Instructions For Forms 1099-R And 5498 - 2015

ADVERTISEMENT

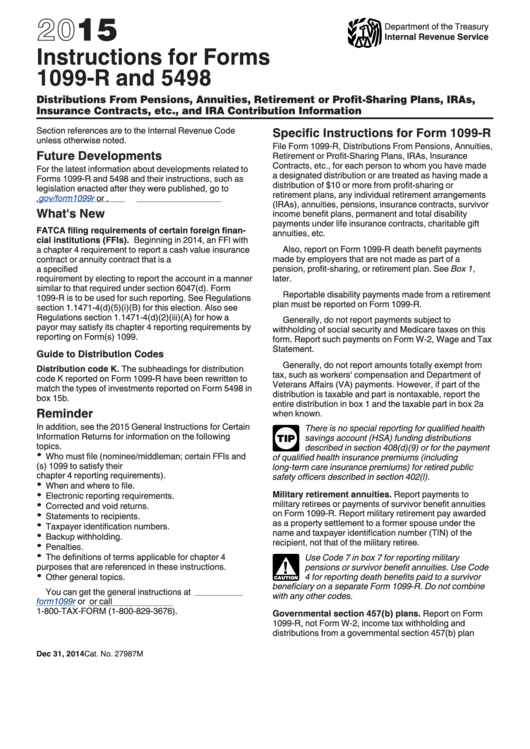

2015

Department of the Treasury

Internal Revenue Service

Instructions for Forms

1099-R and 5498

Distributions From Pensions, Annuities, Retirement or Profit-Sharing Plans, IRAs,

Insurance Contracts, etc., and IRA Contribution Information

Specific Instructions for Form 1099-R

Section references are to the Internal Revenue Code

unless otherwise noted.

File Form 1099-R, Distributions From Pensions, Annuities,

Future Developments

Retirement or Profit-Sharing Plans, IRAs, Insurance

Contracts, etc., for each person to whom you have made

For the latest information about developments related to

a designated distribution or are treated as having made a

Forms 1099-R and 5498 and their instructions, such as

distribution of $10 or more from profit-sharing or

legislation enacted after they were published, go to

retirement plans, any individual retirement arrangements

,gov/form1099r

or .gov/form5498.

(IRAs), annuities, pensions, insurance contracts, survivor

What's New

income benefit plans, permanent and total disability

payments under life insurance contracts, charitable gift

FATCA filing requirements of certain foreign finan-

annuities, etc.

cial institutions (FFIs). Beginning in 2014, an FFI with

Also, report on Form 1099-R death benefit payments

a chapter 4 requirement to report a cash value insurance

contract or annuity contract that is a U.S. account held by

made by employers that are not made as part of a

pension, profit-sharing, or retirement plan. See Box 1,

a specified U.S. person with the FFI may satisfy this

requirement by electing to report the account in a manner

later.

similar to that required under section 6047(d). Form

Reportable disability payments made from a retirement

1099-R is to be used for such reporting. See Regulations

plan must be reported on Form 1099-R.

section 1.1471-4(d)(5)(i)(B) for this election. Also see

Regulations section 1.1471-4(d)(2)(iii)(A) for how a U.S.

Generally, do not report payments subject to

payor may satisfy its chapter 4 reporting requirements by

withholding of social security and Medicare taxes on this

reporting on Form(s) 1099.

form. Report such payments on Form W-2, Wage and Tax

Statement.

Guide to Distribution Codes

Generally, do not report amounts totally exempt from

Distribution code K. The subheadings for distribution

tax, such as workers' compensation and Department of

code K reported on Form 1099-R have been rewritten to

Veterans Affairs (VA) payments. However, if part of the

match the types of investments reported on Form 5498 in

distribution is taxable and part is nontaxable, report the

box 15b.

entire distribution in box 1 and the taxable part in box 2a

Reminder

when known.

In addition, see the 2015 General Instructions for Certain

There is no special reporting for qualified health

Information Returns for information on the following

savings account (HSA) funding distributions

TIP

topics.

described in section 408(d)(9) or for the payment

Who must file (nominee/middleman; certain FFIs and

of qualified health insurance premiums (including

U.S. payors that report on Form(s) 1099 to satisfy their

long-term care insurance premiums) for retired public

chapter 4 reporting requirements).

safety officers described in section 402(l).

When and where to file.

Military retirement annuities. Report payments to

Electronic reporting requirements.

military retirees or payments of survivor benefit annuities

Corrected and void returns.

on Form 1099-R. Report military retirement pay awarded

Statements to recipients.

as a property settlement to a former spouse under the

Taxpayer identification numbers.

name and taxpayer identification number (TIN) of the

Backup withholding.

recipient, not that of the military retiree.

Penalties.

The definitions of terms applicable for chapter 4

Use Code 7 in box 7 for reporting military

purposes that are referenced in these instructions.

pensions or survivor benefit annuities. Use Code

!

Other general topics.

4 for reporting death benefits paid to a survivor

CAUTION

beneficiary on a separate Form 1099-R. Do not combine

You can get the general instructions at

.gov/

with any other codes.

form1099r

or

.gov/form5498

or call

1-800-TAX-FORM (1-800-829-3676).

Governmental section 457(b) plans. Report on Form

1099-R, not Form W-2, income tax withholding and

distributions from a governmental section 457(b) plan

Dec 31, 2014

Cat. No. 27987M

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23