Client Information Form Accountants

ADVERTISEMENT

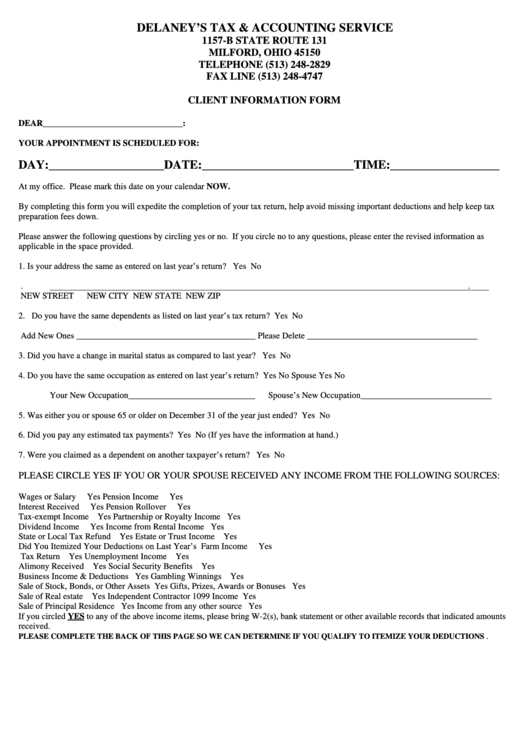

DELANEY’S TAX & ACCOUNTING SERVICE

1157-B STATE ROUTE 131

MILFORD, OHIO 45150

TELEPHONE (513) 248-2829

FAX LINE (513) 248-4747

CLIENT INFORMATION FORM

DEAR________________________________:

YOUR APPOINTMENT IS SCHEDULED FOR:

DAY:___________________DATE:_________________________TIME:__________________

At my office. Please mark this date on your calendar NOW.

By completing this form you will expedite the completion of your tax return, help avoid missing important deductions and help keep tax

preparation fees down.

Please answer the following questions by circling yes or no. If you circle no to any questions, please enter the revised information as

applicable in the space provided.

1.

Is your address the same as entered on last year’s return?

Yes

No

.

.

NEW STREET

NEW CITY

NEW STATE

NEW ZIP

2.

Do you have the same dependents as listed on last year’s tax return?

Yes

No

Add New Ones _________________________________________ Please Delete _______________________________________

3.

Did you have a change in marital status as compared to last year?

Yes

No

4.

Do you have the same occupation as entered on last year’s return?

Yes

No

Spouse Yes

No

Your New Occupation_____________________________

Spouse’s New Occupation______________________________

5.

Was either you or spouse 65 or older on December 31 of the year just ended?

Yes

No

6.

Did you pay any estimated tax payments?

Yes

No

(If yes have the information at hand.)

7.

Were you claimed as a dependent on another taxpayer’s return?

Yes

No

PLEASE CIRCLE YES IF YOU OR YOUR SPOUSE RECEIVED ANY INCOME FROM THE FOLLOWING SOURCES:

Wages or Salary

Yes

Pension Income

Yes

Interest Received

Yes

Pension Rollover

Yes

Tax-exempt Income

Yes

Partnership or Royalty Income

Yes

Dividend Income

Yes

Income from Rental Income

Yes

State or Local Tax Refund

Yes

Estate or Trust Income

Yes

Did You Itemized Your Deductions on Last Year’s

Farm Income

Yes

Tax Return

Yes

Unemployment Income

Yes

Alimony Received

Yes

Social Security Benefits

Yes

Business Income & Deductions

Yes

Gambling Winnings

Yes

Sale of Stock, Bonds, or Other Assets

Yes

Gifts, Prizes, Awards or Bonuses

Yes

Sale of Real estate

Yes

Independent Contractor 1099 Income

Yes

Sale of Principal Residence

Yes

Income from any other source

Yes

If you circled YES to any of the above income items, please bring W-2(s), bank statement or other available records that indicated amounts

received.

.

PLEASE COMPLETE THE BACK OF THIS PAGE SO WE CAN DETERMINE IF YOU QUALIFY TO ITEMIZE YOUR DEDUCTIONS

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Business

1

1 2

2