Supplement To The New Residential Rental Property Rebate Application Page 3

ADVERTISEMENT

Clear Data

Help

Protected B

– when completed

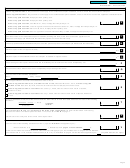

Section C – Rebate calculation for Type 8 – Unit in a co-op

If the co-op paid the GST on the purchase or self-supply of the residential complex or addition, enter on line K the amount of the GST paid.

If the co-op paid the HST on the purchase or self-supply of the residential complex or addition, enter on line K the result of the applicable calculation below:

If the co-op paid 12% HST, multiply the HST paid by 5/12.

If the co-op paid 13% HST, multiply the HST paid by 5/13.

K

$

If the co-op paid 14% HST, after March 31, 2013, multiply the HST paid by 5/14.

If the co-op paid 14% HST, under an agreement entered into before October 31, 2007, multiply the HST paid by 6/14.

If the co-op paid 15% HST after June 30, 2010, multiply the HST paid by 5/15.

If the co-op paid 15% HST under an agreement entered into before May 3, 2006, multiply the HST paid by 7/15.

Fair market value of the residential complex or addition (building and land) at the time tax became payable on the

L

$

purchase or self-supply (do not include the GST/HST payable on the fair market value).

M

$

If the co-op purchased the residential complex, enter the purchase price of the complex (do not include the GST/HST).

Total floor space of the unit (square metres).

N

2

m

Total floor space of all residential units in the complex or addition in square metres.

O

2

m

Unit percentage of floor space. Amount from line N divided by the amount from line O and multiplied by 100

P

%

Unit fair market value. Amount from line L multiplied by the percentage from line P.

Q

$

Enter the result of the following calculation:

R

× 36%) × line P:

$

(line K:

%

Tick the applicable box and enter the indicated amount on line S.

If the co-op paid the GST at 5%, or the HST at 12% or 13%, 14% after March 31, 2013, or if the co-op paid

the HST at 15% after June 30, 2010, enter the amount from line R or $6,300, whichever is less.

S

$

If the co-op paid 6% GST or 14% HST before January 1, 2008, enter the amount from line R or $7,560,

whichever is less.

If the co-op paid 7% GST or 15% HST before July 1, 2006, enter the amount from line R or $8,750, whichever

is less.

If line Q is $350,000 or less, enter the amount from line S or if line Q is more than $350,000 enter the result of the following

calculation:

($450,000 – line Q)

× line S

T

$

If negative,

enter "0"

$100,000

Complete lines U to W only if the purchaser of the share of the capital stock can claim the GST/HST new housing

rebate for the GST or the federal part of the HST. If not, enter "0" on line W on page 4.

U

$

Total amount of the sale price for the share of the capital stock.

Rebate rate and maximum rebate amount

Enter the result of the following calculation on line V (up to the maximum that applies to you):

V

%

$

Amount from line U: $

× Rebate rate from page 5 of Form GST524:

To find out the rebate rate and the maximum rebate amount that apply to you, see "Rebate rate" on page 5 of Form GST524.

If your rebate rate is 1.71%, indicate which situation (A, B, or C), as described on page 5 of Form GST524, applied to you:

(only one situation can apply).

Page 3

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4