Gift Deed Chart For Calculation Of Value With Regard To Circle Rate For The Payment Of Stamp Duty And Transfer Duty

ADVERTISEMENT

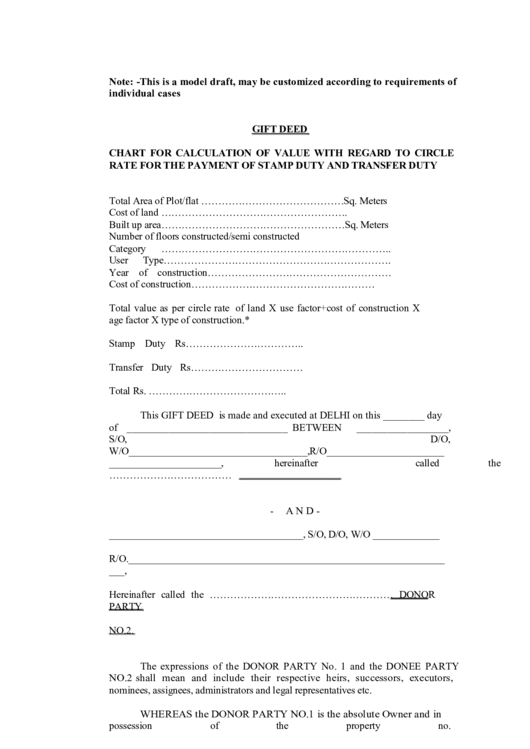

Note: -This is a model draft, may be customized according to requirements of

individual cases

GIFT DEED

CHART FOR CALCULATION OF VALUE WITH REGARD TO CIRCLE

RATE FOR THE PAYMENT OF STAMP DUTY AND TRANSFER DUTY

Total Area of Plot/flat ……………………………………Sq. Meters

Cost of land ……………………………………………….

Built up area………………………………………………Sq. Meters

Number of floors constructed/semi constructed

Category

…………………………………………………………..

User

Type………………………………………………………….

Year of construction………………………………………………

Cost of construction………………………………………………

Total value as per circle rate i.e. Cost of land X use factor+cost of construction X

age factor X type of construction.*

Stamp Duty Rs……………………………..

Transfer Duty Rs……………………………

Total Rs. …………………………………..

This GIFT DEED is made and executed at DELHI on this ________ day

of _______________________________ BETWEEN

__________________,

S/O,

D/O,

W/O___________________________________,R/O_______________________

______________________,

hereinafter

called

the

………………………………..DONOR PARTY NO.1.

-

A N D -

______________________________________, S/O, D/O, W/O _____________

R/O.______________________________________________________________

___,

Hereinafter called the ……………………………………………… DONOR

PARTY

NO.2.

The expressions of the DONOR PARTY No. 1 and the DONEE PARTY

NO.2 shall mean and include their respective heirs, successors, executors,

nominees, assignees, administrators and legal representatives etc.

WHEREAS the DONOR PARTY NO.1 is the absolute Owner and in

possession

of

the

property

no.

_____

bounded

as

under,

by

virtue

of

sale

deed/lease

deed_______________________dated:

_____________ duly registered as

Document NO. _______________, in Addl. Book. No. 1________, Volume

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Business

1

1 2

2 3

3