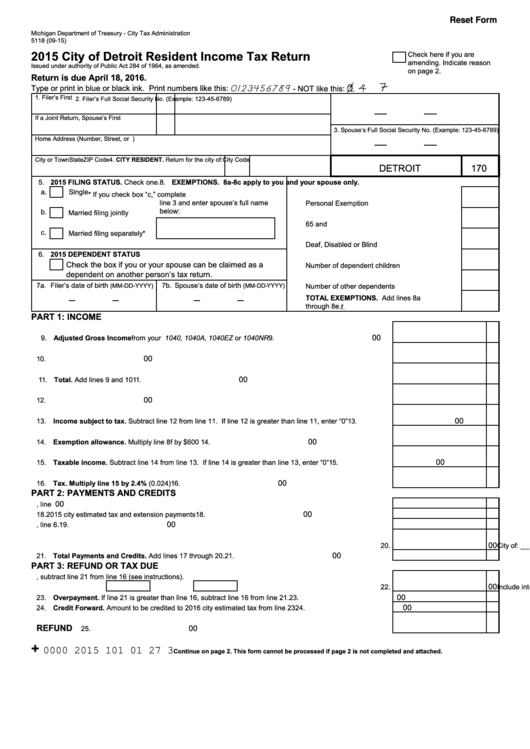

Reset Form

Michigan Department of Treasury - City Tax Administration

5118 (09-15)

2015 City of Detroit Resident Income Tax Return

Check here if you are

amending. Indicate reason

Issued under authority of Public Act 284 of 1964, as amended.

on page 2.

Return is due April 18, 2016.

1 4

Type or print in blue or black ink. Print numbers like this:

0123456789

- NOT like this:

1. Filer’s First Name

M.I.

Last Name

2. Filer’s Full Social Security No. (Example: 123-45-6789)

If a Joint Return, Spouse’s First Name

M.I.

Last Name

3. Spouse’s Full Social Security No. (Example: 123-45-6789)

Home Address (Number, Street, or P.O. Box)

City or Town

State

ZIP Code

4. CITY RESIDENT. Return for the city of:

City Code

DETROIT

170

5. 2015 FILING STATUS. Check one.

8. EXEMPTIONS. 8a-8c apply to you and your spouse only.

a.

Single

* If you check box “c,” complete

line 3 and enter spouse’s full name

Personal Exemption ......................................

a.

below:

b.

Married filing jointly

65 and over...................................................... b.

c.

Married filing separately*

Deaf, Disabled or Blind ..................................... c.

6. 2015 DEPENDENT STATUS

Check the box if you or your spouse can be claimed as a

Number of dependent children ........................ d.

dependent on another person’s tax return.

7a. Filer’s date of birth

7b. Spouse’s date of birth

(MM-DD-YYYY)

(MM-DD-YYYY)

Number of other dependents ........................... e.

TOTAL EXEMPTIONS. Add lines 8a

through 8e. ...................................................... f.

PART 1: INCOME

00

9. Adjusted Gross Income from your U.S. Forms 1040, 1040A, 1040EZ or 1040NR ...................................

9.

00

10. Additions from line 29 ...................................................................................................................................

10.

00

11. Total. Add lines 9 and 10 ..............................................................................................................................

11.

00

12. Subtractions from line 37 ..............................................................................................................................

12.

00

13. Income subject to tax. Subtract line 12 from line 11. If line 12 is greater than line 11, enter “0” ...............

13.

00

14. Exemption allowance. Multiply line 8f by $600 .........................................................................................

14.

00

15. Taxable income. Subtract line 14 from line 13. If line 14 is greater than line 13, enter “0” ........................

15.

00

16. Tax. Multiply line 15 by 2.4% (0.024) .........................................................................................................

16.

PART 2: PAYMENTS AND CREDITS

00

17. Tax withheld from City Schedule W, line 5....................................................................................................

17.

00

18. 2015 city estimated tax and extension payments .........................................................................................

18.

00

19. Tax paid for you by a partnership from City Schedule W, line 6. ..................................................................

19.

20. Credit for income taxes paid to another city. ................................................................................................

00

City of: __________________________________________

20.

00

21. Total Payments and Credits. Add lines 17 through 20. .............................................................................

21.

PART 3: REFUND OR TAX DUE

22. If line 16 is greater than line 21, subtract line 21 from line 16 (see instructions).

YOU OWE

00

Include interest

and penalty

if applicable........................

22.

00

23. Overpayment. If line 21 is greater than line 16, subtract line 16 from line 21. ............................................

23.

00

24. Credit Forward. Amount to be credited to 2016 city estimated tax from line 23 .........................................

24.

REFUND

00

25. Subtract line 24 from line 23. ...................................................................................................

25.

+

0000 2015 101 01 27 3

Continue on page 2. This form cannot be processed if page 2 is not completed and attached.

1

1 2

2