FIS 2135 (3/10) Office of Financial and Insurance Regulation Page 1 of 1

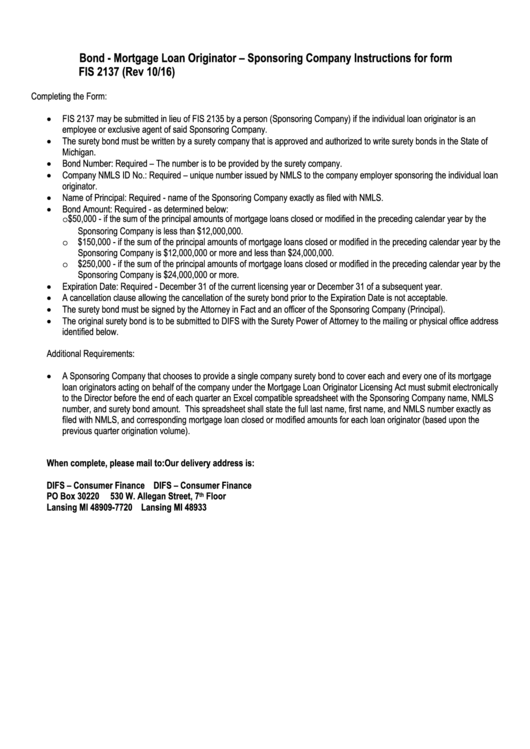

Bond - Mortgage Loan Originator – Sponsoring Company Instructions for form

FIS 2137 (Rev 10/16)

Completing the Form:

FIS 2137 may be submitted in lieu of FIS 2135 by a person (Sponsoring Company) if the individual loan originator is an

employee or exclusive agent of said Sponsoring Company.

The surety bond must be written by a surety company that is approved and authorized to write surety bonds in the State of

Michigan.

Bond Number: Required – The number is to be provided by the surety company.

Company NMLS ID No.: Required – unique number issued by NMLS to the company employer sponsoring the individual loan

originator.

Name of Principal: Required - name of the Sponsoring Company exactly as filed with NMLS.

Bond Amount: Required - as determined below:

o $50,000 - if the sum of the principal amounts of mortgage loans closed or modified in the preceding calendar year by the

Sponsoring Company is less than $12,000,000.

o $150,000 - if the sum of the principal amounts of mortgage loans closed or modified in the preceding calendar year by the

Sponsoring Company is $12,000,000 or more and less than $24,000,000.

o $250,000 - if the sum of the principal amounts of mortgage loans closed or modified in the preceding calendar year by the

Sponsoring Company is $24,000,000 or more.

Expiration Date: Required - December 31 of the current licensing year or December 31 of a subsequent year.

A cancellation clause allowing the cancellation of the surety bond prior to the Expiration Date is not acceptable.

The surety bond must be signed by the Attorney in Fact and an officer of the Sponsoring Company (Principal).

The original surety bond is to be submitted to DIFS with the Surety Power of Attorney to the mailing or physical office address

identified below.

Additional Requirements:

A Sponsoring Company that chooses to provide a single company surety bond to cover each and every one of its mortgage

loan originators acting on behalf of the company under the Mortgage Loan Originator Licensing Act must submit electronically

to the Director before the end of each quarter an Excel compatible spreadsheet with the Sponsoring Company name, NMLS

number, and surety bond amount. This spreadsheet shall state the full last name, first name, and NMLS number exactly as

filed with NMLS, and corresponding mortgage loan closed or modified amounts for each loan originator (based upon the

previous quarter origination volume).

When complete, please mail to:

Our delivery address is:

DIFS – Consumer Finance

DIFS – Consumer Finance

PO Box 30220

530 W. Allegan Street, 7

Floor

th

Lansing MI 48909-7720

Lansing MI 48933

1

1 2

2 3

3