Incidental Expenses For Merchant Seaman

ADVERTISEMENT

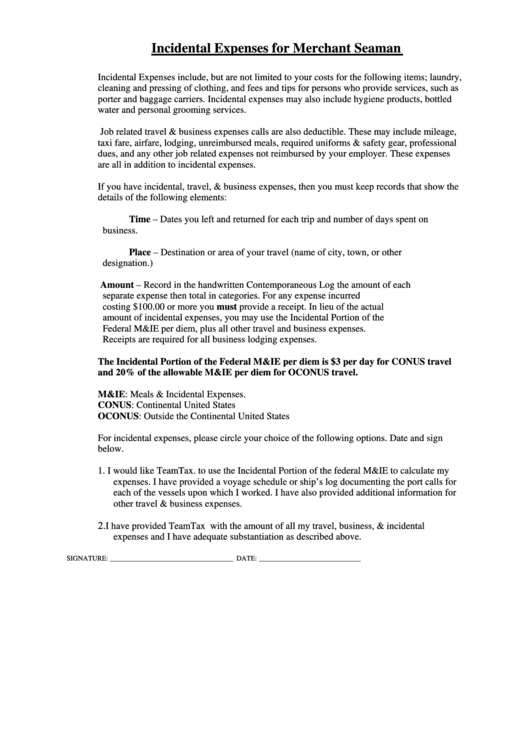

Incidental Expenses for Merchant Seaman

Incidental Expenses include, but are not limited to your costs for the following items; laundry,

cleaning and pressing of clothing, and fees and tips for persons who provide services, such as

porter and baggage carriers. Incidental expenses may also include hygiene products, bottled

water and personal grooming services.

Job related travel & business expenses calls are also deductible. These may include mileage,

taxi fare, airfare, lodging, unreimbursed meals, required uniforms & safety gear, professional

dues, and any other job related expenses not reimbursed by your employer. These expenses

are all in addition to incidental expenses.

If you have incidental, travel, & business expenses, then you must keep records that show the

details of the following elements:

Time – Dates you left and returned for each trip and number of days spent on

business.

Place – Destination or area of your travel (name of city, town, or other

designation.)

Amount – Record in the handwritten Contemporaneous Log the amount of each

separate expense then total in categories. For any expense incurred

costing $100.00 or more you must provide a receipt. In lieu of the actual

amount of incidental expenses, you may use the Incidental Portion of the

Federal M&IE per diem, plus all other travel and business expenses.

Receipts are required for all business lodging expenses.

The Incidental Portion of the Federal M&IE per diem is $3 per day for CONUS travel

and 20% of the allowable M&IE per diem for OCONUS travel.

M&IE: Meals & Incidental Expenses.

CONUS: Continental United States

OCONUS: Outside the Continental United States

For incidental expenses, please circle your choice of the following options. Date and sign

below.

1.

I would like TeamTax. to use the Incidental Portion of the federal M&IE to calculate my

expenses. I have provided a voyage schedule or ship’s log documenting the port calls for

each of the vessels upon which I worked. I have also provided additional information for

other travel & business expenses.

2.

I have provided TeamTax with the amount of all my travel, business, & incidental

expenses and I have adequate substantiation as described above.

SIGNATURE: ___________________________________

DATE: _____________________________

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Business

1

1 2

2 3

3