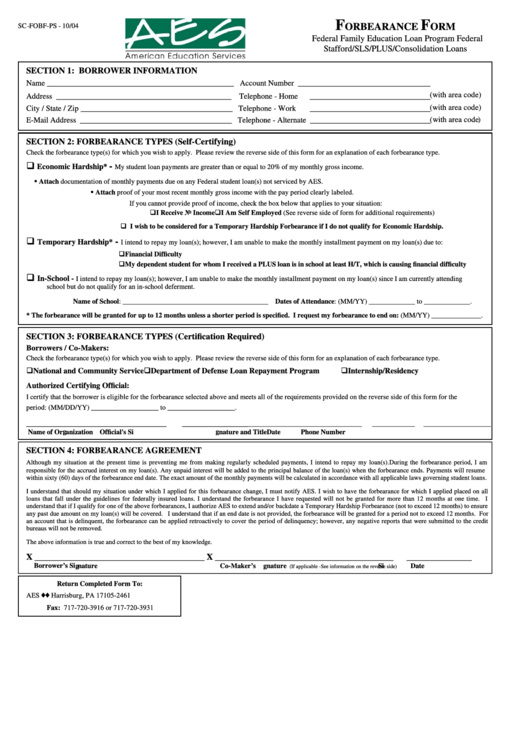

Federal Family Education Loan Program Forbearance Request Form

ADVERTISEMENT

F

F

ORBEARANCE

ORM

SC-FOBF-PS - 10/04

Federal Family Education Loan Program Federal

Stafford/SLS/PLUS/Consolidation Loans

SECTION 1: BORROWER INFORMATION

Name ________________________________________________ Account Number __________________________________

(with area code)

Address _____________________________________________ Telephone - Home

_______________________________

(with area code)

City / State / Zip _______________________________________ Telephone - Work

_______________________________

(with area code)

E-Mail Address _______________________________________ Telephone - Alternate _______________________________

SECTION 2: FORBEARANCE TYPES (Self-Certifying)

Check the forbearance type(s) for which you wish to apply. Please review the reverse side of this form for an explanation of each forbearance type.

-

Economic Hardship*

My student loan payments are greater than or equal to 20% of my monthly gross income.

Attach documentation of monthly payments due on any Federal student loan(s) not serviced by AES.

Attach proof of your most recent monthly gross income with the pay period clearly labeled.

If you cannot provide proof of income, check the box below that applies to your situation:

I Receive No Income

I Am Self Employed (See reverse side of form for additional requirements)

I wish to be considered for a Temporary Hardship Forbearance if I do not qualify for Economic Hardship.

-

Temporary Hardship*

I intend to repay my loan(s); however, I am unable to make the monthly installment payment on my loan(s) due to:

Financial Difficulty

My dependent student for whom I received a PLUS loan is in school at least H/T, which is causing financial difficulty

In-School -

I intend to repay my loan(s); however, I am unable to make the monthly installment payment on my loan(s) since I am currently attending

school but do not qualify for an in-school deferment.

Name of School: _________________________________________ Dates of Attendance: (MM/YY) _____________ to _____________.

* The forbearance will be granted for up to 12 months unless a shorter period is specified. I request my forbearance to end on: (MM/YY) ______________.

SECTION 3: FORBEARANCE TYPES (Certification Required)

Borrowers / Co-Makers:

Check the forbearance type(s) for which you wish to apply. Please review the reverse side of this form for an explanation of each forbearance type.

National and Community Service

Department of Defense Loan Repayment Program

Internship/Residency

Authorized Certifying Official:

I certify that the borrower is eligible for the forbearance selected above and meets all of the requirements provided on the reverse side of this form for the

period: (MM/DD/YY) ___________________ to ___________________.

____________________________________

_________________

________________________________

____________

___________________

Name of Organization

Official's Signature and Title

Date

Phone Number

SECTION 4: FORBEARANCE AGREEMENT

Although my situation at the present time is preventing me from making regularly scheduled payments, I intend to repay my loan(s). During the forbearance period, I am

responsible for the accrued interest on my loan(s). Any unpaid interest will be added to the principal balance of the loan(s) when the forbearance ends. Payments will resume

within sixty (60) days of the forbearance end date. The exact amount of the monthly payments will be calculated in accordance with all applicable laws governing student loans.

I understand that should my situation under which I applied for this forbearance change, I must notify AES. I wish to have the forbearance for which I applied placed on all

loans that fall under the guidelines for federally insured loans. I understand the forbearance I have requested will not be granted for more than 12 months at one time.

I

understand that if I qualify for one of the above forbearances, I authorize AES to extend and/or backdate a Temporary Hardship Forbearance (not to exceed 12 months) to ensure

any past due amount on my loan(s) will be covered. I understand that if an end date is not provided, the forbearance will be granted for a period not to exceed 12 months. For

an account that is delinquent, the forbearance can be applied retroactively to cover the period of delinquency; however, any negative reports that were submitted to the credit

bureaus will not be removed.

The above information is true and correct to the best of my knowledge.

X _______________________________________

X _________________________________________

_______________

Borrower’s Signature

Co-Maker’s Signature

Date

(If applicable -See information on the reverse side)

Return Completed Form To:

AES

P.O. Box 2461

Harrisburg, PA 17105-2461

Fax: 717-720-3916 or 717-720-3931

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Business

1

1 2

2