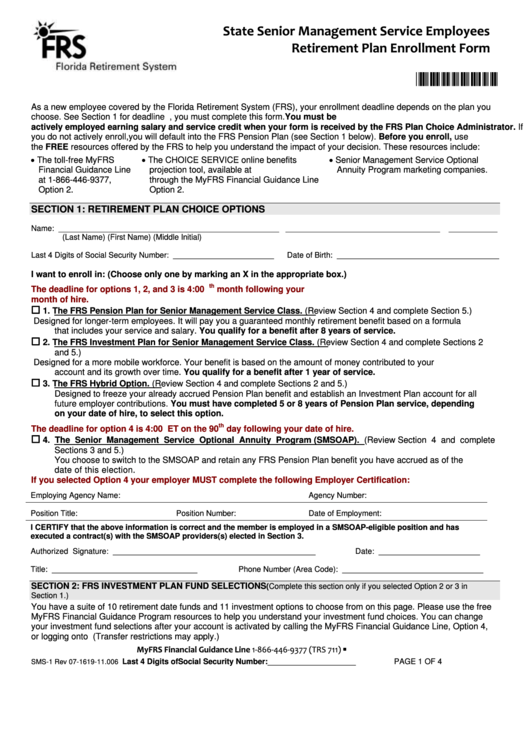

State Senior Management Service Employees - Retirement Plan Enrollment Form

ADVERTISEMENT

State Senior Management Service Employees

Retirement Plan Enrollment Form

*088009*

As a new employee covered by the Florida Retirement System (FRS), your enrollment deadline depends on the plan you

choose. See Section 1 for deadline information. To make your plan choice, you must complete this form. You must be

actively employed earning salary and service credit when your form is received by the FRS Plan Choice Administrator. If

you do not actively enroll, you will default into the FRS Pension Plan (see Section 1 below). Before you enroll, use

the FREE resources offered by the FRS to help you understand the impact of your decision. These resources include:

The toll-free MyFRS

The CHOICE SERVICE online benefits

Senior Management Service Optional

Financial Guidance Line

projection tool, available at or

Annuity Program marketing companies.

at 1-866-446-9377,

through the MyFRS Financial Guidance Line

Option 2.

Option 2.

SECTION 1: RETIREMENT PLAN CHOICE OPTIONS

Name: __________________________________________________

___________________________________

___________

(Last Name)

(First Name)

(Middle Initial)

Last 4 Digits of Social Security Number: _______________________

Date of Birth: _____________________________________

I want to enroll in: (Choose only one by marking an X in the appropriate box.)

th

The deadline for options 1, 2, and 3 is 4:00 p.m. ET on the last business day of the 5

month following your

month of hire.

1. The FRS Pension Plan for Senior Management Service Class. (Review Section 4 and complete Section 5.)

Designed for longer-term employees. It will pay you a guaranteed monthly retirement benefit based on a formula

that includes your service and salary. You qualify for a benefit after 8 years of service.

2. The FRS Investment Plan for Senior Management Service Class. (Review Section 4 and complete Sections 2

and 5.)

Designed for a more mobile workforce. Your benefit is based on the amount of money contributed to your

account and its growth over time. You qualify for a benefit after 1 year of service.

3. The FRS Hybrid Option. (Review Section 4 and complete Sections 2 and 5.)

Designed to freeze your already accrued Pension Plan benefit and establish an Investment Plan account for all

future employer contributions. You must have completed 5 or 8 years of Pension Plan service, depending

on your date of hire, to select this option.

th

The deadline for option 4 is 4:00 p.m. ET on the 90

day following your date of hire.

4. The Senior Management Service Optional Annuity Program (SMSOAP). (Review Section 4 and complete

Sections 3 and 5.)

You choose to switch to the SMSOAP and retain any FRS Pension Plan benefit you have accrued as of the

date of this election.

If you selected Option 4 your employer MUST complete the following Employer Certification:

Employing Agency Name:

Agency Number:

Position Title:

Position Number:

Date of Employment:

I CERTIFY that the above information is correct and the member is employed in a SMSOAP-eligible position and has

executed a contract(s) with the SMSOAP providers(s) elected in Section 3.

Authorized Signature: ______________________________________________

Date: _______________________

Title: _________________________________

Phone Number (Area Code): ________________________________

SECTION 2: FRS INVESTMENT PLAN FUND SELECTIONS

(Complete this section only if you selected Option 2 or 3 in

Section 1.)

You have a suite of 10 retirement date funds and 11 investment options to choose from on this page. Please use the free

MyFRS Financial Guidance Program resources to help you understand your investment fund choices. You can change

your investment fund selections after your account is activated by calling the MyFRS Financial Guidance Line, Option 4,

or logging onto . (Transfer restrictions may apply.)

MyFRS Financial Guidance Line 1-866-446-9377 (TRS 711)

Last 4 Digits of Social Security Number:____________________

PAGE 1 OF 4

SMS-1 Rev 07-16

19-11.006 F.A.C.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2 3

3 4

4