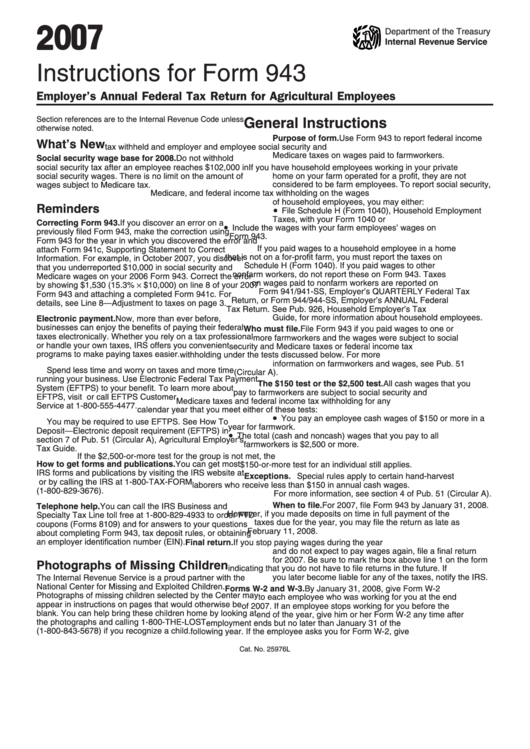

Instructions For Form 943 - Employer'S Annual Federal Tax Return For Agricultural Employees - 2007

ADVERTISEMENT

2 0 07

Department of the Treasury

Internal Revenue Service

Instructions for Form 943

Employer’s Annual Federal Tax Return for Agricultural Employees

Section references are to the Internal Revenue Code unless

General Instructions

otherwise noted.

Purpose of form. Use Form 943 to report federal income

What’s New

tax withheld and employer and employee social security and

Medicare taxes on wages paid to farmworkers.

Social security wage base for 2008. Do not withhold

social security tax after an employee reaches $102,000 in

If you have household employees working in your private

social security wages. There is no limit on the amount of

home on your farm operated for a profit, they are not

considered to be farm employees. To report social security,

wages subject to Medicare tax.

Medicare, and federal income tax withholding on the wages

of household employees, you may either:

Reminders

•

File Schedule H (Form 1040), Household Employment

Taxes, with your Form 1040 or

Correcting Form 943. If you discover an error on a

•

Include the wages with your farm employees’ wages on

previously filed Form 943, make the correction using

Form 943.

Form 943 for the year in which you discovered the error and

If you paid wages to a household employee in a home

attach Form 941c, Supporting Statement to Correct

that is not on a for-profit farm, you must report the taxes on

Information. For example, in October 2007, you discover

Schedule H (Form 1040). If you paid wages to other

that you underreported $10,000 in social security and

nonfarm workers, do not report these on Form 943. Taxes

Medicare wages on your 2006 Form 943. Correct the error

by showing $1,530 (15.3% × $10,000) on line 8 of your 2007

on wages paid to nonfarm workers are reported on

Form 941/941-SS, Employer’s QUARTERLY Federal Tax

Form 943 and attaching a completed Form 941c. For

Return, or Form 944/944-SS, Employer’s ANNUAL Federal

details, see Line 8 — Adjustment to taxes on page 3.

Tax Return. See Pub. 926, Household Employer’s Tax

Guide, for more information about household employees.

Electronic payment. Now, more than ever before,

businesses can enjoy the benefits of paying their federal

Who must file. File Form 943 if you paid wages to one or

taxes electronically. Whether you rely on a tax professional

more farmworkers and the wages were subject to social

or handle your own taxes, IRS offers you convenient

security and Medicare taxes or federal income tax

programs to make paying taxes easier.

withholding under the tests discussed below. For more

information on farmworkers and wages, see Pub. 51

Spend less time and worry on taxes and more time

(Circular A).

running your business. Use Electronic Federal Tax Payment

The $150 test or the $2,500 test. All cash wages that you

System (EFTPS) to your benefit. To learn more about

pay to farmworkers are subject to social security and

EFTPS, visit or call EFTPS Customer

Medicare taxes and federal income tax withholding for any

Service at 1-800-555-4477.

calendar year that you meet either of these tests:

•

You pay an employee cash wages of $150 or more in a

You may be required to use EFTPS. See How To

year for farmwork.

Deposit — Electronic deposit requirement (EFTPS) in

•

The total (cash and noncash) wages that you pay to all

section 7 of Pub. 51 (Circular A), Agricultural Employer’s

farmworkers is $2,500 or more.

Tax Guide.

If the $2,500-or-more test for the group is not met, the

How to get forms and publications. You can get most

$150-or-more test for an individual still applies.

IRS forms and publications by visiting the IRS website at

Exceptions. Special rules apply to certain hand-harvest

or by calling the IRS at 1-800-TAX-FORM

laborers who receive less than $150 in annual cash wages.

(1-800-829-3676).

For more information, see section 4 of Pub. 51 (Circular A).

When to file. For 2007, file Form 943 by January 31, 2008.

Telephone help. You can call the IRS Business and

However, if you made deposits on time in full payment of the

Specialty Tax Line toll free at 1-800-829-4933 to order FTD

taxes due for the year, you may file the return as late as

coupons (Forms 8109) and for answers to your questions

February 11, 2008.

about completing Form 943, tax deposit rules, or obtaining

an employer identification number (EIN).

Final return. If you stop paying wages during the year

and do not expect to pay wages again, file a final return

for 2007. Be sure to mark the box above line 1 on the form

Photographs of Missing Children

indicating that you do not have to file returns in the future. If

you later become liable for any of the taxes, notify the IRS.

The Internal Revenue Service is a proud partner with the

National Center for Missing and Exploited Children.

Forms W-2 and W-3. By January 31, 2008, give Form W-2

Photographs of missing children selected by the Center may

to each employee who was working for you at the end

appear in instructions on pages that would otherwise be

of 2007. If an employee stops working for you before the

blank. You can help bring these children home by looking at

end of the year, give him or her Form W-2 any time after

the photographs and calling 1-800-THE-LOST

employment ends but no later than January 31 of the

(1-800-843-5678) if you recognize a child.

following year. If the employee asks you for Form W-2, give

Cat. No. 25976L

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4