Annual Report Sample

ADVERTISEMENT

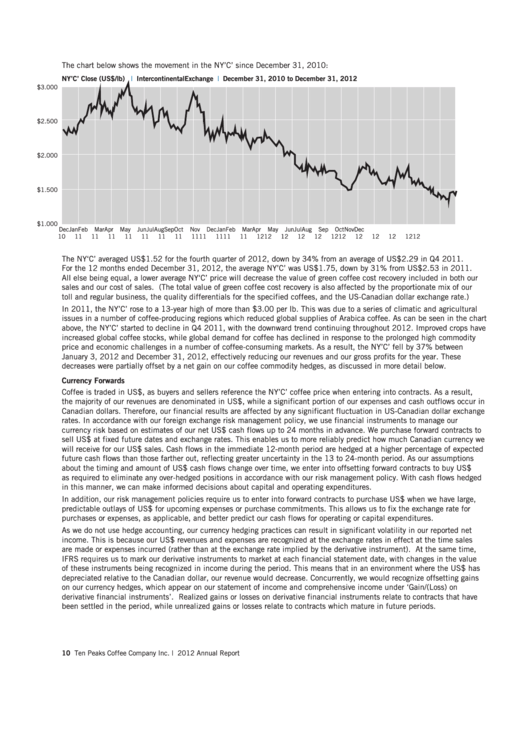

The chart below shows the movement in the NY’C’ since December 31, 2010:

NY’C’ Close (US$/lb)

|

IntercontinentalExchange

|

December 31, 2010 to December 31, 2012

$3.000

$2.500

$2.000

$1.500

$1.000

Dec Jan

Feb

Mar

Apr

May

Jun

Jul

Aug

Sep

Oct

Nov

Dec

Jan

Feb

Mar

Apr

May

Jun

Jul

Aug

Sep

Oct

Nov Dec

10

11

11

11

11

11

11

11

11

11

11

11

11

12

12

12

12

12

12

12

12

12

12

12

12

The NY‘C’ averaged US$1.52 for the fourth quarter of 2012, down by 34% from an average of US$2.29 in Q4 2011.

For the 12 months ended December 31, 2012, the average NY’C’ was US$1.75, down by 31% from US$2.53 in 2011.

All else being equal, a lower average NY‘C’ price will decrease the value of green coffee cost recovery included in both our

sales and our cost of sales. (The total value of green coffee cost recovery is also affected by the proportionate mix of our

toll and regular business, the quality differentials for the specified coffees, and the US-Canadian dollar exchange rate.)

In 2011, the NY’C’ rose to a 13-year high of more than $3.00 per lb. This was due to a series of climatic and agricultural

issues in a number of coffee-producing regions which reduced global supplies of Arabica coffee. As can be seen in the chart

above, the NY’C’ started to decline in Q4 2011, with the downward trend continuing throughout 2012. Improved crops have

increased global coffee stocks, while global demand for coffee has declined in response to the prolonged high commodity

price and economic challenges in a number of coffee-consuming markets. As a result, the NY’C’ fell by 37% between

January 3, 2012 and December 31, 2012, effectively reducing our revenues and our gross profits for the year. These

decreases were partially offset by a net gain on our coffee commodity hedges, as discussed in more detail below.

Currency Forwards

Coffee is traded in US$, as buyers and sellers reference the NY’C’ coffee price when entering into contracts. As a result,

the majority of our revenues are denominated in US$, while a significant portion of our expenses and cash outflows occur in

Canadian dollars. Therefore, our financial results are affected by any significant fluctuation in US-Canadian dollar exchange

rates. In accordance with our foreign exchange risk management policy, we use financial instruments to manage our

currency risk based on estimates of our net US$ cash flows up to 24 months in advance. We purchase forward contracts to

sell US$ at fixed future dates and exchange rates. This enables us to more reliably predict how much Canadian currency we

will receive for our US$ sales. Cash flows in the immediate 12-month period are hedged at a higher percentage of expected

future cash flows than those farther out, reflecting greater uncertainty in the 13 to 24-month period. As our assumptions

about the timing and amount of US$ cash flows change over time, we enter into offsetting forward contracts to buy US$

as required to eliminate any over-hedged positions in accordance with our risk management policy. With cash flows hedged

in this manner, we can make informed decisions about capital and operating expenditures.

In addition, our risk management policies require us to enter into forward contracts to purchase US$ when we have large,

predictable outlays of US$ for upcoming expenses or purchase commitments. This allows us to fix the exchange rate for

purchases or expenses, as applicable, and better predict our cash flows for operating or capital expenditures.

As we do not use hedge accounting, our currency hedging practices can result in significant volatility in our reported net

income. This is because our US$ revenues and expenses are recognized at the exchange rates in effect at the time sales

are made or expenses incurred (rather than at the exchange rate implied by the derivative instrument). At the same time,

IFRS requires us to mark our derivative instruments to market at each financial statement date, with changes in the value

of these instruments being recognized in income during the period. This means that in an environment where the US$ has

depreciated relative to the Canadian dollar, our revenue would decrease. Concurrently, we would recognize offsetting gains

on our currency hedges, which appear on our statement of income and comprehensive income under ‘Gain/(Loss) on

derivative financial instruments’. Realized gains or losses on derivative financial instruments relate to contracts that have

been settled in the period, while unrealized gains or losses relate to contracts which mature in future periods.

10 Ten Peaks Coffee Company Inc. | 2012 Annual Report

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Business

1

1