Gwrra Financial Report

Download a blank fillable Gwrra Financial Report in PDF format just by clicking the "DOWNLOAD PDF" button.

Open the file in any PDF-viewing software. Adobe Reader or any alternative for Windows or MacOS are required to access and complete fillable content.

Complete Gwrra Financial Report with your personal data - all interactive fields are highlighted in places where you should type, access drop-down lists or select multiple-choice options.

Some fillable PDF-files have the option of saving the completed form that contains your own data for later use or sending it out straight away.

ADVERTISEMENT

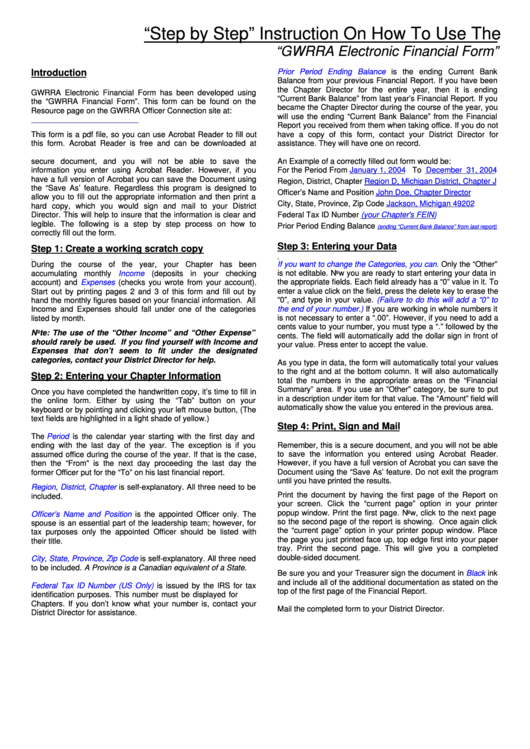

“Step by Step” Instruction On How To Use The

“GWRRA Electronic Financial Form”

Introduction

Prior Period Ending Balance

is the ending Current Bank

Balance from your previous Financial Report. If you have been

the Chapter Director for the entire year, then it is ending

GWRRA Electronic Financial Form has been developed using

“Current Bank Balance” from last year’s Financial Report. If you

the “GWRRA Financial Form”. This form can be found on the

became the Chapter Director during the course of the year, you

Resource page on the GWRRA Officer Connection site at:

will use the ending “Current Bank Balance” from the Financial

Report you received from them when taking office. If you do not

This form is a pdf file, so you can use Acrobat Reader to fill out

have a copy of this form, contact your District Director for

this form. Acrobat Reader is free and can be downloaded at

assistance. They will have one on record.

This is a

secure document, and you will not be able to save the

An Example of a correctly filled out form would be:

information you enter using Acrobat Reader. However, if you

For the Period From

January 1, 2004

To

December 31, 2004

have a full version of Acrobat you can save the Document using

Region, District, Chapter

Region D, Michigan District, Chapter J

the “Save As’ feature. Regardless this program is designed to

Officer’s Name and Position

John Doe, Chapter Director

allow you to fill out the appropriate information and then print a

City, State, Province, Zip Code

Jackson, Michigan 49202

hard copy, which you would sign and mail to your District

Director. This will help to insure that the information is clear and

Federal Tax ID Number

(your Chapter's FEIN)

legible. The following is a step by step process on how to

Prior Period Ending Balance

(ending “Current Bank Balance” from last report)

correctly fill out the form.

Step 3: Entering your Data

Step 1: Create a working scratch copy

If you want to change the Categories, you can.

Only the “Other”

During the course of the year, your Chapter has been

accumulating monthly

Income

(deposits in your checking

is not editable. Now you are ready to start entering your data in

the appropriate fields. Each field already has a “0” value in it. To

account) and

Expenses

(checks you wrote from your account).

Start out by printing pages 2 and 3 of this form and fill out by

enter a value click on the field, press the delete key to erase the

“0”, and type in your value.

(Failure to do this will add a “0” to

hand the monthly figures based on your financial information. All

Income and Expenses should fall under one of the categories

the end of your number.)

If you are working in whole numbers it

is not necessary to enter a “.00”. However, if you need to add a

listed by month.

cents value to your number, you must type a “.” followed by the

Note: The use of the “Other Income” and “Other Expense”

cents. The field will automatically add the dollar sign in front of

should rarely be used. If you find yourself with Income and

your value. Press enter to accept the value.

Expenses that don’t seem to fit under the designated

categories, contact your District Director for help.

As you type in data, the form will automatically total your values

to the right and at the bottom column. It will also automatically

Step 2: Entering your Chapter Information

total the numbers in the appropriate areas on the “Financial

Summary” area. If you use an ”Other” category, be sure to put

Once you have completed the handwritten copy, it’s time to fill in

in a description under item for that value. The “Amount” field will

the online form. Either by using the “Tab” button on your

automatically show the value you entered in the previous area.

keyboard or by pointing and clicking your left mouse button, (The

text fields are highlighted in a light shade of yellow.)

Step 4: Print, Sign and Mail

The

Period

is the calendar year starting with the first day and

Remember, this is a secure document, and you will not be able

ending with the last day of the year. The exception is if you

to save the information you entered using Acrobat Reader.

assumed office during the course of the year. If that is the case,

However, if you have a full version of Acrobat you can save the

then the “From” is the next day proceeding the last day the

Document using the “Save As’ feature. Do not exit the program

former Officer put for the “To” on his last financial report.

until you have printed the results.

Region, District, Chapter

is self-explanatory. All three need to be

Print the document by having the first page of the Report on

included.

your screen. Click the “current page” option in your printer

popup window. Print the first page. Now, click to the next page

Officer’s Name and Position

is the appointed Officer only. The

so the second page of the report is showing. Once again click

spouse is an essential part of the leadership team; however, for

the “current page” option in your printer popup window. Place

tax purposes only the appointed Officer should be listed with

the page you just printed face up, top edge first into your paper

their title.

tray. Print the second page. This will give you a completed

double-sided document.

City, State, Province, Zip Code

is self-explanatory. All three need

to be included. A Province is a Canadian equivalent of a State.

Be sure you and your Treasurer sign the document in

Black

ink

and include all of the additional documentation as stated on the

Federal Tax ID Number (US Only)

is issued by the IRS for tax

top of the first page of the Financial Report.

identification purposes. This number must be displayed for U.S.

Chapters. If you don’t know what your number is, contact your

Mail the completed form to your District Director.

District Director for assistance.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Business

1

1 2

2 3

3 4

4