Business Information Sheet

Download a blank fillable Business Information Sheet in PDF format just by clicking the "DOWNLOAD PDF" button.

Open the file in any PDF-viewing software. Adobe Reader or any alternative for Windows or MacOS are required to access and complete fillable content.

Complete Business Information Sheet with your personal data - all interactive fields are highlighted in places where you should type, access drop-down lists or select multiple-choice options.

Some fillable PDF-files have the option of saving the completed form that contains your own data for later use or sending it out straight away.

ADVERTISEMENT

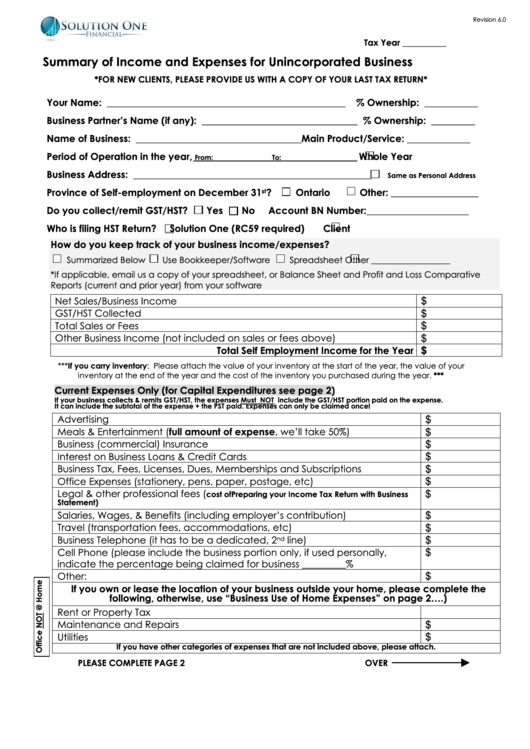

Revision 6.0

Tax Year __________

Summary of Income and Expenses for Unincorporated Business

*FOR NEW CLIENTS, PLEASE PROVIDE US WITH A COPY OF YOUR LAST TAX RETURN*

Your Name: _________________________________________________

% Ownership: ___________

Business Partner’s Name (if any): ________________________________ % Ownership: _________

Name of Business:

__________________________________Main Product/Service: _____________

Period of Operation in the year,

Whole Year

From:

To:

Business Address: _________________________________________________

Same as Personal Address

Province of Self-employment on December 31

?

Ontario

Other: __________________

st

Do you collect/remit GST/HST?

Yes

No

Account BN Number: _____________________

Who is filing HST Return?

Solution One (RC59 required)

Client

How do you keep track of your business income/expenses?

Summarized Below

Use Bookkeeper/Software

Spreadsheet

Other __________________

*If applicable, email us a copy of your spreadsheet, or Balance Sheet and Profit and Loss Comparative

Reports (current and prior year) from your software

Net Sales/Business Income

$

GST/HST Collected

$

Total Sales or Fees

$

Other Business Income (not included on sales or fees above)

$

Total Self Employment Income for the Year

$

***If you carry inventory: Please attach the value of your inventory at the start of the year, the value of your

inventory at the end of the year and the cost of the inventory you purchased during the year. ***

Current Expenses Only (for Capital Expenditures see page 2)

If your business collects & remits GST/HST, the expenses Must NOT include the GST/HST portion paid on the expense.

It can include the subtotal of the expense + the PST paid. Expenses can only be claimed once!

Advertising

$

Meals & Entertainment (full amount of expense, we’ll take 50%)

$

Business (commercial) Insurance

$

Interest on Business Loans & Credit Cards

$

Business Tax, Fees, Licenses, Dues, Memberships and Subscriptions

$

Office Expenses (stationery, pens, paper, postage, etc)

$

Legal & other professional fees (

cost of Preparing your Income Tax Return with Business

$

Statement)

Salaries, Wages, & Benefits (including employer’s contribution)

$

Travel (transportation fees, accommodations, etc)

$

Business Telephone (it has to be a dedicated, 2

line)

nd

$

Cell Phone (please include the business portion only, if used personally,

$

indicate the percentage being claimed for business _________%

Other:

$

If you own or lease the location of your business outside your home, please complete the

following, otherwise, use “Business Use of Home Expenses” on page 2….)

Rent or Property Tax

Maintenance and Repairs

$

Utilities

$

If you have other categories of expenses that are not included above, please attach.

PLEASE COMPLETE PAGE 2

OVER

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2