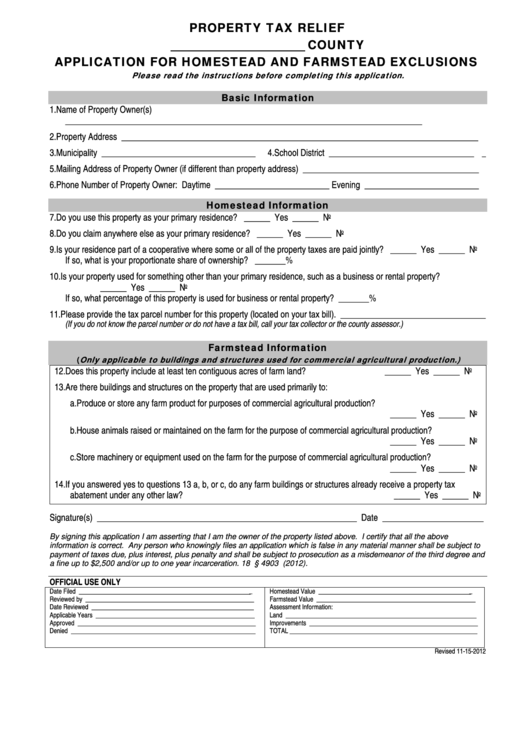

Property Tax Relief Application For Homestead And Farmstead Exclusions

ADVERTISEMENT

PROPERTY TAX RELIEF

______________________ COUNTY

APPLICATION FOR HOMESTEAD AND FARMSTEAD EXCLUSIONS

Please read the instructions before completing this application.

Basic Information

1. Name of Property Owner(s)

_________________________________________________________________________________

2. Property Address _________________________________________________________________________________

3. Municipality ___________________________________ 4. School District __________________________________

5. Mailing Address of Property Owner (if different than property address) ________________________________________

6. Phone Number of Property Owner: Daytime __________________________ Evening __________________________

Homestead Information

7. Do you use this property as your primary residence?

______ Yes ______ No

8. Do you claim anywhere else as your primary residence?

______ Yes ______ No

9. Is your residence part of a cooperative where some or all of the property taxes are paid jointly? ______ Yes ______ No

If so, what is your proportionate share of ownership? _______%

10. Is your property used for something other than your primary residence, such as a business or rental property?

______ Yes ______ No

If so, what percentage of this property is used for business or rental property? _______%

11. Please provide the tax parcel number for this property (located on your tax bill). _________________________________

(If you do not know the parcel number or do not have a tax bill, call your tax collector or the county assessor.)

Farmstead Information

Only applicable to buildings and structures used for commercial agricultural production.)

(

12. Does this property include at least ten contiguous acres of farm land?

______ Yes ______ No

13. Are there buildings and structures on the property that are used primarily to:

a. Produce or store any farm product for purposes of commercial agricultural production?

______ Yes ______ No

b. House animals raised or maintained on the farm for the purpose of commercial agricultural production?

______ Yes ______ No

c. Store machinery or equipment used on the farm for the purpose of commercial agricultural production?

______ Yes ______ No

14. If you answered yes to questions 13 a, b, or c, do any farm buildings or structures already receive a property tax

abatement under any other law?

______ Yes ______ No

Signature(s) ___________________________________________________________ Date _______________________

By signing this application I am asserting that I am the owner of the property listed above. I certify that all the above

information is correct. Any person who knowingly files an application which is false in any material manner shall be subject to

payment of taxes due, plus interest, plus penalty and shall be subject to prosecution as a misdemeanor of the third degree and

a fine up to $2,500 and/or up to one year incarceration. 18 Pa.C.S. § 4903 (2012).

OFFICIAL USE ONLY

Date Filed _______________________________________________________

Homestead Value _________________________________________________

Reviewed by _____________________________________________________

Farmstead Value __________________________________________________

Date Reviewed ___________________________________________________

Assessment Information:

Applicable Years __________________________________________________

Land ____________________________________________________________

Approved ________________________________________________________

Improvements _____________________________________________________

Denied __________________________________________________________

TOTAL ___________________________________________________________

Revised 11-15-2012

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3