Rental Property Income And Expenses Worksheet

ADVERTISEMENT

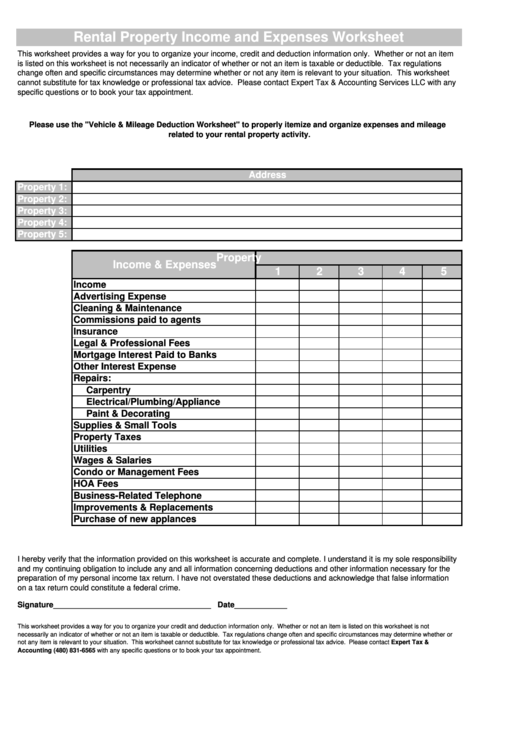

Rental Property Income and Expenses Worksheet

This worksheet provides a way for you to organize your income, credit and deduction information only. Whether or not an item

is listed on this worksheet is not necessarily an indicator of whether or not an item is taxable or deductible. Tax regulations

change often and specific circumstances may determine whether or not any item is relevant to your situation. This worksheet

cannot substitute for tax knowledge or professional tax advice. Please contact Expert Tax & Accounting Services LLC with any

specific questions or to book your tax appointment.

Please use the "Vehicle & Mileage Deduction Worksheet" to properly itemize and organize expenses and mileage

related to your rental property activity.

Address

Property 1:

Property 2:

Property 3:

Property 4:

Property 5:

Property

Income & Expenses

1

2

3

4

5

Income

Advertising Expense

Cleaning & Maintenance

Commissions paid to agents

Insurance

Legal & Professional Fees

Mortgage Interest Paid to Banks

Other Interest Expense

Repairs:

Carpentry

Electrical/Plumbing/Appliance

Paint & Decorating

Supplies & Small Tools

Property Taxes

Utilities

Wages & Salaries

Condo or Management Fees

HOA Fees

Business-Related Telephone

Improvements & Replacements

Purchase of new applances

I hereby verify that the information provided on this worksheet is accurate and complete. I understand it is my sole responsibility

and my continuing obligation to include any and all information concerning deductions and other information necessary for the

preparation of my personal income tax return. I have not overstated these deductions and acknowledge that false information

on a tax return could constitute a federal crime.

Signature____________________________________ Date____________

This worksheet provides a way for you to organize your credit and deduction information only. Whether or not an item is listed on this worksheet is not

necessarily an indicator of whether or not an item is taxable or deductible. Tax regulations change often and specific circumstances may determine whether or

not any item is relevant to your situation. This worksheet cannot substitute for tax knowledge or professional tax advice. Please contact Expert Tax &

Accounting (480) 831-6565 with any specific questions or to book your tax appointment.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Business

1

1