Income Tax Worksheet - 2015-2016

ADVERTISEMENT

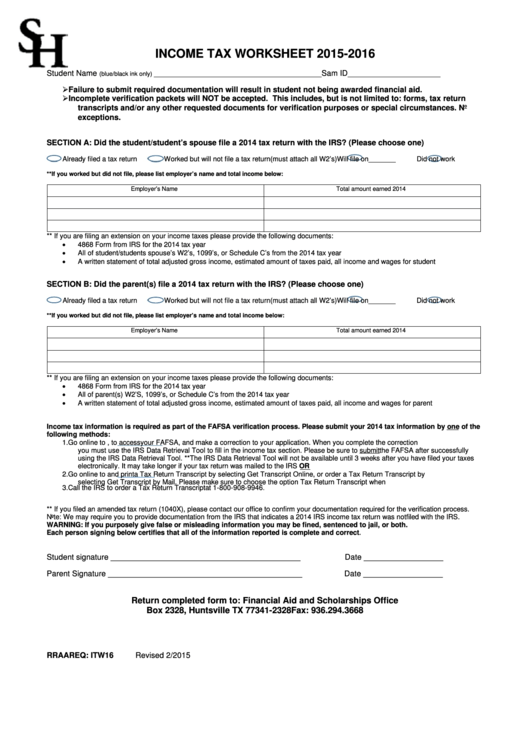

INCOME TAX WORKSHEET 2015-2016

Student Name

______________________________________ Sam ID_____________________

(blue/black ink only)

Failure to submit required documentation will result in student not being awarded financial aid.

Incomplete verification packets will NOT be accepted. This includes, but is not limited to: forms, tax return

transcripts and/or any other requested documents for verification purposes or special circumstances. No

exceptions.

SECTION A: Did the student/student’s spouse file a 2014 tax return with the IRS? (Please choose one)

Already filed a tax return

Worked but will not file a tax return (must attach all W2’s)

Will file on_______

Did not work

**If you worked but did not file, please list employer’s name and total income below:

Employer’s Name

Total amount earned 2014

** If you are filing an extension on your income taxes please provide the following documents:

•

4868 Form from IRS for the 2014 tax year

•

All of student/students spouse’s W2’s, 1099’s, or Schedule C’s from the 2014 tax year

•

A written statement of total adjusted gross income, estimated amount of taxes paid, all income and wages for student

SECTION B: Did the parent(s) file a 2014 tax return with the IRS? (Please choose one)

Already filed a tax return

Worked but will not file a tax return (must attach all W2’s)

Will file on_______

Did not work

**If you worked but did not file, please list employer’s name and total income below:

Employer’s Name

Total amount earned 2014

** If you are filing an extension on your income taxes please provide the following documents:

•

4868 Form from IRS for the 2014 tax year

•

All of parent(s) W2’S, 1099’s, or Schedule C’s from the 2014 tax year

•

A written statement of total adjusted gross income, estimated amount of taxes paid, all income and wages for parent

Income tax information is required as part of the FAFSA verification process. Please submit your 2014 tax information by one of the

following methods:

1.

Go online to , to access your FAFSA, and make a correction to your application. When you complete the correction

you must use the IRS Data Retrieval Tool to fill in the income tax section. Please be sure to submit the FAFSA after successfully

using the IRS Data Retrieval Tool. ** The IRS Data Retrieval Tool will not be available until 3 weeks after you have filed your taxes

electronically. It may take longer if your tax return was mailed to the IRS OR

2.

Go online to

and print a Tax Return Transcript by selecting Get Transcript Online, or order a Tax Return Transcript by

selecting Get Transcript by Mail. Please make sure to choose the option Tax Return Transcript when

3.

Call the IRS to order a Tax Return Transcript at 1-800-908-9946.

** If you filed an amended tax return (1040X), please contact our office to confirm your documentation required for the verification process.

Note: We may require you to provide documentation from the IRS that indicates a 2014 IRS income tax return was not filed with the IRS.

WARNING: If you purposely give false or misleading information you may be fined, sentenced to jail, or both.

Each person signing below certifies that all of the information reported is complete and correct

.

Student signature ___________________________________________

Date __________________

Parent Signature ____________________________________________

Date __________________

Return completed form to: Financial Aid and Scholarships Office

Box 2328, Huntsville TX 77341-2328

Fax: 936.294.3668

RRAAREQ: ITW16

Revised 2/2015

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1