St-101.4 - Annual Schedule Nj

ADVERTISEMENT

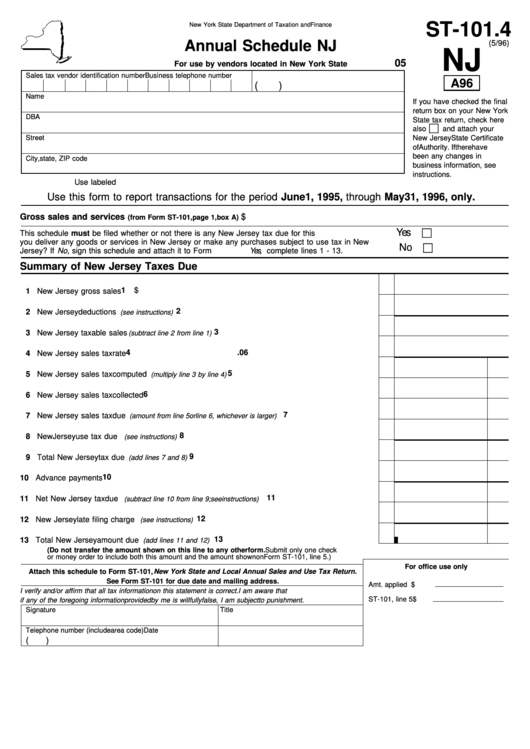

ST-101.4

New York State Department of Taxation and Finance

Annual Schedule NJ

(5/96)

NJ

05

For use by vendors located in New York State

Sales tax vendor identification number

Business telephone number

A96

(

)

Name

If you have checked the final

return box on your New York

DBA

State tax return, check here

also

and attach your

Street

New Jersey State Certificate

of Authority. If there have

been any changes in

City, state, ZIP code

business information, see

instructions.

Use labeled form. Read the instructions carefully before completing this schedule.

Use this form to report transactions for the period June 1, 1995, through May 31, 1996, only.

Gross sales and services

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

$

(from Form ST-101, page 1, box A)

Yes

This schedule must be filed whether or not there is any New Jersey tax due for this period. Did

you deliver any goods or services in New Jersey or make any purchases subject to use tax in New

No

Jersey? If No, sign this schedule and attach it to Form ST-101. If Yes, complete lines 1 - 13.

Summary of New Jersey Taxes Due

1

$

1 New Jersey gross sales . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2

2 New Jersey deductions

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

(see instructions)

3

3 New Jersey taxable sales

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

(subtract line 2 from line 1)

4

.06

4 New Jersey sales tax rate. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

5

5 New Jersey sales tax computed

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

(multiply line 3 by line 4)

6

6 New Jersey sales tax collected. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

7

7 New Jersey sales tax due

. . . . . . . . . . . . . . . . . . . . . . . . . . .

(amount from line 5 or line 6, whichever is larger)

8

8 New Jersey use tax due

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

(see instructions)

9

9 Total New Jersey tax due

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

(add lines 7 and 8)

10 Advance payments. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 10

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 11

11 Net New Jersey tax due

(subtract line 10 from line 9; see instructions)

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 12

12 New Jersey late filing charge

(see instructions)

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 13

13 Total New Jersey amount due

(add lines 11 and 12)

(Do not transfer the amount shown on this line to any other form. Submit only one check

or money order to include both this amount and the amount shown on Form ST-101, line 5.)

For office use only

Attach this schedule to Form ST-101, New York State and Local Annual Sales and Use Tax Return.

See Form ST-101 for due date and mailing address.

Amt. applied N.Y. $

I verify and/or affirm that all tax information on this statement is correct. I am aware that

ST-101, line 5

$

if any of the foregoing information provided by me is willfully false, I am subject to punishment.

Signature

Title

Telephone number (include area code)

Date

(

)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3