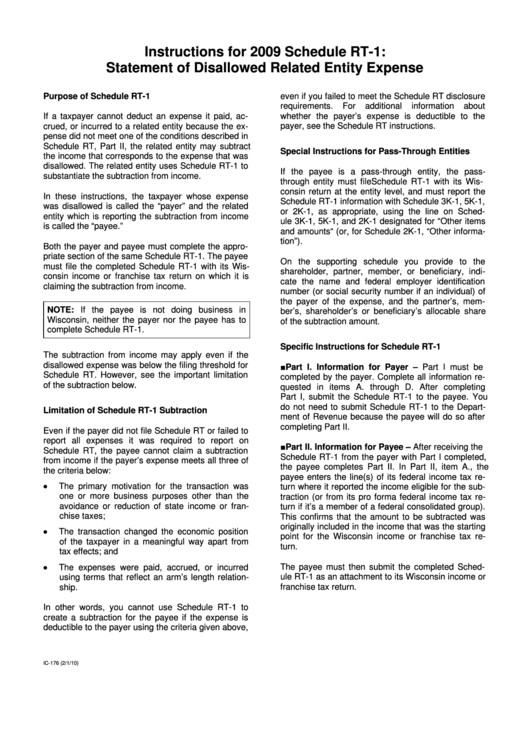

Instructions For 2009 Schedule Rt-1: Statement Of Disallowed Related Entity Expense

ADVERTISEMENT

Instructions for 2009 Schedule RT-1:

Statement of Disallowed Related Entity Expense

Purpose of Schedule RT-1

even if you failed to meet the Schedule RT disclosure

requirements.

For

additional

information

about

If a taxpayer cannot deduct an expense it paid, ac-

whether the payer’s expense is deductible to the

crued, or incurred to a related entity because the ex-

payer, see the Schedule RT instructions.

pense did not meet one of the conditions described in

Schedule RT, Part II, the related entity may subtract

Special Instructions for Pass-Through Entities

the income that corresponds to the expense that was

disallowed. The related entity uses Schedule RT-1 to

If the payee is a pass-through entity, the pass-

substantiate the subtraction from income.

through entity must file Schedule RT-1 with its Wis-

consin return at the entity level, and must report the

In these instructions, the taxpayer whose expense

Schedule RT-1 information with Schedule 3K-1, 5K-1,

was disallowed is called the “payer” and the related

or 2K-1, as appropriate, using the line on Sched-

entity which is reporting the subtraction from income

ule 3K-1, 5K-1, and 2K-1 designated for “Other items

is called the “payee.”

and amounts“ (or, for Schedule 2K-1, “Other informa-

tion”).

Both the payer and payee must complete the appro-

priate section of the same Schedule RT-1. The payee

On the supporting schedule you provide to the

must file the completed Schedule RT-1 with its Wis-

shareholder, partner, member, or beneficiary, indi-

consin income or franchise tax return on which it is

cate the name and federal employer identification

claiming the subtraction from income.

number (or social security number if an individual) of

the payer of the expense, and the partner’s, mem-

NOTE: If the payee is not doing business in

ber’s, shareholder’s or beneficiary’s allocable share

Wisconsin, neither the payer nor the payee has to

of the subtraction amount.

complete Schedule RT-1.

Specific Instructions for Schedule RT-1

The subtraction from income may apply even if the

disallowed expense was below the filing threshold for

■ Part I. Information for Payer – Part I must be

Schedule RT. However, see the important limitation

completed by the payer. Complete all information re-

of the subtraction below.

quested in items A. through D. After completing

Part I, submit the Schedule RT-1 to the payee. You

do not need to submit Schedule RT-1 to the Depart-

Limitation of Schedule RT-1 Subtraction

ment of Revenue because the payee will do so after

completing Part II.

Even if the payer did not file Schedule RT or failed to

report all expenses it was required to report on

■ Part II. Information for Payee – After receiving the

Schedule RT, the payee cannot claim a subtraction

Schedule RT-1 from the payer with Part I completed,

from income if the payer’s expense meets all three of

the payee completes Part II. In Part II, item A., the

the criteria below:

payee enters the line(s) of its federal income tax re-

•

The primary motivation for the transaction was

turn where it reported the income eligible for the sub-

one or more business purposes other than the

traction (or from its pro forma federal income tax re-

avoidance or reduction of state income or fran-

turn if it’s a member of a federal consolidated group).

chise taxes;

This confirms that the amount to be subtracted was

originally included in the income that was the starting

•

The transaction changed the economic position

point for the Wisconsin income or franchise tax re-

of the taxpayer in a meaningful way apart from

turn.

tax effects; and

•

The payee must then submit the completed Sched-

The expenses were paid, accrued, or incurred

ule RT-1 as an attachment to its Wisconsin income or

using terms that reflect an arm’s length relation-

franchise tax return.

ship.

In other words, you cannot use Schedule RT-1 to

create a subtraction for the payee if the expense is

deductible to the payer using the criteria given above,

IC-176 (2/1/10)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2