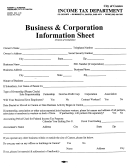

Business Information Sheet Page 2

Download a blank fillable Business Information Sheet in PDF format just by clicking the "DOWNLOAD PDF" button.

Open the file in any PDF-viewing software. Adobe Reader or any alternative for Windows or MacOS are required to access and complete fillable content.

Complete Business Information Sheet with your personal data - all interactive fields are highlighted in places where you should type, access drop-down lists or select multiple-choice options.

Some fillable PDF-files have the option of saving the completed form that contains your own data for later use or sending it out straight away.

ADVERTISEMENT

Page 2

Business Use of Home Expenses

Area of Home Used for Business

_______________sq. ft.

_____________%

Total Area of Home

______________sq. ft. _______________100%

Heat

$

Electricity

$

Home Insurance

$

Maintenance and Repairs (Don’t include capital expenditures)

$

Mortgage Interest (Don’t include payments to principal)

$

Property Taxes

Rent

$

+ Unused amount carried forward from previous years, if applicable

$

Motor Vehicle Expenses (Only for Vehicles Used in the Business)

***It is very important to keep a log of your kilometers to prove the use of your vehicle for business purposes***

Vehicle 1

Vehicle 2

Vehicle Description(s)

Yr/Make/Model

Yr/Make/Model

Kilometers Driven in the Tax Year for Business Use

__________

__________

km

km

___________km

___________km

Total Kilometers Driven in the Tax Year

Fuel and oil

$

$

Motor Vehicle Insurance premium for the year

$

$

License & Registration

$

$

Maintenance & Repairs (Including Car Washes)

$

$

Business Parking Fees, CAA, and Road Assistance

$

$

If you own the vehicle(s), you can claim the car loan interest and depreciation.

For leased vehicles claim the lease payments only.

Car Loan Total Interest Paid in the Tax Year

$

$

Date Interest Payments Commenced

YY/MM/DD

YY/MM/DD

Date Interest Payments Ended

YY/MM/DD

YY/MM/DD

Cost of Vehicle, if purchased in the current tax year

$

$

A)

Date Purchased

YY/MM/DD

YY/MM/DD

Fair market value of previously- owned vehicles, if

B)

$

$

this is the first year that vehicle was used in business

Leasing Costs (Total Payments in the Tax Year)

$

$

Date Lease Commenced

YY/MM/DD

YY/MM/DD

Date Lease Ends

YY/MM/DD

YY/MM/DD

Capital Expenditures (Tools, Equipment & Furniture Purchased or Sold in the year over $250)

Date of

Description

Cost

Purchase (P) or Sale (S) P S

If GST/HST registrant, don’t

include the GST/HST.

Undepreciated Capital Cost for Equipment, Furniture, & Vehicles Purchased in Prior Years

*If you were our client last year, don’t worry about it, we have this on file for you.

Description

Undepreciated Capital Cost

SIGNATURE

(of person providing information): _________________________________ DATE _________________________

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2