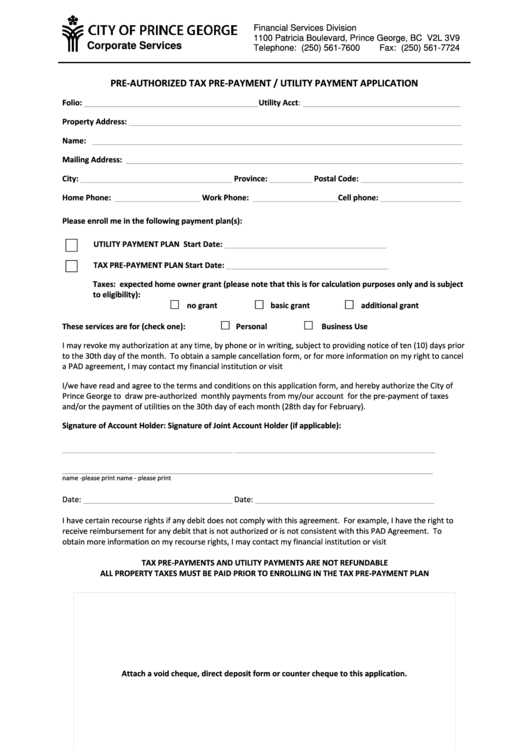

Pre-Authorized Tax Pre-Payment / Utility Payment Application

ADVERTISEMENT

Financial Services Division

1100 Patricia Boulevard, Prince George, BC V2L 3V9

Corporate Services

Telephone: (250) 561-7600

Fax: (250) 561-7724

PRE-AUTHORIZED TAX PRE-PAYMENT / UTILITY PAYMENT APPLICATION

Folio:

_________________________________________

Utility

Acct:

_____________________________________

Property Address:

______________________________________________________________________________

Name:

_______________________________________________________________________________________

Mailing Address:

_______________________________________________________________________________

City:

Province:

Postal Code:

___________________________________

__________

________________________

Home Phone:

____________________

Work Phone:

____________________

Cell phone:

___________________

Please enroll me in the following payment plan(s):

UTILITY PAYMENT PLAN

Start Date:

______________________________________

TAX PRE-PAYMENT PLAN

Start Date:

______________________________________

Taxes: expected home owner grant (please note that this is for calculation purposes only and is subject

to eligibility):

no grant

basic grant

additional grant

These services are for (check one):

Personal

Business Use

I may revoke my authorization at any time, by phone or in writing, subject to providing notice of ten (10) days prior

to the 30th day of the month. To obtain a sample cancellation form, or for more information on my right to cancel

a PAD agreement, I may contact my financial institution or visit

I/we have read and agree to the terms and conditions on this application form, and hereby authorize the City of

Prince George to draw pre-authorized monthly payments from my/our account for the pre-payment of taxes

and/or the payment of utilities on the 30th day of each month (28th day for February).

Signature of Account Holder:

Signature of Joint Account Holder (if applicable):

________________________________________

_______________________________________________

________________________________________

_______________________________________________

name - please print

name - please print

Date:

___________________________________

Date:

__________________________________________

I have certain recourse rights if any debit does not comply with this agreement. For example, I have the right to

receive reimbursement for any debit that is not authorized or is not consistent with this PAD Agreement. To

obtain more information on my recourse rights, I may contact my financial institution or visit

TAX PRE-PAYMENTS AND UTILITY PAYMENTS ARE NOT REFUNDABLE

ALL PROPERTY TAXES MUST BE PAID PRIOR TO ENROLLING IN THE TAX PRE-PAYMENT PLAN

Attach a void cheque, direct deposit form or counter cheque to this application.

office use only

entered tax _______ ut ______

date stamp

tax ____ pmts of $ __________

ut $ ______________________

edms doc 150399

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2