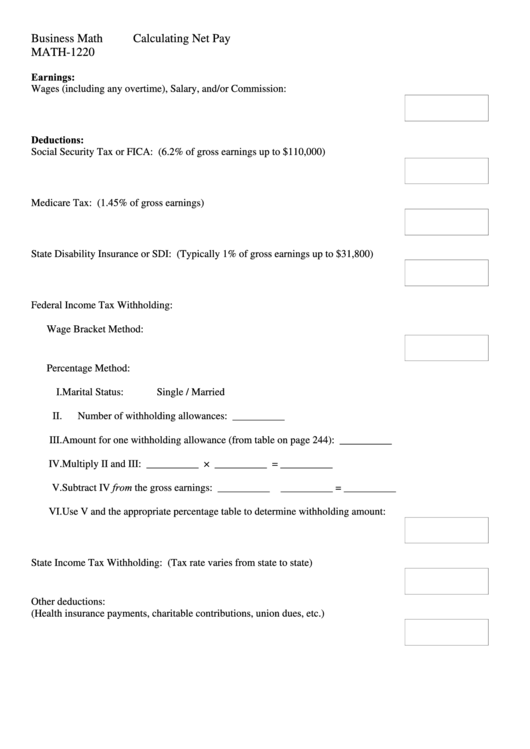

Calculating Net Pay Worksheet

ADVERTISEMENT

Business Math

Calculating Net Pay

MATH-1220

Earnings:

Wages (including any overtime), Salary, and/or Commission:

Deductions:

Social Security Tax or FICA: (6.2% of gross earnings up to $110,000)

Medicare Tax: (1.45% of gross earnings)

State Disability Insurance or SDI: (Typically 1% of gross earnings up to $31,800)

Federal Income Tax Withholding:

Wage Bracket Method:

Percentage Method:

I.

Marital Status:

Single / Married

II.

Number of withholding allowances: __________

III.

Amount for one withholding allowance (from table on page 244): __________

IV.

Multiply II and III: __________ × __________ = __________

Subtract IV from the gross earnings: __________ – __________ = __________

V.

VI.

Use V and the appropriate percentage table to determine withholding amount:

State Income Tax Withholding: (Tax rate varies from state to state)

Other deductions:

(Health insurance payments, charitable contributions, union dues, etc.)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Education

1

1 2

2